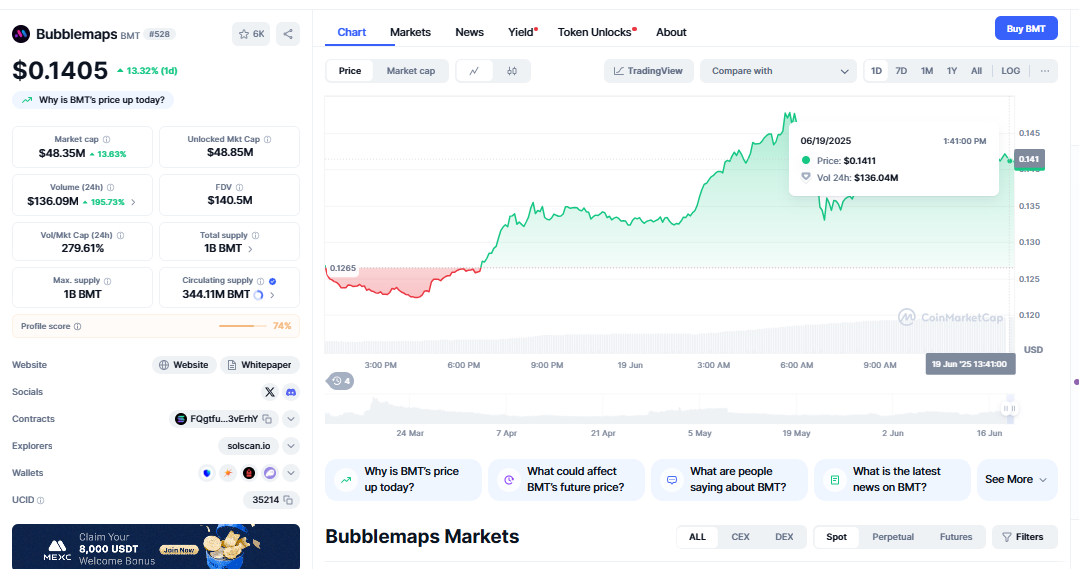

$BMT Shows W-Shaped Recovery, Eyes Breakout Toward $0.16

The cryptocurrency market continues to show dynamic price shifts, and among the many altcoins gaining attention, $BMT is standing out with a compelling technical setup. $BMT breakout analysis, After reclaiming the 9-day Exponential Moving Average (EMA) on the daily chart, $BMT is forming what appears to be a W-shaped recovery pattern—a classic bullish reversal signal.

Despite a slight 2.18% decline in the last 24 hours, bringing its price to $0.14172, signs of bullish momentum are beginning to take shape. RAY/USDT Breakout, With increasing volume and positive market structure, $BMT may be gearing up for a breakout, potentially targeting the $0.16 range in the near term.

Let’s break down the technicals, fundamentals, and why $BMT is worth watching in today’s market.

Technical Analysis: $BMT’s Bullish Setup

Several technical indicators and chart patterns are aligning to support a bullish thesis:

-

W-Shaped Recovery Formation

This double-bottom pattern typically suggests the end of a downtrend and the beginning of a potential uptrend. It’s a key signal that traders often watch for when identifying breakout opportunities. -

Reclaiming the 9 EMA

The 9-day EMA is a short-term momentum indicator. $BMT breakout analysis ability to close back above it signals that buyers are regaining control after recent weakness. -

Testing Overhead Resistance

$BMT is currently pressing up against a prior support zone that has flipped into resistance. If it breaks and holds above this level, the price could rally toward the next resistance near $0.16. -

Volume Trends

Volume is steadily increasing, a key factor supporting a potential breakout. Rising volume combined with upward price action is a strong confirmation for trend continuation.

Key Price Levels to Monitor

Monitoring key price zones can help traders and investors manage entries and exits more effectively:

-

$0.10 – Crucial Support Zone

A major psychological and technical level. Holding above $0.10 keeps the bullish pattern intact and limits downside risk. -

$0.14172 – Current Trading Price

After a small dip, $BMT is stabilizing and beginning to build a base. $BMT breakout analysis consolidation near resistance could lead to a breakout. -

$0.16 – Short-Term Target

If the current resistance is flipped into support, $0.16 becomes the next logical upside target—representing a potential double-digit percentage gain from current levels.

Why $BMT Deserves a Spot on Your Crypto Watchlist

With thousands of altcoins on the market, what makes $BMT stand out? Here are a few compelling reasons:

-

Clear Technical Structure

Many coins trade in choppy, unpredictable patterns. In contrast, $BMT is showing clean chart structure, a reliable W-reversal, and strong support zones. -

Momentum Building Behind the Scenes

Despite a short-term price dip, the increase in volume and reclaiming of key EMAs signal a change in market sentiment. -

Supportive Risk-to-Reward Setup

Buying near support ($0.10) while targeting resistance ($0.16) provides a favorable risk-reward ratio for both swing traders and longer-term investors. -

Market Rotation Favors Mid-Caps

As capital rotates out of overheated large-cap tokens, mid-cap coins like $BMT often benefit from renewed investor interest and trading volume.

Comparison to Other Crypto Movers

When looking at current top crypto gainers and losers, $BMT presents a more organised and technically promising structure than many other tokens. While some assets are drifting sideways or showing weak volume, $BMT offers:

-

A defined bullish pattern

-

Momentum indicators turning positive

-

A clear path to upside with manageable risk

In short, it’s showing characteristics typically seen before breakout moves.

What’s Next for $BMT? Prepare for Potential Breakout

All eyes are on the resistance zone currently being tested. If $BMT breaks above and flips this zone into support, we could quickly see momentum push the token toward $0.16 or higher. Bubblemaps (BMT) Gains, The breakout setup appears increasingly likely if volume continues rising and daily closes remain above the 9 EMA.

Here’s what traders and investors should consider doing:

-

Set Price Alerts: Monitor $BMT around the $0.145–$0.150 region.

-

Track Volume: Watch for increasing buy-side volume during resistance tests.

-

Look for Confirmation: Wait for a strong daily close above resistance before entering new positions.

FAQs

Q1. What is the current price trend of $BMT?

Ans: $BMT is showing a W-shaped recovery and reclaiming the 9 EMA, suggesting a potential bullish reversal despite a minor recent dip.

Q2. Why is the $0.10 level important for $BMT?

Ans: $0.10 serves as a crucial support zone; holding above it keeps the bullish structure valid and limits downside risk.

Q3. What makes the W-shaped pattern significant?

Ans: The W-shaped recovery is a classic double-bottom formation that often signals the end of a downtrend and the start of an upward breakout.

Q4. What is the short-term target for $BMT if it breaks resistance?

Ans: If $BMT flips its current resistance zone into support, it could target $0.16 in the near term, a key resistance level.

Q5. Is now a good time to watch or trade $BMT?

Ans: With rising volume, improving structure, and momentum indicators turning bullish, $BMT is worth monitoring for a potential breakout.