AI Altcoins Lead June 2025 Crypto Rally as Bitcoin Dominance

The cryptocurrency market is experiencing a significant shift in June 2025, with artificial intelligence-focused altcoins emerging as the primary drivers of the current rally. As Bitcoin dominance continues to decline and institutional interest in AI technology reaches new heights, investors are increasingly turning their attention to blockchain projects that combine cutting-edge artificial intelligence with decentralised finance capabilities.

Current State of AI Altcoins in June 2025

The artificial intelligence cryptocurrency sector has demonstrated remarkable resilience and growth potential throughout 2025. Top 5 Altcoins, Market analysts observe that AI-backed altcoins are outperforming traditional cryptocurrencies, driven by several fundamental factors that position these digital assets for sustained growth.

As Bitcoin holds steady, altcoins focused on artificial intelligence technologies are positioning themselves to lead a significant breakout in June 2025. This trend reflects a broader market maturation, where investors are seeking projects with real-world utility and technological innovation that extends beyond mere speculative value.

The convergence of artificial intelligence and blockchain technology has created unprecedented opportunities for both developers and investors. These projects are not merely riding the AI hype wave but are building substantial infrastructure that addresses real-world problems through decentralised solutions.

Leading AI Altcoins Driving the June 2025 Rally

Fetch.ai (FET)

Fetch.ai represents one of the most compelling AI blockchain projects in the current market cycle. The platform combines artificial intelligence with blockchain technology to create an autonomous agent economy where software agents can represent individuals, organisations, and devices in decentralised interactions.

FET is among the top altcoins positioned to lead the June 2025 crypto breakout, with its unique approach to AI-powered automation attracting significant institutional attention. The project’s focus on creating autonomous economic agents that can negotiate, transact, and collaborate without human intervention positions it at the forefront of the AI revolution.

The Fetch.ai ecosystem enables developers to build sophisticated AI agents with specific capabilities, from supply chain optimisation to financial trading algorithms. This practical application of AI technology in decentralised networks has captured the imagination of both retail and institutional investors.

SingularityNET (AGIX/ASI)

SingularityNET has established itself as a pioneer in democratizing access to artificial intelligence services through blockchain technology. The platform utilises blockchain technology to establish a marketplace where anyone can create, share, and monetise AI services, creating a truly decentralised AI economy.

The project’s significance has grown exponentially with the recent announcement of the merger. The merger to unite FET, AGIX, and Ocean Protocol communities into one decentralised artificial intelligence network began on June 11 and ended on June 13, with the FET token being renamed ASI. This consolidation represents a significant milestone in the AI cryptocurrency space, combining three major AI projects into a single, more powerful ecosystem.

SingularityNET’s marketplace approach allows AI developers to monetise their algorithms while providing users with access to a diverse range of AI services. This model has proven particularly attractive to enterprises seeking AI solutions without the overhead of developing proprietary systems.

Emerging AI Altcoin Projects

The AI altcoin space continues to evolve with new projects entering the market regularly. Ozak AI (OZ) represents a decentralised network which combines predictive AI with unique data analytics and financial market models, showcasing the innovative approaches being developed in this sector.

These emerging projects often focus on specific AI applications, ranging from predictive analytics to automated trading systems, each contributing to the growth and diversification of the broader AI blockchain ecosystem.

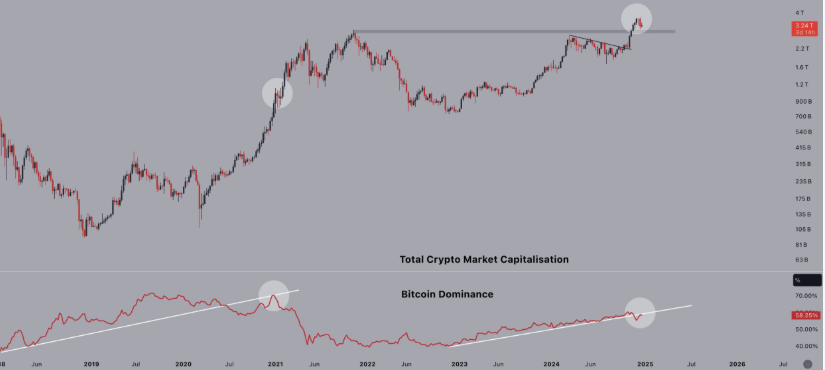

Bitcoin Dominance Decline and Capital Rotation

Bitcoin dominance fell sharply from over 65% to 63.89%, triggering a broad altcoin rally with major cryptocurrencies gaining significant percentages. This shift in market dynamics has created favourable conditions for alternative cryptocurrencies, particularly those with strong technological foundations like AI-focused projects.

The decline in Bitcoin dominance typically signals the beginning of “altseason,” a period when alternative cryptocurrencies outperform Bitcoin. Should dominance fall below 50%, it could trigger an accelerated altcoin rally, with assets like Ethereum and Solana leading the way, creating additional upward pressure on AI altcoins.

