Ethereum Price Surges on Smart Contracts and DeFi Growth

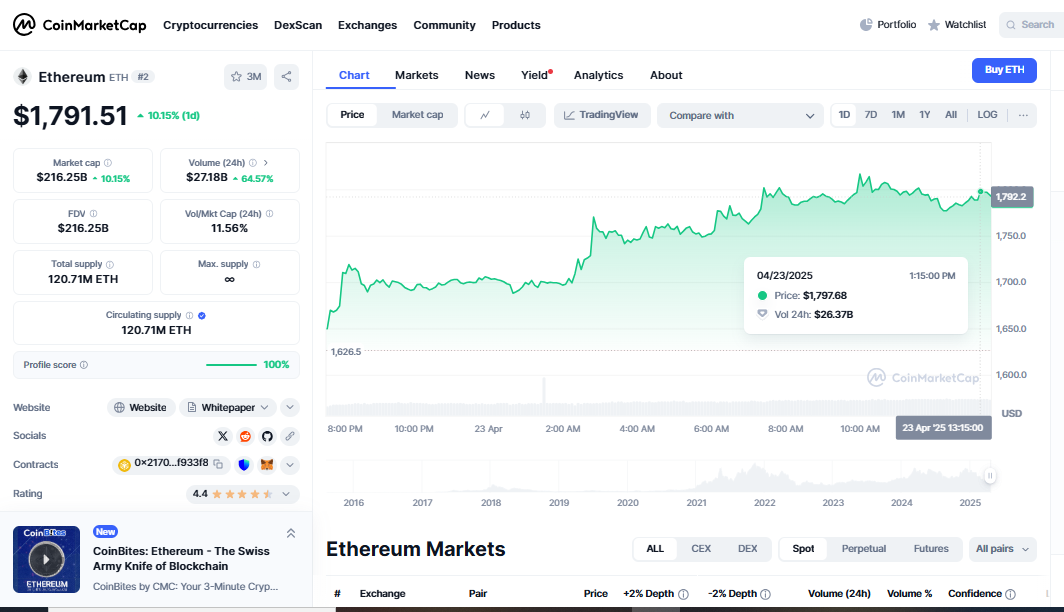

Ethereum, the second most valuable cryptocurrency, is once again demonstrating its leadership in the digital asset field. Ethereum Price Growth, As expected by market analysts, the price of Ether (ETH) today is $1,791 and has been steadily growing, attracting new interest from both institutional and retail buyers. $ETH continues to grow as predicted. Not only has this been the case, but real-world application, ongoing development, and strong foundations have also been driving adoption across various spheres.

Moving Forward from Strong Foundations

Unlike many other cryptocurrencies that move based on hype, Ethereum’s fundamental technology and growing demand drive its upward momentum. Still, the most important component of smart contracts, distributed finance (DeFi), and non-fungible currencies (NFTs), the Ethereum blockchain remains at the center of these still-emerging new concepts. Bitcoin vs Ethereum, This contrast is why $ETH has evolved from a mechanism for storing value to a technological powerhouse supporting the Web3 movement in general.

ETF Surge | Apr 23

◾️ Bitcoin spot ETFs added 10,430 $BTC ($913M)

◾️ Ethereum spot ETFs added 24,580 $ETH ($39M)

Ethereum is among the most valuable cryptocurrencies, as it enables decentralised applications (dApps) and permissionless purchase authorisation. Ethereum has a large network and a significant number of users; therefore, developers are continually adding to it. Ethereum Price Growth, Such activity, in particular, highlights the blockchain’s long-term potential. This constant adaptation raises market trust and facilitates price rises.

Smart contracts and DeFi help to precisely do this:

DeFi’s rise is one main reason for Ethereum’s growth. Without passing through a third party, platforms such as Uniswap, Aave, and Compound on Ethereum enable users to lend, borrow, and earn interest on crypto assets. With billions of dollars trapped in DeFi systems, Ethereum has gained significant importance.

Moreover, one of the most notable aspects of Ethereum is its smart contracts. These self-executing agreements allow sophisticated financial and legal transactions to be instantly executed on a blockchain. This innovation has changed everything, including games, real estate, and supply chain management. Transparency and automation are becoming increasingly necessary, which is why Ethereum’s value is growing in both conventional and cryptocurrency-oriented businesses.

Ethereum uses proof-of-stake (PoS).

Often referred to as “The Merge,” one of Ethereum’s most anticipated changes recently was the transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS). This change reduced the Ethereum network’s energy consumption, thereby improving the environment and attracting investors concerned about environmental, social, and governance (ESG) issues more broadly.

Throughout the transition, changes in the generation and distribution method of new ETH also slowed down the overall increase in supply. The fewer tokens created suggest that prices will rise over time, making this deflation strategy more positive for $ETH. We anticipate significant improvements in Ethereum’s scalability and efficiency. This gets it ready for even more widespread use, not too far off.

The condition of the market and the pricing trend

The market’s overall impression of Ethereum is currently extremely positive. Traders and long-term investors are seeking additional resistance levels, as technical signals now align with underlying strength. Ethereum has historically been quick to bounce back from falls; its current performance suggests a similar trend, possibly spanning the next few months.

Ethereum’s pricing mechanism drives it to keep increasing, even if certain falls are unavoidable. Should $ETH continue on its current trajectory, it could soon challenge its all-time highs. The cryptocurrency market remains volatile. Therefore, investors should be vigilant and manage their risk effectively.

Increasing appeal of Ethereum for businesses

Ethereum is also attracting an increasing number of institutions. Starting to commit part of their money to Ethereum are publicly traded companies, asset managers, and hedge funds. They consider it a speculative tool as well as a fundamental element of a varied digital strategy.

With controlled Ethereum futures and exchange-traded products (ETPs), ETH even further gains legitimacy in the financial industry. Ethereum Price Growth, As more businesses use Ethereum, it becomes more liquid, dependable, and perceptive. Support of institutions will enable it to become even more popular and lead to a slow price rise.

Summary

Ethereum often surpasses its expectations and frequently exceeds market projections. Strong foundations, useful applications, and support from major institutions help $ETH remain the leader in the crypto sector. Its steady rise is guiding the development toward distributed systems and blockchain-based solutions, empowering consumers and developers.

Ethereum is exhibiting behavior that presents both short-term and long-term prospects for investors. Individuals engaged in the market should conduct an extensive study, track changes in the ecosystem, and consider both technical and basic issues when choosing an investment. Ethereum is present now and will continue to be in the future. Now is the ideal time if you haven’t previously considered $ETH.