Fed Rate Cut Hits Bitcoin and April 2025 Market Impact

On April 7, 2025, the U.S. Federal Reserve finally met much-sought expectations. This decision changed not only the fast-developing bitcoin landscape but also traditional banking. The Fed interest rate cut impact on Bitcoin: interest rate cut by 25 basis points to 4.50% to increase economic growth, even with substantial pricing pressure. The influence of this decision went far beyond Wall Street.

This news changed the crypto scene right away, including Bitcoin (BTC). People are also concerned about the degree of connectivity of digital assets with the global financial system. Once a barrier against unstable conventional currencies, bitcoin now follows macroeconomic policy and starts a new phase of evolution.

The Fed’s Decision: A Shift in Tone

Though markets projected a rate cut, the Fed’s future course surprised them. While Chair Jerome Powell only sees two, investors expected three or more reductions in 2025. Raising its 2025 inflation prediction from 2.1% to 2.5%, the Fed cited Prospective levies, unstable global supply networks, and labor market changes, causing the Federal Reserve to worry about long-term inflation. The Fed is not flexible yet, even if it is easing.

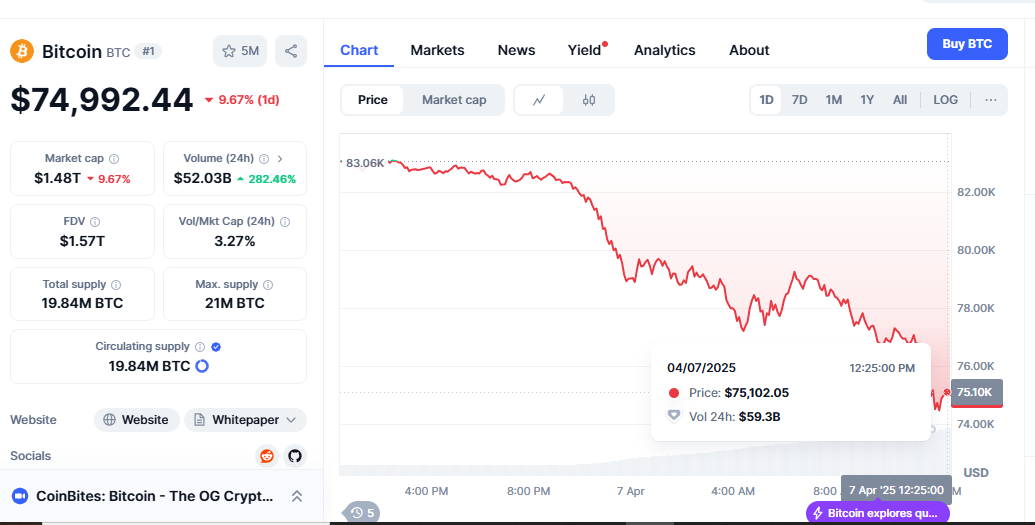

Reaction of the market: Bitcoin and Ether drop

The bitcoin market answered Fed comments quickly. Bitcoin fell 4.6% to $101,300 only a few hours after the news. It only recently reached a record of $108,000. Ether (ETH) declined about 6% to $3,600. These rapid price declines show how sensitively crypto assets react to economic changes.

Experts quickly concluded that $100,000–$98,000 was a reasonable support level for Bitcoin, noting that if that level is breached, further negative pressure could follow. The explosive rise of cryptocurrency matched the worst day the S&P 500 has ever experienced, unveiling the connections among several markets.

Regarding traditional marketplaces

The huge swings in Bitcoin after the Fed’s ruling indicate a change in its financial role. Now behaving as such, bitcoin moves like stocks and commodities—risky investments. Thanks mostly to wealthy investors, Bitcoin ETFs, and financial institutions embracing cryptocurrencies.

Bitcoin is beginning to resemble conventional markets. This suggests that central bank policies, which were once thought to have little bearing on the decentralization of cryptocurrencies, now affect market mood, trading tactics, and price swings.

Context and Current Activities

Coins were active before the Fed decided. Many felt better knowing that, in late 2024, consumer prices rose 2.7% year over year. Inflation seemed to be finally slowing down. Fed interest rate cut impact on Bitcoin. This hope helped Bitcoin first top $100,000 and reach new highs.

Global volatility, changing trade policy, and a less dovish Fed all contributed to quickening the finish of this surge. The new U.S. government’s tax and expenditure policy, particularly regarding tariffs, could affect decisions on money supply, therefore skewing the market perspective.

Forward is what?

Several elements will shape the crypto market in future years. The Fed’s approach will nonetheless help define events. Should inflation remain high longer than anticipated, the central bank may stop downgrading rates. This discouraged risk-taking could limit loan applications. Moreover, modifications in the laws will be crucial. The incoming government could review stablecoins, distributed funds, and crypto tax rules.

These developments might enable the industry to grow by clarifying or simplifying it. Depending on market psychology, liquidity, and monetary dynamics, Bitcoin could remain a regular asset class even while institutional products like ETFs gain more popularity.

Summary

Federal Reserve rate cuts in April 2025 go beyond a simple technicality. They show the close relationship modern money has with digital assets. From a fringe idea to a financial pillar, Bitcoin’s evolution hinged heavily on its response to news and stock market tracking. Bitcoin Price Hits $83,344, Politicians and central bankers will shape crypto more than developers and miners as it grows. Investors, dealers, businesses, and consumers all negotiating the future of cryptocurrency must grasp monetary policy.