Best Ethereum Staking Platforms in Canada for 2025

Ethereum staking has emerged as one of the most compelling opportunities for Canadian cryptocurrency investors seeking to generate passive income. Since Ethereum’s transition to proof-of-stake through the Ethereum Merge in September 2022, Canadian investors can now earn rewards by participating in network validation while supporting blockchain security and decentralisation.

The Canadian cryptocurrency landscape presents unique opportunities and challenges for Ethereum staking, with regulatory clarity from the Canadian Securities Administrators (CSA) and favorable tax treatment under certain circumstances. This comprehensive guide examines the best Ethereum staking platforms available to Canadian residents, analysing fees, security measures, regulatory compliance, and overall user experience.

Ethereum Staking Fundamentals

Ethereum staking involves locking up ETH tokens to participate in the network’s consensus mechanism. Validators who stake their ETH help secure the blockchain by proposing and validating new blocks, earning staking rewards in return. Ethereum Break $4,000, The minimum requirement for solo staking is 32 ETH, but staking pools and platforms allow participation with smaller amounts.

Current Ethereum staking yields range from 3% to 6% annually, depending on network participation rates and validator performance. These rewards come from transaction fees, priority fees, and maximum extractable value (MEV). Canadian investors should be aware that stakeholder rewards are typically subject to income tax obligations under the Canada Revenue Agency (CRA) guidelines.

