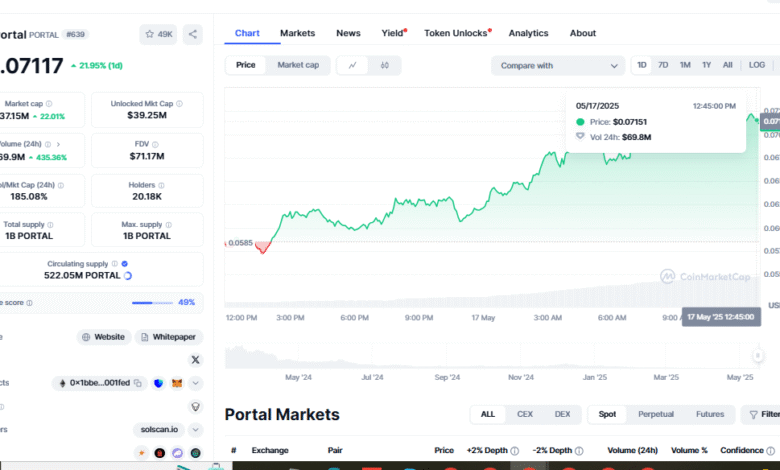

$PORTAL Tests $0.0708 Resistance, Signals Potential Reversal

Following a quick ascent, the $PORTAL/USDT trading pair has recently hit strong resistance near the $0.0708 price level. Traders are closely monitoring this support zone since the way prices have moved indicates a possible turnaround. Given early signs of losing momentum following the test of this limit, $PORTAL resistance reversal, a slip towards lower support zones is more likely. $MECO Price Surge, If traders want to profit from short-term price changes while controlling their risk, they should know how $PORTAL reacts to this barrier.

Enough is is said about the importance of resistance degrees in technical research. Resistance is found at a position on the price curve when buying power is less than selling power. This halts an even more notable price rise. Should it not break and stay above this vital support close to $0.0708, a price drop in $PORTAL is most likely. Volatile markets like cryptocurrency go through regular pullbacks of this nature. They allow traders to buy ones at better rates or bail out from bets before their probable losses worsen.

Analyzing the trading setup: negative perspective

Right now, signals of decreasing momentum and recent price corrections indicate a more likely downward market movement. Traders should closely monitor market movements near the resistance level to guarantee the real turnabout. If the price struggles significantly getting through the barrier, then going short around $0.0706 could be wise.

Target gains from recent support levels that have kept historical price stability, set around $0.0675 and $0.0650. These reasonable guidelines let consumers exhibit interest once more, stopping more declines. Still, keeping adequate risk control is really important. Should a stop-loss order around $0.0715, somewhat above the tested support, exist, it helps traders prevent sudden bullish breakouts, thereby undercutting the bearish setup.

When the market is volatile, traders who set different entrance, take-profit, and stop-loss positions help to be focused and avoid acting emotionally. When trading unstable assets like $PORTAL, which can swing in both directions quickly, this disciplined technique is essential for lowering losses and locking in winnings.

Why, then, are confirmatory bearish rejection candles so important?

Bearish rejection candles are one of the best signals that the price is poised to turn around close to resistance. The patterns on these candles show that intense selling pressure prohibited buyers from succeeding even if they sought to increase the price. The price closed quite close to its all-time low for the period. These kinds of patterns expose still antagonism and suggest that the momentum might be moving toward sellers.

Before making a short trading commitment, traders should be extra alert for these signs of a slowing market. These confirmations help lower the likelihood of false breakouts—that is, occurrences whereby price rises over resistance and then falls back. Knowing rejection candles helps traders plan their activities more precisely, increasing their chances of profiting from trades.

Why, in trading cryptocurrencies, does resistance matter?

In crypto trading, resistance levels are rather important since they expose where market beliefs regarding prices change. With almost $0.0708, a pricing range with great demand for sales, $PORTAL/USDT faces a hurdle. The fact that this level hasn’t been broken suggests buyers and sellers are still reluctant to boost the price without new reasons.

Resistance levels provide momentum traders looking at a trend’s strength with like-minded checkpoints. Although repeated failure usually results in consolidation or a drop, a strong break above resistance could mark the start of a long-term advance. Since cryptocurrencies are so unpredictable, traders have to understand and value these technical levels to avoid costly mistakes and spot better opportunities.

Variability in the market and the changes in the $PORTAL price

Since the markets for cryptocurrencies are often erratic, news from outside the market can quickly influence the values of tokens like $PORTAL based on rumors and market opinion. The recent rise, followed by resistance testing, is the perfect example of this pricing behavior. Traders usually make short-term price adjustments more by reacting quickly to technical cues. Thus, rallies and pullbacks look larger than they really are.

Although the crypto market swings, tokens like $PORTAL frequently follow their own momentum cycles, much influenced by trader psychology and social media hype. Technical analysis is, therefore, a valuable tool for deciding where prices are most likely to go; nevertheless, you always have to be informed and able to adapt to changing market conditions.

Knowing what is going on, make a reasonable trade.

Investors in $PORTAL/USDT or another cryptocurrency must prioritize real-time price movement and technical analysis. They run considerable danger if they simply pay attention to historical performance or market buzz. Traders will judge better if they routinely see essential support and resistance levels and bearish rejection candle patterns.

Furthermore, setting profit targets and stop losses, among other disciplined risk management techniques, helps to protect capital and lower trading mistakes caused by emotional influence. Remember that the goal is to find a reasonable mix of risk and return, especially in markets where price movement and change are rather evident.

Last Words and a Demand to Action

This is a big day for traders observing $PORTAL to check its support close to $0.0708. Whether the token breaks through or goes backwards, knowing. The technical indications at this level will help you manage the price swings with simplicity. These ideas will help you design a trading strategy and monitor price movement to get confirmations.

Follow our channel if you want to stay on top of changes. The $PORTAL market and obtain fast news, analysis, and trade tips. Meme Tokens Gain, Always be aware of the changes in the Bitcoin market, use reasonable trading techniques, and seize the opportunities it presents.