Ethereum Outpaces Bitcoin in Institutional Inflows July 2025

The cryptocurrency investment landscape is experiencing a notable shift in July 2025, with Ethereum (ETH) demonstrating remarkable momentum that has begun to outpace Bitcoin (BTC) in weekly institutional inflows. This development represents a significant turning point for investors seeking to optimise their digital asset allocations, as the second-largest cryptocurrency by market capitalisation shows compelling signs of institutional adoption acceleration and fundamental strength.

ETH vs BTC Performance Dynamics

Ethereum’s recent performance trajectory reveals a fascinating narrative of institutional recognition and growing confidence in the platform’s long-term value proposition. While Bitcoin has maintained its position above the psychological $100,000 threshold with strong ETF inflows, Ethereum has been quietly building momentum that is now becoming impossible to ignore. The contrast between these two leading cryptocurrencies has created unique investment opportunities for both institutional and retail investors.

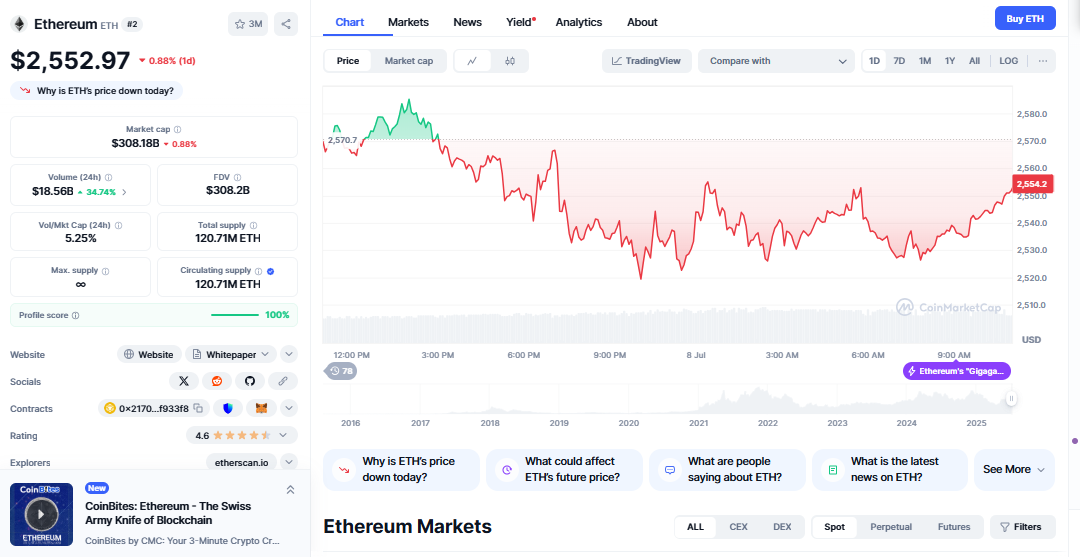

US-based spot Ethereum ETF inflows have outpaced that of Bitcoin over the past 2 weeks, with the ETH price now eyeing to break above the $3,000 mark. This shift in institutional preference signals a fundamental change in how professional investors view Ethereum’s risk-reward profile compared to Bitcoin. The sustained inflow momentum indicates that institutions are increasingly recognising Ethereum’s unique value proposition beyond its role as a digital currency.

The weekly inflow data presents a compelling case for Ethereum’s growing institutional appeal. Ethereum ETFs collectively hold 4,110,246 ETH, with a market value close to $9.94 billion. The largest Ethereum fund, iShares Ethereum Trust, manages 1,768,573 ETH. These numbers reflect not just current institutional interest but also the substantial capital allocation decisions being made by sophisticated investors who have thoroughly analyzed both assets.