Top Ethereum Staking Platforms for Canadians

1. Coinbase (Advanced) – Best Overall Platform

Rating: 9.2/10

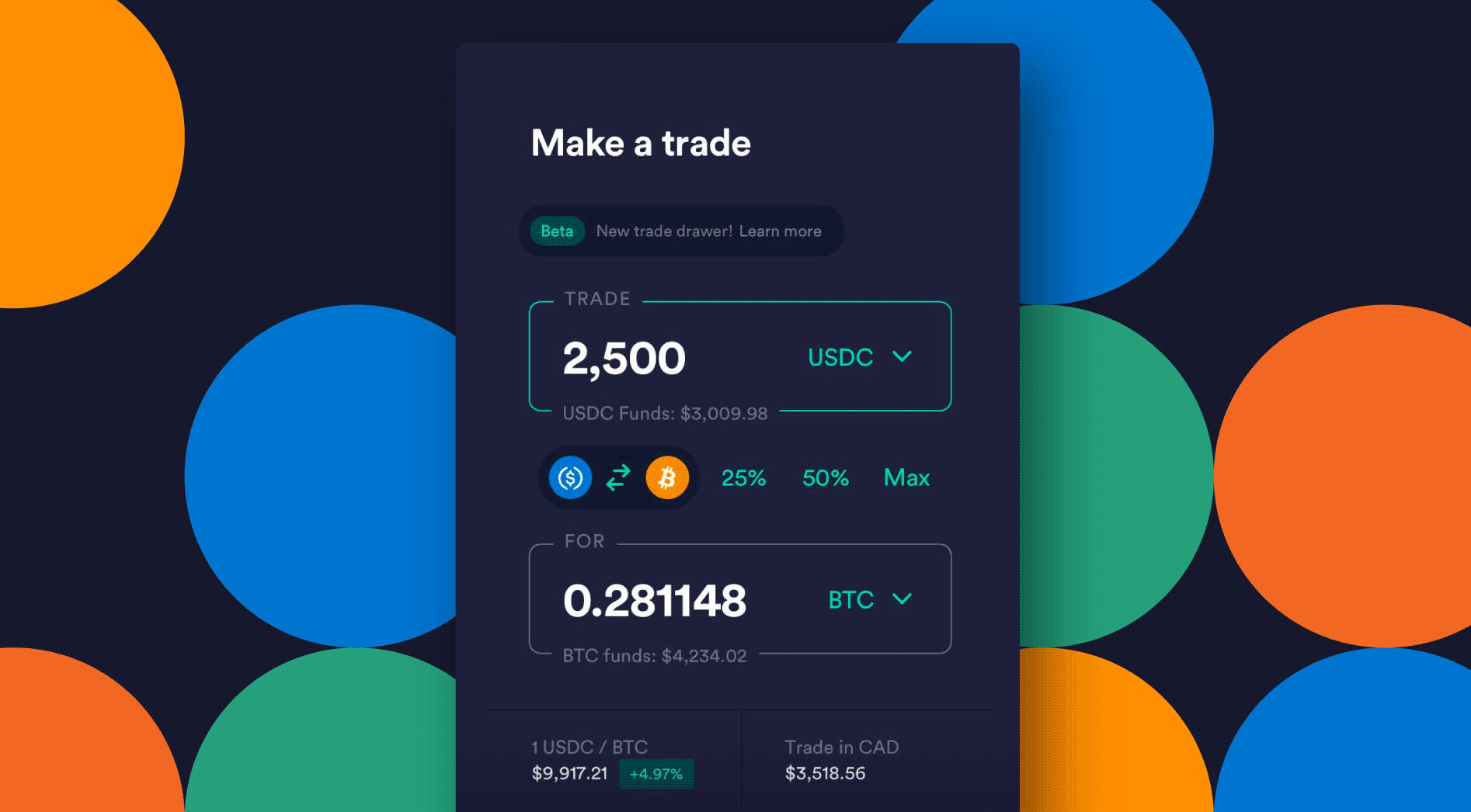

Coinbase stands as the premier choice for Canadian Ethereum staking, offering institutional-grade security with user-friendly accessibility. The platform provides seamless integration with Canadian banking systems and maintains full regulatory compliance with Canadian financial authorities.

Key Features:

- No minimum staking requirement

- Approximate 3.2% annual percentage yield (APY)

- FDIC insurance protection for USD deposits

- Advanced security measures including cold storage

- 24/7 customer support with Canadian phone line

- Integrated tax reporting tools for CRA compliance

Fees: 25% commission on staking rewards Supported Provinces: All Canadian provinces and territories

2. Kraken – Best for Advanced Users

Rating: 9.0/10

Kraken offers sophisticated staking services with competitive rates and extensive educational resources. The platform’s deep liquidity and professional-grade tools make it ideal for experienced Canadian cryptocurrency traders and institutional investors.

Key Features:

- Multiple staking options including on-chain and parachain staking

- Competitive 4-6% APY range

- Advanced portfolio management tools

- Extensive API support for automated strategies

- Strong regulatory compliance record

- Educational resources and market analysis

Fees: Variable commission structure (15-25%). Supported Provinces: All provinces except Ontario (restricted services)

3. Bitbuy – Best Canadian-Focused Platform

Rating: 8.8/10

As Canada’s leading cryptocurrency exchange, Bitbuy offers tailored services for Canadian investors with local banking integration and CAD trading pairs. The platform emphasizes regulatory compliance and provides comprehensive customer support in both English and French.

Key Features:

- Native Canadian exchange with CAD support

- Integrated e-transfer and wire transfer options

- Comprehensive educational resources in both official languages

- Strong security protocols and insurance coverage

- Dedicated Canadian customer service team

- Tax optimization features for Canadian investors

Fees: 20% commission on staking rewards Supported Provinces: All Canadian provinces and territories

4. Binance – Best for Low Fees

Rating: 8.5/10

Binance offers competitive staking rates with minimal fees, making it attractive for cost-conscious Canadian investors. The platform provides various staking products including flexible and locked staking options with different risk profiles.

Key Features:

- Multiple staking products (flexible, locked, DeFi staking)

- Low commission rates (5-15%)

- High liquidity and trading volume

- Advanced trading tools and derivatives

- Mobile app with comprehensive staking features

- Multi-language support

Fees: 5-15% commission on staking rewards. Regulatory Status: Limited services in some Canadian provinces

5. Lido Finance – Best Decentralised Option

Rating: 8.3/10

Lido Finance represents the leading decentralized staking protocol, offering liquid staking through stETH tokens. This approach allows Canadian investors to maintain liquidity while earning staking rewards, providing flexibility for active portfolio management.

Key Features:

- Liquid staking with stETH tokens

- No minimum staking requirement

- Decentralized governance model

- Integration with DeFi protocols

- Transparent validator selection process

- Competitive staking yields

Fees: 10% protocol fee on staking rewards Access Method: Through DeFi wallets and decentralized exchanges

Regulatory Landscape for Ethereum Staking in Canada

- Canadian Securities Regulation: The Canadian Securities Administrators (CSA) has provided guidance on cryptocurrency staking activities, generally treating staking rewards as income for tax purposes. Canadian investors must report stakeholder income at fair market value when received, with the cost basis established for future capital gains calculations.

