AI Crypto Trends 2025 DePIN, Autonomous Agents and Blockchain

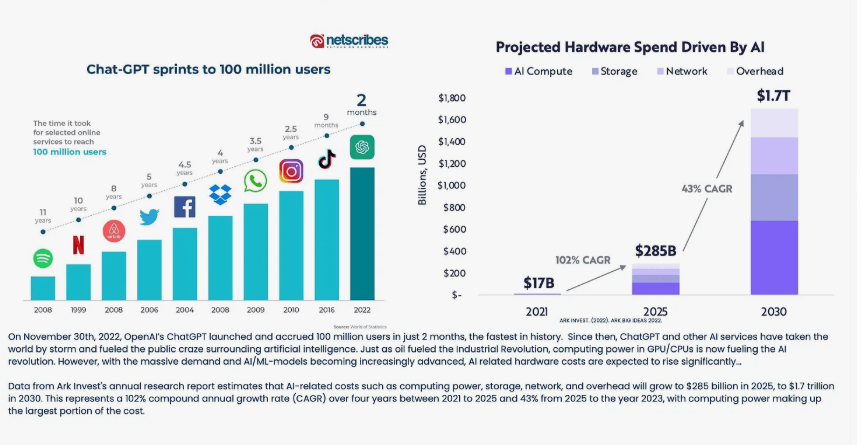

The convergence of artificial intelligence and cryptocurrency has reached an unprecedented milestone in 2025, with AI-powered blockchain projects emerging as the dominant narrative in the digital asset space. Artificial intelligence tokens captured 35.7% of global investor interest in Q1 2025, setting the stage for explosive growth as we enter the third quarter of the year.

As we approach Q3 2025, the intersection of AI and blockchain technology is no longer a speculative concept but a tangible reality driving innovation across decentralised networks, autonomous agents, and intelligent financial protocols. AI and big data tokens have experienced a remarkable 131% increase in market capitalisation, reaching new heights in both adoption and technological sophistication.

This comprehensive analysis explores the most significant AI crypto trends positioned to shape the market landscape in Q3 2025. Best AI Crypto Coins, from decentralised physical infrastructure networks (DePIN) to autonomous trading algorithms and next-generation AI agents operating on blockchain networks.

Current State of AI-Crypto Integration

The AI cryptocurrency sector has demonstrated remarkable resilience and growth throughout 2025, establishing itself as a cornerstone of the digital asset ecosystem. “No trend stands out more than the intersection of AI and crypto,” according to prominent venture capital investors, highlighting the sector’s strategic importance for institutional and retail participants alike.

AI coins are crypto assets that leverage artificial intelligence to improve user experiences, scalability, and security within blockchain networks, representing a fundamental shift from traditional blockchain applications toward intelligent, adaptive systems capable of autonomous decision-making and optimisation.

The sector’s growth trajectory reflects broader technological convergence trends, where machine learning algorithms, neural networks, and blockchain consensus mechanisms work synergistically to create unprecedented value propositions for users and developers.

Technological Foundation and Infrastructure Development

Modern AI crypto projects have evolved beyond simple token mechanics to implement sophisticated technological architectures that combine distributed computing, machine learning inference, and cryptographic security. These systems enable real-time data processing, predictive analytics, and autonomous execution of complex financial operations.

The integration of large language models (LLMs) with blockchain networks has opened new possibilities for natural language interfaces, automated smart contract generation, and intelligent portfolio management systems that adapt to market conditions without human intervention.

Edge computing integration within blockchain networks allows AI models to process data locally while maintaining decentralised consensus, addressing latency concerns and improving overall system performance for time-sensitive applications.

