Ethereum Weekly Close Will ETH Break Resistance or Pull Back?

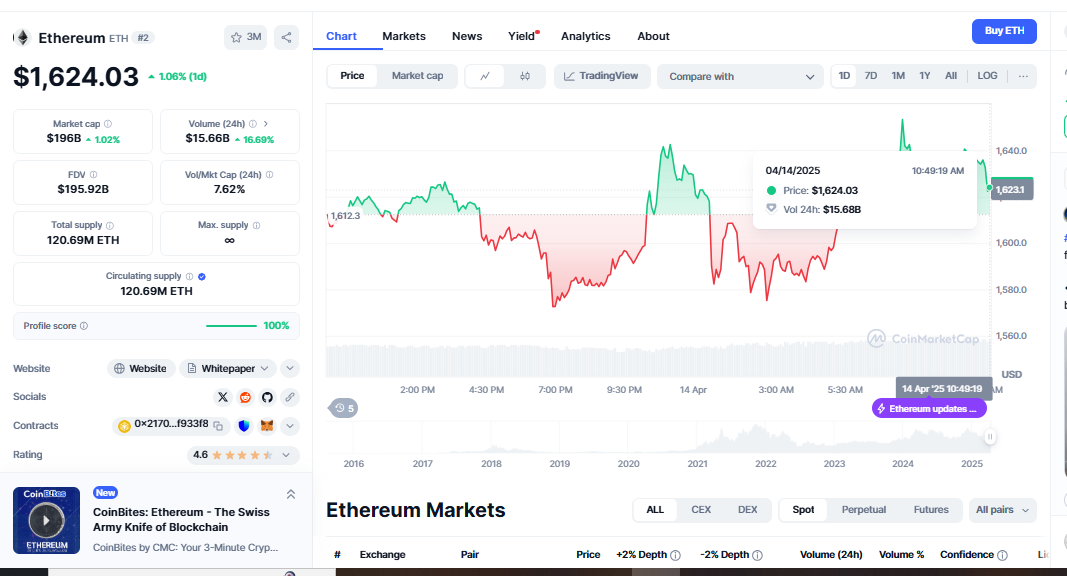

Investors and buyers of Ethereum (ETH) are paying close attention as we head toward the end of another week. The crypto market has not been tranquil lately. Ethereum Weekly Close. This weekly candle can show the asset’s short-term trajectory while ETH is around important trading levels. Ethereum’s Price today is $1,635.14. Everyone wants to know: Will Ethereum continue to rise or stop upon facing resistance?

Technologically speaking, the conclusion of ETH week is always really important. It clearly shows the expected configurations for the next week and the direction of trend momentum. Knowing the signals close to the week’s conclusion will enable you to make strategic decisions, whether you sell a lot or keep onto your investments for a long period.

The Current Ethereum Landscape

As written, Ethereum is selling roughly $[insert current price]. It has remained consistent for a week with just slight variances. ETH has shown fairly aggressive pricing action by trying to exceed a key support level. However, as the crypto market is still generally cautious, such behavior has been welcomed with uncertainty.

People in the market are split between those who think there would be a recession and those who think there would be a rise. Ethereum’s performance is closely associated with Bitcoin’s direction; since BTC generates contradicting signals, ETH is also.

Even with uncertainty, Ethereum is shown to be strong. ETH Price Prediction: This one is still among the most regularly used networks available on the crypto market. While blockchain activity always changes, gas fees have dropped, and Ethereum-based distributed finance (DeFi) solutions remain strong. These ideas support that any falls would be temporary should macro conditions stay favorable.

Key Indicators to Watch Before the Close

Crucial Indices to Track Right Before the Day Ends. Price captures just one scene element. To detect where movement is headed, traders pay great attention to Ethereum’s Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD). The RSI has some moving space but is not quite overbought; it is somewhat near a neutral zone. Rising buying demand could potentially cause a breakout.

The volume has been rather low, which is usual before more important events. A notable rise in traffic right before the closure could throw the balances in any direction. The following hours can reveal more turbulence as traders prepare for the next week.

Data on the chain is a second absolutely important clue. Wallet activity and ETH transactions hint that money could gather behind the scenes. Apart from ETH’s strong support outside the $[insert support level] zone, the case for a greater price increase is still strong as long as momentum continues strong.

What Could Happen at ETH Weekly Close?

Given a few days left in the week, numerous possible outcomes exist.

Should Ethereum close above the current level of support, a stronger upward movement could begin. This would accentuate the increasing trend and could lead one to migrate into the $[insert objective level] area next week.

Should ETH lose its position and fall below support, we might once more see a test of smaller levels before a new run-up. This action might cause short-term weakness and disturb excessively leveraged positions, even if it does not defy the general trend.

Another third option is a sideways close, which leaves the market wondering what to do. This may happen should neither the bears nor the bulls take over before the candle closes. In such a case, the beginning of the week could be less busy. Government news or macroeconomic data could inspire the next big movement.

Why This Close Is Especially Important

Weekly closures expose more data than noise does. They show how consumers in the market feel over long periods, decreasing the impact of the emotional swings in daily and hourly price changes. Ethereum mostly relies on this close since it corresponds with a time.

After weeks of unchanging behavior, the crypto market is looking for direction. A major movement from now on will define Ethereum’s future in the near to medium term. Will it be about slipping back, looking for support, returning on track, and aiming for a new cycle high?

The behavior of Ethereum will be fascinating.

Though many theories have been developed, the chart will ultimately expose the story. Right now, Ethereum is in a somewhat dangerous condition where it might either burst or implode. What do you think $ ETH will do after the week ends? Will bears help relocate it? Will it close strong and set the tone for the next week? Comment with your estimate; we shall find out who is right.