Institutional Interest and Investment Flow

The growing institutional interest in artificial intelligence technology has translated into increased investment in AI-backed cryptocurrency projects. Professional investors recognise that blockchain-based AI platforms offer unique advantages, including decentralisation, transparency, and global accessibility.

This institutional adoption has provided stability to AI altcoin prices while creating sustained demand for tokens with real utility in the AI ecosystem. The combination of retail investor enthusiasm and institutional backing has created a powerful foundation for continued growth.

Technological Advancement and Real-World Applications

Unlike many cryptocurrency projects that struggle to demonstrate practical utility, AI altcoins benefit from clear, measurable, real-world applications. From autonomous trading systems to decentralised AI marketplaces, these projects are solving tangible problems while generating revenue through their native tokens.

The integration of artificial intelligence with blockchain technology addresses several critical challenges in both sectors, including AI accessibility, data privacy, computational resource distribution, and algorithm monetisation.

Investment Strategies for AI Altcoins

When evaluating AI altcoins for investment, several fundamental factors should be considered. The strength of the development team, the practical utility of the AI applications, partnership agreements with established companies, and the token economics model all play crucial roles in determining long-term success.

Investors should also examine the competitive landscape within the AI blockchain space, as multiple projects often compete for similar market segments. Projects with unique technological advantages or first-mover benefits in specific niches tend to outperform broader, less focused initiatives.

Risk Management Approaches

While AI altcoins present significant growth potential, they also carry inherent risks associated with both cryptocurrency volatility and the adoption of emerging technologies. Diversification across multiple AI projects can help mitigate project-specific risks while maintaining exposure to the sector’s growth potential.

Real Vision’s chief crypto analyst, Jamie Coutts, predicts that “high-quality” altcoins could see one final huge rally this cycle, suggesting that selective investment in proven AI projects may yield superior returns compared to broad market exposure.

Future Outlook for AI Altcoins

The artificial intelligence blockchain sector continues to evolve rapidly, with new developments in machine learning algorithms, decentralized computing, and AI governance systems. These technological advances are expected to drive continued innovation and adoption within the AI altcoin ecosystem.

Projects that successfully implement advanced AI capabilities while maintaining decentralized governance structures are likely to capture significant market share as the industry matures. The integration of emerging technologies like quantum computing and advanced neural networks may further differentiate leading AI altcoin projects.

Market Expansion and Adoption

The global artificial intelligence market is project to continue its exponential growth, creating expanding opportunities for blockchain-based AI platforms. As traditional industries increasingly adopt AI solutions, the demand for decentralised AI services is expected to grow correspondingly.

Regulatory clarity around both artificial intelligence and cryptocurrency is also expected to improve, potentially removing barriers to institutional adoption and creating more stable market conditions for the growth of AI and altcoins.

Technical Analysis and Price Predictions

Technical analysis of AI altcoins reveals several bullish patterns that support continued upward momentum. Many leading AI tokens have broken through key resistance levels, establishing new support zones that provide foundations for further price appreciation.

Most altcoins remain far from their respective all-time highs, with Ethereum still about 20% below its November 2021 peak and Solana more than 30% below its former highs. This suggests significant upside potential for quality AI altcoins that demonstrate strong fundamentals and technological innovation.

Volume Analysis and Market Sentiment

Trading volumes for AI altcoins have increased substantially, indicating growing investor interest and market participation. This volume increase, combined with positive sentiment around artificial intelligence adoption, creates favourable conditions for sustained price appreciation.

Social media sentiment analysis and developer activity metrics also support the bullish outlook for AI altcoins, with increasing community engagement and continued development progress across major projects.

Regulatory Environment and Compliance

The regulatory environment for AI altcoins involves complex considerations around both cryptocurrency regulations and artificial intelligence governance. Most jurisdictions are still developing comprehensive frameworks for AI regulation, creating both opportunities and uncertainties for blockchain-based AI projects.

Projects that proactively engage with regulators and implement robust compliance measures are better position to navigate the evolving regulatory landscape. This includes implementing proper Know Your Customer (KYC) procedures, anti-money laundering (AML) compliance, and data protection measures.

Anticipated regulatory developments include clearer guidelines for AI algorithm transparency, data usage rights, and cross-border AI service provision. Projects that design their systems with regulatory compliance in mind are likely to benefit from reduced regulatory risk and improved institutional adoption.

Summary

The June 2025 rally in AI-backed altcoins represents more than a temporary market phenomenon; it reflects the fundamental shift toward practical, utility-driven cryptocurrency projects. As artificial intelligence continues to transform industries worldwide, blockchain-based AI platforms are positioned to capture significant value through their unique combination of decentralisation, accessibility, and innovation.

Investors considering AI altcoins should focus on projects with strong technological foundations, experienced development teams, and clear paths to real-world adoption. While the sector presents significant growth potential, careful analysis and risk management remain essential for successful investment outcomes.

The convergence of artificial intelligence and blockchain technology is creating unprecedented opportunities for both developers and investors. As the market continues to mature, AI altcoins that successfully deliver practical solutions will emerge. While maintaining decentralised principles is likely to emerge as the long-term winners in this evolving landscape.