(DePIN)The $3.5 Trillion Revolution

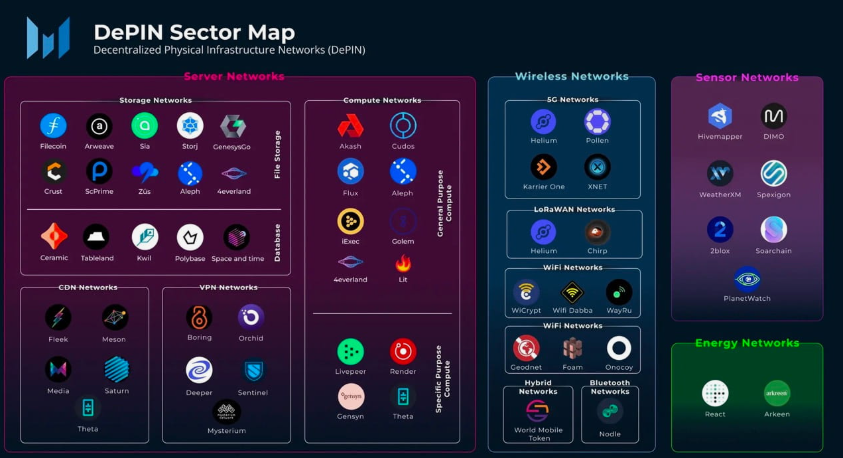

The decentralised physical infrastructure networks (DePIN) market could reach a value of 3.5 trillion dollars by 2028, representing one of the most significant opportunities in the AI crypto space. DePIN projects combine artificial intelligence with real-world infrastructure deployment, creating networks that optimise everything from energy distribution to wireless connectivity.

These networks leverage cryptocurrency incentives to encourage participants to contribute physical resources such as computing power, storage capacity, wireless coverage, and sensor data collection. AI algorithms then optimise resource allocation and network performance across distributed infrastructure components.

The scalability potential of DePIN networks stems from their ability to create self-improving systems where AI optimisation algorithms continuously enhance network efficiency. At the same time, token economics ensure sustainable participation and growth.

Key DePIN Projects Gaining Momentum

- Helium Network has pioneered the wireless DePIN model, deploying thousands of hotspots worldwide to create decentralised wireless coverage. The integration of AI-powered network optimisation has improved coverage prediction and resource allocation, making the network more efficient and profitable for participants.

- Filecoin continues expanding its decentralised storage network with AI-enhanced data placement algorithms that optimise retrieval times and storage costs. The network’s machine learning systems predict storage demand patterns and automatically adjust pricing mechanisms to maintain network stability.

- Render Network leverages distributed GPU resources for AI model training and rendering tasks, with intelligent workload distribution algorithms that match computational requirements with available hardware resources. The network has become essential infrastructure for AI development teams requiring scalable computing power.

Investment Opportunities and Risk Assessment

DePIN tokens have demonstrated a strong correlation with infrastructure adoption metrics, creating investment opportunities based on real-world utility rather than speculative trading. AIOZ Network rose 569% amid AI-DePIN growth, exemplifying the sector’s potential for substantial returns tied to network expansion.

Investors should evaluate DePIN projects based on infrastructure deployment rates, network utilisation metrics, and the sophistication of AI optimisation algorithms. Projects with clear utility cases and growing user adoption present the most compelling investment narratives.

Risk factors include regulatory uncertainty surrounding the deployment of physical infrastructure, competition from centralised alternatives, and the technical complexity of maintaining distributed networks at scale.

Autonomous AI Agents and Smart Contract Automation

Autonomous AI agents represent the next frontier in blockchain automation, capable of executing complex financial strategies, managing decentralised autonomous organisations (DAOs), and optimising protocol parameters without human intervention. These agents utilise advanced decision-making algorithms trained on historical blockchain data and market patterns.

Projects like Fetch.ai are developing decentralised AI networks that enable autonomous agents to collaborate across different blockchain ecosystems, creating a new paradigm for cross-chain interoperability and automated protocol management.

The integration of natural language processing (NLP) capabilities allows these agents to interpret human instructions, execute complex multi-step operations, and provide explanatory feedback about their decision-making processes.

Practical Applications and Use Cases

- Yield Farming Optimisation: AI agents continuously monitor DeFi protocols to identify optimal yield farming opportunities, automatically moving funds between platforms to maximise returns while managing risk exposure through sophisticated portfolio rebalancing algorithms.

- Governance Participation: Autonomous agents can participate in DAO governance by analysing proposal implications, voting according to predefined criteria, and even drafting new proposals based on community sentiment analysis and protocol performance metrics.

- MEV (Maximal Extractable Value) Strategies: Advanced AI agents identify arbitrage opportunities, liquidation scenarios, and other MEV extraction possibilities across multiple blockchain networks simultaneously, executing profitable strategies within milliseconds of opportunity identification.

