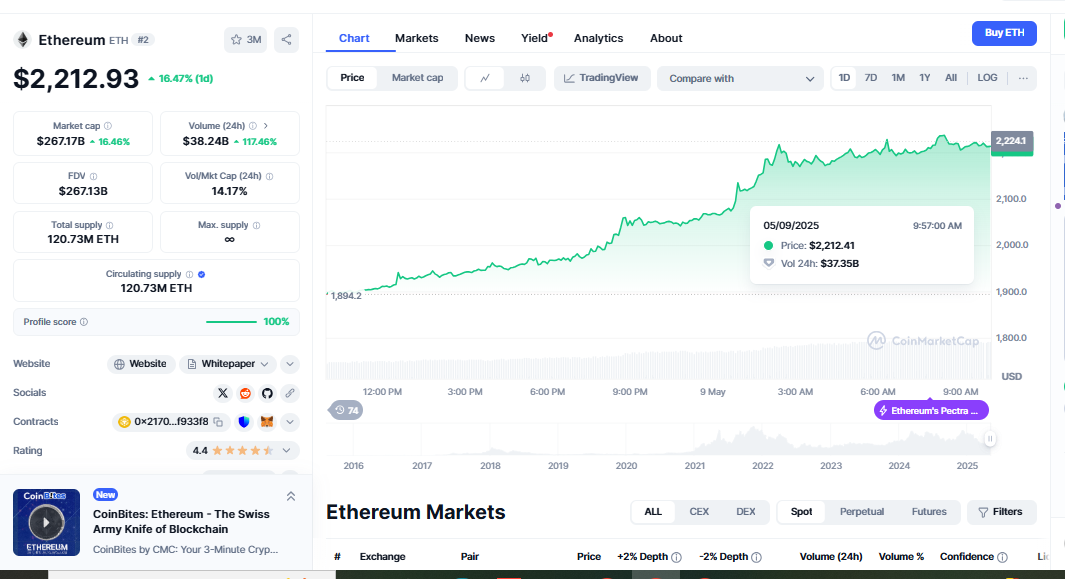

Ethereum Price Surges Past $2K: Is a Bull Run Starting?

Ethereum is once more under public focus. Ethereum has issued one of its most potent daily green candles in recent memory following months of sideways movement and languishing behind Bitcoin. For the second-largest cryptocurrency in the world, ETH’s price jumped beyond the $2,000 mark—a figure that has usually been a positive indication for things. As market mood changes, many traders wonder: Is Ethereum’s next major run starting here?

Ethereum Follows Bitcoin’s Lead

As the leading player in the crypto sector, Bitcoin is usually followed by other assets when it moves. Bitcoin has attracted much attention, setting monthly highs and increasing investor enthusiasm. Relatively quiet, Ethereum finally caught up and pushed across the psychologically significant $2,000 threshold.

This pricing range is not only another round figure. It has been a vital source of resistance in earlier market cycles, at least. Every time Ethereum convincingly crosses this threshold, the market follows with great increasing velocity. The recent breakthrough can indicate a comeback in the phase of accumulation and positive price movement.

Why the $2,000 Level Matters

The $2,000 price mark is more than just a psychological benchmark. It has technical significance:

-

In 2021, crossing $2,000 was followed by Ethereum’s run toward its all-time high.

-

It often serves as a pivot point between bearish corrections and bullish momentum.

-

When ETH holds above $2,000, it attracts higher volumes and new inflows.

Both long-term investors and traders see this level as a portal to better values. Reclaiming it implies that, particularly if more general market conditions remain positive, Ethereum may be starting a significant rally.

Momentum Backed by Market Activity

The explosion of Ethereum did not happen alone. On-chain indicators such as user behaviour and trading volume are rising. Healthy interaction continues for decentralised apps (dApps), NFTS, and DeFi projects developed on the Ethereum blockchain.

Furthermore, recent infrastructure changes to Ethereum—especially the move to proof-of-stake via “The Merge”—have positioned it as a scalable and energy-efficient platform. This update is starting to show in market activity and has raised investor confidence. Trade sessions recently have revealed rising buy pressure. Ethereum’s increasing strength could become a self-fulfilling prophecy of more increases as institutional and retail traders return to the market.

What’s Fueling the Optimism?

Several factors are combining to support the current Ethereum rally:

-

Bitcoin’s dominance cooling: This allows capital to flow into altcoins, particularly Ethereum.

-

Improved regulatory outlook: The SEC and other global regulators have shown more willingness to work with crypto companies than against them.

-

Growing use cases: Ethereum is not just a cryptocurrency. It powers NFTS, DeFi, DAOS, and smart contracts, transforming industries.

-

Exchange inflows dropping: Fewer ETH coins are being deposited into exchanges, suggesting holders are preparing to ride out a longer-term trend rather than sell.

Real-World Implications and Market Sentiment

This price behaviour has actual consequences for both newbies and experienced investors. Strong closes above $2,000 confirm for long-term holders their endurance throughout months of turmoil. For traders, it offers chances to create longer-term positions or profit from momentum bets.

On Twitter and Reddit, among other social media sites, crypto experts and aficionados are buzzing with conjecture and enthusiasm. Making connections to past cycles, many see this as the beginning of a fresh Ethereum bull period. ETH-related activity is also increasing on main trading hubs and exchanges. To encourage involvement, some provide discounts, bonuses, and lowered trading fees for Ethereum trading pairs.

What Comes Next for ETH?

Though Ethereum Price Surges, the road ahead is uncertain, but indications are encouraging. Should ETH keep momentum above $2,000, the next resistance level falls close to $2,200 and $2,400. A sustained move above these could bring $2,800 and even $3,000 into focus within the next few months.

Short-term pullbacks are also feasible, though. The consolidation phases typically follow such a fast breakout. The secret is that if consumers keep stepping in at lower points, they strengthen the optimistic framework. Investors should also watch macroeconomic events, including inflation data, interest rate decisions, and Bitcoin performance. These all impact Ethereum’s price indirectly but significantly.

Conclusion

Ethereum’s regaining of $2,000 is a declaration of fresh strength rather than just a price event. With better fundamentals, increasing on-chain activity, and market-wide hope, ETH could set itself up for a big breakthrough season. Whether you know about cryptocurrencies or are just starting your path, right now is a pivotal point in keeping close market observation. In the following weeks, Ethereum’s fast-changing narrative will define its course for the rest of the year.