- Provincial Regulations: Different provinces maintain varying approaches to cryptocurrency regulation. Ontario has implemented specific registration requirements for crypto asset trading platforms, while other provinces follow federal guidelines with additional consumer protection measures.

- Tax Implications for Canadian Stakers: Staking rewards are considered taxable income under Canadian tax law, requiring them to be reported on annual tax returns. The Canada Revenue Agency (CRA) treats staking differently from capital gains, with rewards taxed at marginal income tax rates. Investors should maintain detailed records of their staking activities for tax compliance purposes.

Security Considerations for Canadian Stakeholders

Platform Security Assessment

When evaluating staking platforms, Canadian investors should prioritize security features, including:

- Cold storage implementation for the majority of funds

- Multi-signature wallet architecture

- Regular security audits and penetration testing

- Insurance coverage for digital assets

- Two-factor authentication and advanced access controls

- Regulatory compliance and licensing status

Personal Security Best Practices

Canadian stakers should implement comprehensive security measures including hardware wallet usage for long-term storage, secure password management, and regular security updates. Avoiding public Wi-Fi for staking activities and maintaining separate devices for cryptocurrency management enhances overall security posture.

Staking Strategies for Canadian Investors

Dollar-Cost Averaging into Staking

Canadian investors can implement dollar-cost averaging strategies by regularly purchasing ETH with Canadian dollars and staking the assets immediately. This approach reduces timing risk while building staking positions over time.

Portfolio Allocation Considerations

Financial advisors recommend limiting cryptocurrency exposure to 5-10% of total investment portfolios. Within cryptocurrency allocations, staking provides a more conservative approach compared to active trading or speculative investments.

Yield Optimization Techniques

Advanced Canadian investors can optimise staking yields through:

- Comparing platform fees and reward structures

- Utilizing liquid staking for DeFi integration

- Tax-loss harvesting strategies during market downturns

- Diversifying across multiple staking platforms

- Monitoring validator performance and slashing risks

Risk Management for Ethereum Staking

Market Risk Considerations

Ethereum staking involves exposure to ETH price volatility, which can significantly impact overall returns. Canadian investors should consider this market risk alongside stake yield expectations when making investment decisions.

Platform and Counterparty Risk

Centralised staking platforms introduce counterparty risk, as investors must trust platform operators with their assets. Decentralised alternatives reduce this risk but may involve additional complexity and technical requirements.

Regulatory Risk Assessment

The evolving regulatory landscape for cryptocurrencies in Canada presents ongoing risks for staking investors. Future regulatory changes could impact platform operations, tax treatment, or accessibility of staking services.

Summary

Major Canadian financial institutions are increasingly exploring cryptocurrency services, with several banks and investment firms considering Ethereum staking products for retail and institutional clients. This institutional adoption could drive increased mainstream acceptance and regulatory clarity.

Upcoming Ethereum protocol upgrades, including the implementation of sharding and improved scalability solutions, may affect staking rewards and participation requirements. On-chain staking in Canada: monitoring these developments for potential opportunities and risks.

The Canadian government continues developing comprehensive cryptocurrency regulations, with potential impacts on staking services and tax treatment. Staying informed about regulatory developments helps investors make informed decisions about stakeholder strategies.

FAQs

Q1. What is Ethereum staking and how does it work in Canada?

Ans: Ethereum staking allows Canadians to earn passive income by locking ETH to validate network transactions post-Merge.

Q2. Is Ethereum staking legal and regulated in Canada?

Ans: Yes, it’s legal. The CSA provides guidelines, and staking rewards are treated as taxable income under CRA rules.

Q3. What are the best Ethereum staking platforms for Canadians?

Ans: Top options include Coinbase, Kraken, Bitbuy, Binance, and Lido, each offering unique features, fees, and compliance levels.

Q4. How much can I earn from staking Ethereum in Canada?

Ans: Staking yields range from 3% to 6% annually, depending on platform, validator performance, and network conditions.

Q5. Do I need 32 ETH to stake in Canada?

Ans: No. Platforms and pools enable staking with as little as 32 ETH, making it accessible to retail Canadian investors.