ETH Futures Hit Record as Stablecoin Market Eyes $2T

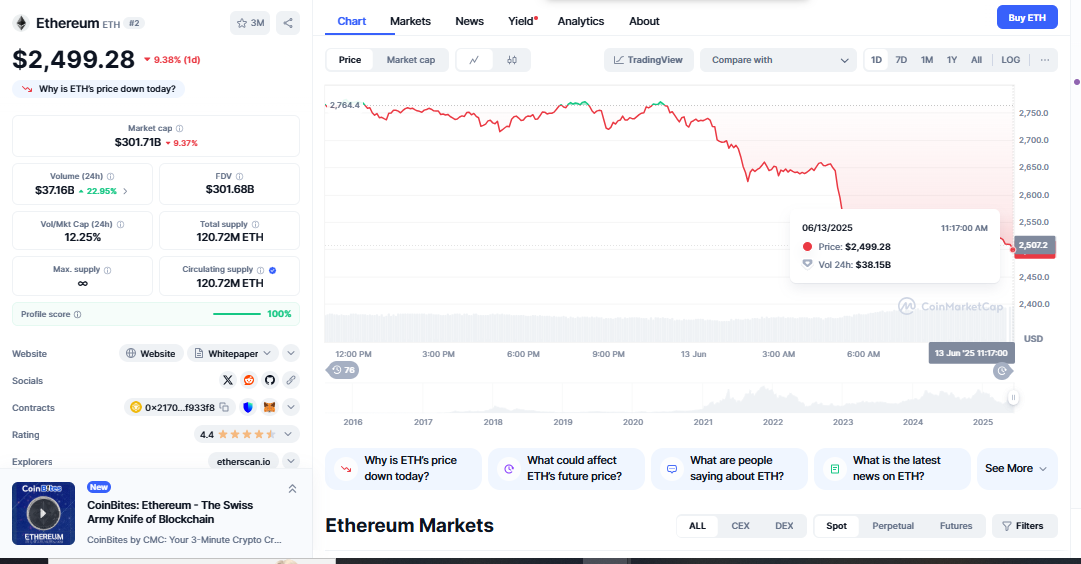

The digital asset market is continually evolving despite economic uncertainty and increased institutional interest. Ethereum and Bitcoin dominate blockchain adoption and pricing discussions. Today’s market activity seemed calm: Ethereum ($ETH) rose 0.02% to $2,754.88, while Bitcoin ($BTC) fell 1.35% to $107,637.23. ETH futures record, However, these tiny changes conceal structural signs that indicate an emerging ecology of leverage, Bitcoin and Ethereum Surge, and a growing yearning for stability through fiat-backed digital assets.

Strength of ETH Despite Record Futures

Ethereum’s performance today may seem calm, but the wider picture suggests otherwise. ETH futures open interest reached a record $20 billion. This illustrates that leverage increases risk for major and retail traders. This leverage is increasingly driven by high ETF movement and speculation. Messari figures suggest that Ethereum-based ETFs now pull in over $240 million daily, surpassing Bitcoin’s.

This is a crucial moment. Bitcoin was the first digital product to work with cash for years. Ethereum can be used for smart contracts, DeFi protocols, NFT infrastructure, and Layer 2 rollups, giving institutions more than simply a method to store assets. With VanEck, BlackRock, and Fidelity as major ETF issuers, ETH is becoming a regulated investment. This means the currency will appreciate over time.

BTC Brings Together while analysts forecast $200K targets

Bitcoin’s slight decline today corresponds with recent consolidation patterns. At $107,637.23, BTC is still over psychological thresholds like $100,000, but it hasn’t recovered from mid-May. However, macro-experts remain optimistic. After lower-than-expected U.S. inflation data this week, many believe Bitcoin will reach $200,000 before year’s end.

Based on monetary policy and the knowledge that bold interest rate hikes are unlikely, such projections are made. Risky assets like crypto, especially those with restricted supply like Bitcoin, may do well as inflation falls. This is supported by ARK Invest and Galaxy Digital economists. If ETF-driven individual and institutional investor flows persist, they foresee parabolic situations.

Total Market Cap, Volume, and Volatility

The crypto market is worth $3.54 trillion, down 1.39% from yesterday. Trading fell 13.03% in 24 hours to $44.72 billion. This may reduce speculation and short-term instability. Bitcoin’s market share rose to 60.6%, confirming its “anchor” status during stability. The Fear & Greed Index is 9.43% (+0.44%), indicating severe greed. This could indicate that people are overusing debt or that the market is bullish despite short-term declines.

Volatility breakouts usually occur first in calm economies and narrow price bands. Traders and investors watch for confirmation indications in either direction. This is crucial since ETH and BTC are still affected by ETF flows, stablecoin supply, and futures market leverage ratios.

Stablecoin Growth and Infrastructure

Another major shift occurred with stablecoins. Messari specialists and the U.S. Treasury estimate that the stablecoin market might reach $2 trillion by 2028. It is envisaged that more payment systems will use it, regulatory restrictions will clarify, and decentralized finance and centralized exchanges will collaborate.

Crypto and digital goods are being traded using stablecoins like USDT, USDC, and PayPal’s PYUSD. These assets are utilized as margin collateral, to produce money, and for cross-border transfers, making them more than speculative. Important infrastructure. Most institutional ETH and BTC flows use stablecoin conversions. This speeds up digital dollar circulation and deepens markets in uncertain times.

Midyear positioning, risk, and leverage

ETH hasn’t gone as high as lately (around $2.8K), but open interest and futures activity show traders are confident. Such behavior often precedes major trends. According to Glassnode on-chain data, more ETH is being staked or locked in smart contracts, reducing trade volume. This, together with ETF flows and institutional leverage, makes selling tougher and raises prices.

Bitcoin is strengthening, but wealth is flowing into altcoin ecosystems and Layer 1 rivals. Treasury rates, the U.S. Dollar Index (DXY), and CPI and PCE inflation movements may help BTC traders. BTC’s price could rise again to meet high-end expert estimates of $200K if these signals continue.

Summary

Even though prices aren’t moving much today, the market may turn. The stage is set for a huge price rise with $ETH futures at record highs, ETF inflows accelerating, and stablecoin velocity rising. Ethereum Outpaces BTC, While volatility is low, indicators of the next major wave are emerging.

Options spreads and leverage plays make institutional players wiser. People are increasingly doubting ETH’s ETF. In the coming weeks, inflation and central bank discourse will define the macro stage and crypto asset performance. Traders should watch open interest jumps, chain wallet behavior, and global economic indicators.