Investment Patterns and Market Dynamics

The institutional investment landscape for Ethereum has undergone a remarkable transformation throughout 2025, with professional investors increasingly viewing ETH as a distinct asset class rather than merely an alternative to Bitcoin. This shift in perception has been driven by several factors, including Ethereum’s transition to proof-of-stake, its role as the foundation for decentralized finance (DeFi), and the platform’s continued innovation in areas such as non-fungible tokens (NFTs) and smart contracts.

BlackRock’s iShares Ethereum Trust, which manages the largest portion of institutional Ethereum holdings, has become a barometer for professional sentiment toward the cryptocurrency. The fund’s substantial AUM reflects the confidence that institutional investors have in Ethereum’s long-term prospects, particularly as the platform continues to evolve and expand its capabilities. This institutional backing provides a level of stability and credibility that was previously absent from the Ethereum ecosystem.

The weekly inflow patterns demonstrate that institutional investors are not simply following momentum but are making strategic allocation decisions based on fundamental analysis of Ethereum’s unique characteristics. The fact that these inflows are outpacing Bitcoin, despite the latter’s established position as “digital gold,” suggests that institutions are recognizing Ethereum’s potential for generating superior risk-adjusted returns over the medium to long term.

Technical Analysis and Price Trajectory

From a technical perspective, Ethereum’s current position presents several compelling investment considerations. In July 2025, Ethereum is likely to hover between $2900 and $3000, nearing the psychological $3000 mark. This price range represents a critical juncture for the cryptocurrency, as a sustained breakout above $3,000 could signal the beginning of a new bull run that mirrors or exceeds previous cycle highs.

The technical indicators supporting Ethereum’s bullish momentum include strong support levels, increasing trading volume, and positive divergence in key momentum oscillators. The cryptocurrency’s ability to maintain stability around the $2,800 level while building momentum for a potential breakout above $3,000 demonstrates underlying strength that goes beyond short-term speculation.

Bitcoin recently surged past the $110,000 milestone, while Ethereum has rebounded to $2,800 from a low of $1,400. This recovery trajectory showcases Ethereum’s resilience and the growing confidence of investors in its long-term value proposition. The percentage recovery from the lows has been substantial, indicating that the market has recognized Ethereum’s oversold condition and is now positioning for further upside.

Strengths Driving Ethereum’s Momentum

Ethereum’s recent momentum surge can be attributed to several fundamental factors that distinguish it from Bitcoin and other cryptocurrencies. The platform’s role as the backbone of the DeFi ecosystem has become increasingly important as traditional financial institutions explore blockchain-based solutions. This positioning gives Ethereum a unique advantage in capturing value from the ongoing digitization of financial services.

Ethereum remains below $3,000 but saw its revenue jump 133.7% over three months, outpacing Solana. This revenue growth demonstrates the platform’s increasing utility and adoption, as more developers and users engage with Ethereum-based applications and services. The substantial revenue increase indicates that Ethereum is not just maintaining its position but actively expanding its market share and influence within the blockchain ecosystem.

The transition to proof-of-stake has also enhanced Ethereum’s appeal among environmentally conscious investors and institutions. This consensus mechanism change has reduced the network’s energy consumption by over 99%, addressing one of the primary criticisms that had previously limited institutional adoption. The staking rewards available to ETH holders provide an additional income stream that Bitcoin cannot match, making Ethereum attractive to investors seeking yield in addition to capital appreciation.

Investment and Portfolio Allocation Strategies

The current market dynamics present a compelling case for including Ethereum in diversified cryptocurrency portfolios, particularly for investors who have traditionally focused primarily on Bitcoin. The momentum shift toward Ethereum suggests that the market is recognizing the platform’s unique value proposition and long-term growth potential. This recognition creates opportunities for investors who can position themselves ahead of broader market acceptance.

Portfolio diversification between Bitcoin and Ethereum offers several advantages, including exposure to different use cases, risk profiles, and growth trajectories. While Bitcoin serves as a store of value and hedge against traditional financial system risks, Ethereum provides exposure to the growing DeFi ecosystem, smart contract adoption, and the broader digitization of financial services. This complementary relationship allows investors to benefit from both assets’ strengths while mitigating concentration risk.