Technical Challenges and Solutions

Scalability remains a primary concern for AI agent deployment, as complex decision-making algorithms require significant computational resources that may strain blockchain networks. Layer 2 solutions and off-chain computation with on-chain verification are emerging as preferred architectures.

Security considerations include preventing AI agents from being manipulated through adversarial inputs, ensuring agent behaviour remains within intended parameters, and implementing failsafe mechanisms that can halt agent operations if anomalous behaviour is detected.

Interoperability challenges arise when agents need to operate across multiple blockchain networks with different consensus mechanisms, token standards, and innovative contract architectures. Cross-chain bridge protocols and universal standards are being developed to address these limitations.

AI-Powered Trading and Portfolio Management

Algorithmic Trading Revolution

AI-powered trading algorithms offer smarter, real-time portfolio management, now accessible to retail investors, democratising sophisticated trading strategies previously available only to institutional participants. These systems analyse market microstructure, sentiment data, and macroeconomic indicators to generate trading signals.

Machine learning models trained on years of cryptocurrency market data can identify patterns invisible to human traders, including subtle correlations between different asset classes, optimal entry and exit timing, and risk management strategies tailored to individual portfolio characteristics.

The integration of natural language processing allows trading algorithms to incorporate news sentiment, social media trends, and regulatory announcements into their decision-making processes, providing a more comprehensive view of market dynamics.

Risk Management and Portfolio Optimisation

Advanced AI systems employ dynamic hedging strategies that automatically adjust position sizes and derivative exposures in response to real-time volatility measurements and correlation analysis. These systems can protect portfolios during market downturns while maintaining exposure to the upside during favourable conditions.

Multi-objective optimisation algorithms balance competing goals such as maximising returns, minimising drawdowns, maintaining portfolio diversification, and adhering to risk budgets. The algorithms continuously learn from market feedback to improve their performance over time.

Stress testing capabilities allow AI portfolio managers to simulate various market scenarios and adjust strategies proactively, including black swan events, regulatory changes, and technical failures that could impact portfolio performance.

Emerging Platforms and Protocols

- Numerai continues expanding its decentralised hedge fund model, where data scientists compete to create the most accurate predictive models for financial markets. The platform’s cryptocurrency token (NMR) aligns incentives between model creators and fund performance.

- dHEDGE provides a decentralised asset management infrastructure where AI-powered strategies can be tokenised and made available to retail investors. The platform enables strategy creators to earn performance fees while providing transparent, auditable investment products.

- Enzyme Finance provides comprehensive asset management tools that integrate with AI trading algorithms, enabling fund managers to implement sophisticated strategies while maintaining regulatory compliance and ensuring investor transparency.

Machine Learning Infrastructure and Computing Networks

The computational requirements for training advanced AI models have created significant opportunities for blockchain-based computing networks that aggregate distributed GPU and TPU resources. These networks offer cost-effective alternatives to centralised cloud providers while maintaining decentralised ownership and control.

Token incentive mechanisms encourage hardware providers to contribute computational resources to the network, creating a marketplace where AI developers can access scalable computing power on-demand. Smart contracts automate the distribution of payments based on the computational work completed and the performance metrics of model training.

The emergence of specialised AI chips optimised for machine learning workloads has enhanced the efficiency of decentralised computing networks, making them competitive with traditional cloud computing platforms for many AI development use cases.

Data Marketplaces and Privacy-Preserving ML

Blockchain-based data marketplaces enable AI developers to access high-quality training datasets while preserving data privacy through advanced cryptographic techniques such as homomorphic encryption and secure multi-party computation.

Federated learning protocols allow multiple parties to collaboratively train AI models without sharing raw data, creating opportunities for cross-organisational AI development while maintaining competitive advantages and regulatory compliance.

Zero-knowledge proof systems enable the verification of AI model training and inference results without revealing the underlying data or model parameters, thereby addressing privacy concerns while maintaining transparency and auditability.

Leading Infrastructure Projects

- Akash Network provides a decentralised cloud computing infrastructure specifically optimised for AI workloads, with intelligent resource allocation algorithms that match computational requirements with available hardware. AKT saw a 70% increase in revenue in Q3 2024, driven by heightened demand for AI workloads.

