Bitcoin Price Hits $83,344 Today and Next This Week & Month?

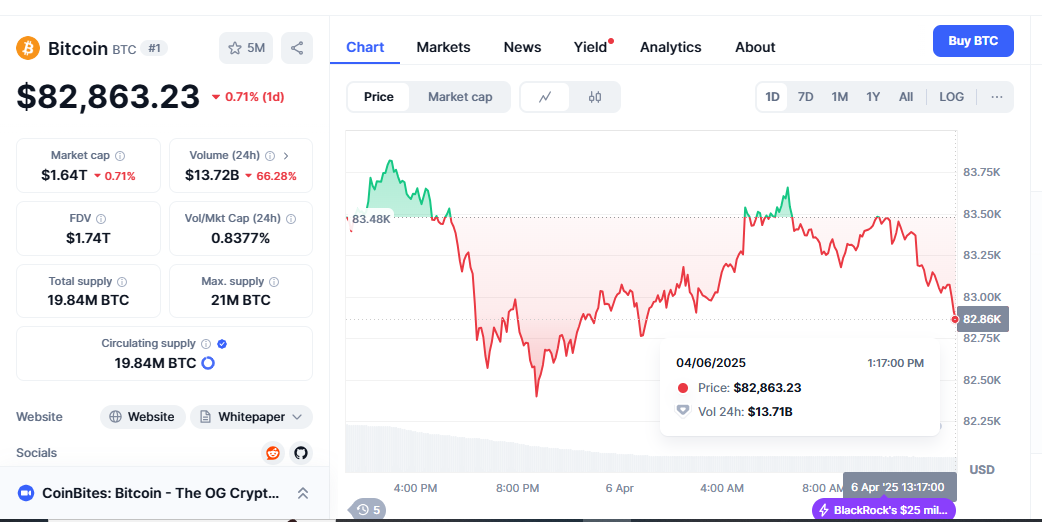

A major turning point in Bitcoin’s (BTC) recent development, it peaked on April 6, 2025, at $83,344. Given its explosive growth, Bitcoin has become one of the most talked-about financial tools. Investors and traders are asking whether the most recent climb in Bitcoin Price Prediction April 2025 is a temporary high in a volatile market or permanent in nature. For Bitcoin, what are the following weeks and months? This essay addresses the main reasons for Bitcoin’s spike and its possible pricing next week and next month.

The amazing climb of Bitcoin

Right now, Bitcoin is worth $83,344, far more than in past months. Its market position is influenced by several elements that led to this current price rise. Good macroeconomics, investor demand, and institutional acceptance have raised Bitcoin.

The price of Bitcoin stayed the same in 2024, but it increased considerably in 2025. The rise of Bitcoin has matched companies and financial institutions’ inclusion of cryptocurrency into their portfolios. Bitcoin is rising thanks partly to institutional transactions, ETFs, and Bitcoin-backed products.

Elements Motivating Bitcoin’s Price Increase

The early April 2025 price increase of Bitcoin follows many noteworthy events and patterns. Among the biggest is institutional interaction with bitcoin markets. Fidelity, JPMorgan, and others are including more of their portfolios to Bitcoin since they see it as a legitimate asset class. Rising in institutional popularity are Bitcoin ETFs, a new financial product that lets average individuals buy Bitcoin without owning it.

Bitcoin has developed as a counterweight against inflation and an alternative asset class during economic uncertainty. Many investors run on the distributed character of Bitcoin and set supply in 2025 when world inflation is high and traditional financial markets are unstable. Bitcoin is more appealing as a store of wealth since the market offers a replacement for fiat money, which is prone to inflation.

Demand for Bitcoin also resulted from the development of distributed finance (DeFi) platforms and digital payments, especially in areas without traditional banking infrastructures. Thanks to this global push towards digital currencies, Bitcoin has become increasingly important to the modern financial environment.

The Weekly Outlook: Can Bitcoin Keep Its Strength?

Either the price of Bitcoin will stabilize this week or surpass past records. Experts and traders will monitor technical levels comprising support and resistance. Given $80,000, Bitcoin most certainly resists at $85,000. Should its rising trend continue to shatter new milestones, Bitcoin may reach $85,000 soon.

The infamous volatility of Bitcoin is still affecting its short-term price movement. Traders say that following its top, Bitcoin may momentarily decline. With prices moving so quickly, crypto markets sometimes correct. Those wanting to purchase during a market slump could find an opportunity between $78,000 and $80,000.

Traders will also observe how the price of Bitcoin responds this week to world financial events such as inflation, interest rates, and legislation. These elements could cause market volatility, skewing the short-term projection.

The Month Ahead: What might one expect?

Technical and basic elements might be driving Bitcoin’s price surge this month. Bitcoin Price Prediction, April 2025 Starting in the second quarter of 2025, institutional adoption and demand for alternative assets should help support Bitcoin’s price.

Acceptance of Bitcoin-related financial instruments on international markets, such as Bitcoin ETFs, could boost Bitcoin. Should the SEC or other authorities sanction more Bitcoin ETFs, institutional capital might influence market prices.

The rising relevance of Bitcoin in the DeFi ecosystem might potentially affect its price rise. Bitcoin is becoming a major DeFi asset as more people hunt for distributed banking and financial services. The liquidity and global store of riches that Bitcoin provides contribute to guaranteeing its long-term hegemony in the cryptocurrency market.

Still, regulatory review might bring down Bitcoin’s price. Governments worldwide are considering cryptocurrency and may soon tighten laws. Any major legislative measure can reduce investor enthusiasm and cause a market slump. Should Bitcoin overcome these obstacles, it may flourish throughout the month.

Summary

The $83,344 price of Bitcoin now shows its increasing attraction. Bitcoin should remain front and center in financial affairs as the market grows. Institutional interest, distributed finance acceptability, and inflation control can explain Bitcoin’s long-term bright future. Bitcoin Surges, Whether your trading is long-term or short-term, the story of Bitcoin is worth reading. Bitcoin’s development will clearly affect the financial world; consequently, it is an asset that investors should not ignore in 2025 and beyond.