The institutional inflow patterns suggest that professional investors are increasingly viewing Ethereum as a core holding rather than a speculative allocation. This shift in institutional sentiment often precedes broader market recognition and can lead to sustained price appreciation as more capital flows into the asset. Retail investors who recognize this trend early may benefit from positioning themselves alongside institutional preferences.

ETH vs BTC Investment Merits

When comparing Ethereum and Bitcoin as investment opportunities, several key differences emerge that can inform allocation decisions. Bitcoin’s established position as “digital gold” provides stability and recognition that appeals to conservative investors seeking exposure to cryptocurrency without excessive risk. However, Ethereum’s broader utility and growth potential may offer superior returns for investors willing to accept higher volatility.

In the past year, Bitcoin prices are up 171% compared to a 62% gain for Ether. While Bitcoin has outperformed Ethereum over this specific timeframe, the narrowing performance gap and Ethereum’s recent momentum suggest that this relationship may be reversing. The institutional inflow patterns support this view, as professional investors appear to be rotating capital from Bitcoin to Ethereum.

The correlation between Bitcoin and Ethereum has decreased over time, providing diversification benefits for investors who hold both assets. This reduced correlation means that portfolio risk can be lowered by holding both cryptocurrencies, as they respond differently to market conditions and fundamental developments. The complementary nature of these assets makes them suitable for inclusion in diversified cryptocurrency portfolios.

Strategic Investment Recommendations

Based on current market dynamics and momentum patterns, a strategic approach to cryptocurrency investment should consider both immediate opportunities and long-term positioning. The institutional inflow momentum favouring Ethereum suggests that near-term allocation toward ETH may be justified, particularly for investors who have been underweight in the second-largest cryptocurrency.

Dollar-cost averaging remains an effective strategy for both Bitcoin and Ethereum, allowing investors to benefit from volatility while building positions over time. The current market environment, with Ethereum showing strong momentum and institutional support, may favour a slightly higher allocation to ETH compared to the traditional 70/30 or 60/40 BTC/ETH splits that have been common in the past.

For investors with higher risk tolerance, the current momentum shift presents an opportunity to increase Ethereum exposure while maintaining Bitcoin holdings for stability. The key is to recognise that both assets serve different purposes in a portfolio and that optimal allocation depends on individual risk preferences, investment timelines, and market outlook.

Market Timing and Entry Point Considerations

The current market environment presents both opportunities and challenges for new investors considering cryptocurrency allocation. Ethereum’s position near the $3,000 psychological resistance level creates a clear technical framework for entry and exit decisions. A sustained breakout above $3,000 could signal the beginning of a new bull run, while failure to break through this level might indicate further consolidation.

The institutional inflow patterns provide a favourable backdrop for Ethereum investment, as professional capital allocation decisions often precede broader market recognition. Investors who position themselves alongside institutional preferences may benefit from the sustained buying pressure that these inflows represent. However, timing the market perfectly is challenging, and systematic investment approaches often outperform attempts to predict short-term price movements.

The relative strength of Ethereum compared to Bitcoin in recent weeks suggests that the market is beginning to recognize ETH’s unique value proposition. This recognition phase often precedes significant price movements, as broader market participants adjust their portfolios to reflect new information and changing fundamentals.

Summary

The current cryptocurrency market environment presents a compelling case for increased Ethereum allocation, particularly given the platform’s growing institutional support and fundamental strengths. The momentum shift toward Ethereum, as evidenced by superior weekly inflows compared to Bitcoin, suggests that the market is recognizing the platform’s unique value proposition and long-term growth potential.

While Bitcoin maintains its position as the leading cryptocurrency and store of value, Ethereum’s broader utility, revenue growth, and institutional adoption make it an attractive complement to BTC holdings. The optimal investment strategy likely involves exposure to both assets, with allocation percentages adjusted based on individual risk preferences and market conditions.