- Internet Computer Protocol (ICP) enables AI applications to run entirely on-chain, providing censorship-resistant infrastructure for AI services while maintaining high performance and scalability through its unique consensus mechanism.

- Bittensor creates a decentralised network for machine learning model training and inference, where participants earn cryptocurrency rewards for contributing computational resources and developing high-performing AI models.

Predictive Analytics and Market Intelligence

AI-powered analytics platforms are revolutionising how investors and developers understand blockchain networks by analysing transaction patterns, user behaviour, and protocol usage to generate actionable insights. These systems can predict market movements, identify emerging trends, and detect anomalous activities that may indicate security threats or market manipulation.

Advanced graph neural networks analyse blockchain transaction graphs to identify relationships between addresses, predict future transaction flows, and assess credit risk for DeFi lending protocols. This analysis provides unprecedented visibility into cryptocurrency market dynamics.

Sentiment analysis algorithms process social media data, news articles, and community discussions to generate real-time sentiment scores for different cryptocurrencies and projects. However, these scores correlate strongly with short-term price movements and can inform trading strategies.

Institutional Adoption and Integration

Traditional financial institutions are increasingly integrating AI-powered cryptocurrency analytics into their risk management and investment decision-making processes. These tools help institutions navigate regulatory requirements while capitalising on cryptocurrency market opportunities.

Compliance automation systems use machine learning to monitor cryptocurrency transactions for suspicious activities, automatically generating reports for regulatory authorities and flagging potential violations of anti-money laundering (AML) regulations.

Portfolio construction algorithms help institutional investors optimise cryptocurrency allocations within broader investment mandates, considering factors such as correlation with traditional assets, volatility characteristics, and regulatory constraints.

Emerging Applications and Use Cases

- Fraud Detection: AI systems analyse transaction patterns to identify potential fraud, Ponzi schemes, and other malicious activities in real-time, protecting users and maintaining ecosystem integrity.

- Credit Scoring: Machine learning models assess credit risk for DeFi borrowers based on on-chain transaction history, social graphs, and protocol interaction patterns, enabling unsecured lending without traditional credit checks.

- Protocol Optimisation: AI algorithms continuously monitor protocol performance metrics and recommend parameter adjustments to improve efficiency, security, and user experience across various DeFi applications.

Regulatory Landscape and Compliance Technologies

The evolving regulatory landscape for cryptocurrency and AI technologies has created demand for sophisticated compliance solutions that can adapt to changing requirements while maintaining operational efficiency. AI-powered compliance systems monitor regulatory developments and automatically adjust protocol behaviour to maintain compliance across multiple jurisdictions.

Automated reporting systems generate regulatory filings and compliance reports using AI analysis of transaction data, trading activities, and user interactions. These systems reduce compliance costs while improvingthe accuracy and timeliness of regulatory submissions.

Privacy-preserving compliance technologies utilise advanced cryptographic techniques to demonstrate regulatory compliance without disclosing sensitive user data or business information, thereby addressing privacy concerns while meeting regulatory requirements.

Cross-Border Regulatory Harmonisation

AI systems analyse regulatory differences across jurisdictions to identify optimal compliance strategies for global cryptocurrency operations. These systems help businesses navigate complex regulatory frameworks while minimising operational overhead and legal risks.

Regulatory sandboxes in various countries are providing opportunities for AI crypto projects to test innovative approaches while working closely with regulators to develop appropriate governance frameworks for emerging technologies.

International coordination efforts are developing common standards for AI and cryptocurrency regulation, creating opportunities for projects that demonstrate early compliance with anticipated global standards.

Summary

Regulators are increasingly focusing on algorithmic transparency and explainability requirements for AI systems operating in financial markets. Top 7 Cryptocurrency Trends: Projects that implement interpretable AI models and provide clear audit trails will have competitive advantages in regulated markets.

Data protection regulations, such as the GDPR, are being extended to cover AI systems, requiring cryptocurrency projects to implement privacy-by-design principles and provide users with greater control over their data usage.

Systemic risk monitoring is becoming a priority for regulators concerned about the potential impact of AI-powered trading systems on market stability. However, Projects that implement appropriate risk controls and circuit breakers will be better positioned for regulatory approval.