Bitcoin Drops to $81K Crypto Market Volatility on April 5, 2025

On April 5, 2025, the market for cryptocurrencies was erratic. Other cryptocurrencies fell, and Bitcoin (BTC) fell to $81,000. Technical signals and geopolitical issues alerted investors to the fragile market during this significant decline. Crypto Market Volatility: The volatility of cryptocurrencies as they are exposed to these outside variables highlights the risk and unpredictability of investing in digital assets.

Fluctuations in Bitcoin

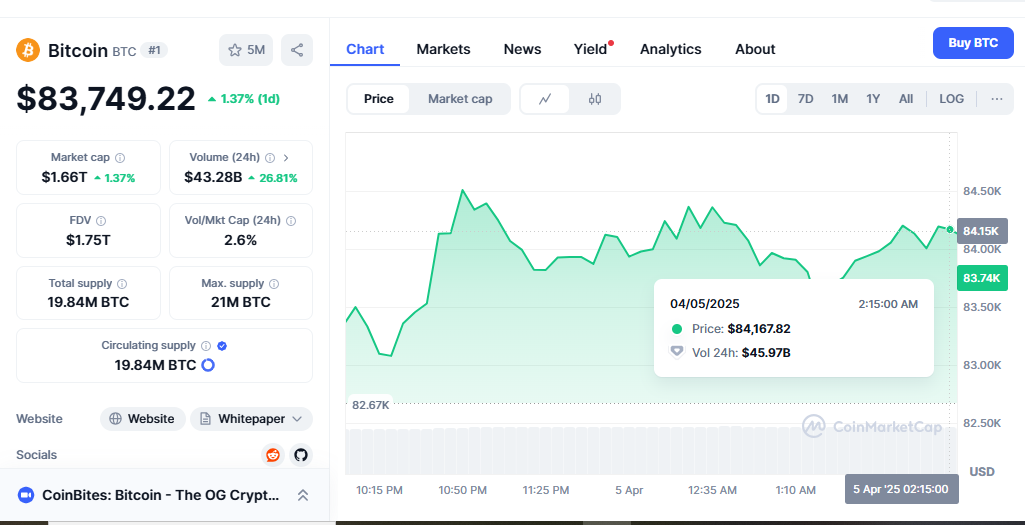

Apr. 5: The Movement in the price of Bitcoin was amazing. After selling at greater levels in the previous days, Bitcoin dropped to $81,000 intraday. The price of the coin recovered somewhat but stayed erratic all day. The downturn in Bitcoin fit a larger pattern as cryptocurrencies responded to world economic worries. A leading indicator of the cryptocurrency industry, Bitcoin suffered as investors turned to safer assets as world uncertainty grew.

The tariff declaration by President Trump mainly caused Bitcoin to decline. Whale (0x56e9) has 40x leveraged short BTC with a net worth of $2.21M and an entry price of $81,669.9. These taxes caused people to take fewer risks, which sparked worries about a trade war. Once considered a defense against financial market risks, the global market mood turned sour on Bitcoin.

Altcoins Come Down

Though altcoins were worse, bitcoin price swings were concerning. The second-largest cryptocurrency by market value, Ethereum (ETH), dropped 5% to $1,681. This decline fits a trend of declining cryptocurrencies, which is more erratic than Bitcoin. Other cryptocurrencies losing 5–9% of their value were Cardano (ADA), Solana (SOL), and Ripple (XRP). Meme coins with value plummeted 7.4%, including Dogecoin (DOGE). Globally, political unrest and market aversion plagued the bitcoin scene.

This fast-declining value points to cryptocurrency volatility. From the start, altcoins have seen both significant losses and great increases. Crypto Market Volatility. This is considerably more evident when trade tensions and economic concerns discourage investors.

World political problems and the Bitcoin market

President Trump’s declaration of new tariffs on April 10, 2025, set off a fall in bitcoin markets. China taxed US goods 34% following the imposition of these tariffs. A protracted trade battle raised questions about a faltering economy, allowing consumers to avoid dangerous assets like bitcoins. This worldwide fight made the global market even less stable, which resulted in declining stock markets and cryptocurrencies.

Buyers hurried to safer assets like gold and government bonds as trade conflicts worsened. Conversely, there was an increasing drive to market digital goods, including Ethereum and Bitcoin. Given the naturally erratic nature of the bitcoin market, it was more likely to swing with world events. This demonstrates the significance of geopolitical events in forming market attitudes.

Technical signals on Bitcoin caution users.

The technical indicators of Bitcoin also indicated that it would drop considerably more, which increased the uncertainty. A technical indication to sell, the “death cross,” was developing. This occurs when the 50-day moving average of Bitcoin falls below its 200-day moving average, indicating a potential declining market.

This indicator suggested that Bitcoin’s price might drop even further. Some analysts believe it may fall to support levels around $73,800, a 13% decrease from its pricing. Crypto Market Volatility. Because of this technical research, people became even more negative about Bitcoin and the whole cryptocurrency sector. Buyers ought to exercise caution; it was abundantly evident.

Whales intend to behave in the uncertain market?

Though the market was declining, evidence of some “whales,” or big investors of digital assets, purchasing specific altcoins with intent was evident. “Whales,” who could indicate good opportunities for astute investors, bought altcoins including Layer Zero (ZRO), Immutable (IMX), and Dogecoin (DOGE).

For seven days, Immutable (IMX) observed a net flow increase of 800%, which implies that large buyers were preparing for a rebound. Though the market is still highly erratic, these clever actions by whales may provide hints about where it is headed.

Summary

On April 5, 2025, other cryptocurrencies, as well as Bitcoin, sank rapidly on the market. Bitcoin Drops to $83K, This resulted from growing geopolitical instability all around the globe and technical indicators pointing to likely additional losses. The fact that Bitcoin dropped to $81,000 and several other cryptocurrencies also dropped demonstrated the volatility of the market for digital assets. Though the risks remain great, some investors could discover opportunities in these developments in the market. Those who trade cryptocurrencies will have to keep current and be ready to adjust to a constantly shifting market as the world economy develops.