Ethereum Price Outlook 2025, ETF Boost and Predictions

The cryptocurrency landscape continues to evolve rapidly, with Ethereum maintaining its position as the second-largest digital asset by market capitalisation. As we navigate through 2025, Ethereum’s ecosystem presents a complex tapestry of technological advancement, regulatory developments, and market speculation that shapes both current trading patterns and future price predictions.

Ethereum Market Status and Developments

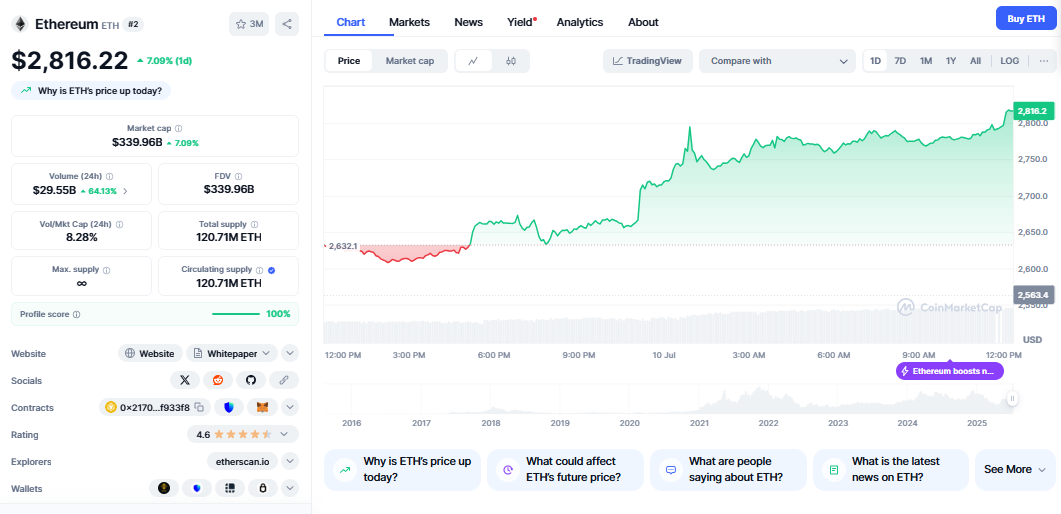

Ethereum’s recent performance reflects the broader cryptocurrency market’s volatility, with significant price movements driven by various fundamental and technical factors. The market has faced challenges recently, with a 45% drop in value during the first quarter of 2025, highlighting the inherent volatility that characterises digital asset markets.

The cryptocurrency’s price action has been influenced by several key developments, including continued institutional adoption, regulatory clarity, and technological improvements to the Ethereum network. Market sentiment analysis reveals mixed signals, with technical indicators showing neutral to bullish patterns while investor psychology remains cautious amid broader economic uncertainties.

Ethereum ETF Landscape and Adoption

The approval of spot Ethereum exchange-traded funds represents a watershed moment for institutional cryptocurrency adoption. The SEC approved the listing and trading of eight Ethereum ETFs, including offerings from major financial institutions such as BlackRock, Fidelity, and VanEck. This regulatory milestone has created new avenues for traditional investors to gain exposure to Ethereum without directly holding the cryptocurrency.

The ETF approval process has been particularly significant for market dynamics, as it provides regulated investment vehicles that can attract institutional capital. These financial products have introduced new layers of liquidity and price discovery mechanisms, potentially reducing volatility over time while increasing overall market participation.

Furthermore, the introduction of options trading on Ethereum ETFs could provide fresh momentum for the asset, offering sophisticated investors additional tools for risk management and speculation. This development represents the continued maturation of cryptocurrency markets and their integration with traditional financial infrastructure.

Technical Analysis and Price Prediction Models

Current technical analysis of Ethereum reveals a complex picture of market sentiment and potential price trajectories. Technical indicators signal a neutral Bullish 64% market sentiment, suggesting that while there is optimism about Ethereum’s future, the market remains cautious about short-term movements.

Price prediction models employ various methodologies, including historical price analysis, on-chain metrics, and fundamental valuation approaches. These models consider factors such as network usage, developer activity, total value locked in decentralised finance protocols, and broader macroeconomic conditions that influence cryptocurrency valuations.

The convergence of multiple analytical approaches provides a more comprehensive view of Ethereum’s potential price evolution, though investors should remain aware of the inherent limitations and uncertainties associated with cryptocurrency forecasting.

Ethereum Price Predictions for 2025

Analysts present varying perspectives on Ethereum’s price trajectory throughout 2025, with predictions ranging from conservative to highly optimistic scenarios. Analysts expect the ETH price to fluctuate between $1,500 and $2,500 in 2025, depending on macroeconomic factors, representing a more measured approach to price forecasting.

More optimistic projections suggest significantly higher price targets, with some analysts anticipating substantial appreciation driven by continued technological development and institutional adoption. ETH price with a potential surge could hit $5,925 in 2025, though such predictions require favorable market conditions and continued ecosystem growth.

The range of predictions reflects the uncertainty inherent in cryptocurrency markets, where technological breakthroughs, regulatory developments, and market sentiment can dramatically influence price movements. Conservative estimates suggest ETH could trade between $3,000 and $3,700 by the end of 2025, providing a middle ground between bearish and extremely bullish scenarios.

Ethereum Price Outlook Through 2030

Looking beyond 2025, long-term price predictions for Ethereum become increasingly speculative, though they offer insights into potential growth trajectories under various scenarios. The price of Ethereum could reach a high of $15,575 by 2030, representing substantial appreciation from current levels.

These extended forecasts consider Ethereum’s role as the foundation for decentralized applications, smart contracts, and the broader Web3 ecosystem. The network’s transition to proof-of-stake consensus, ongoing scalability improvements, and potential for new use cases contribute to optimistic long-term valuations.

However, long-term predictions must account for numerous variables, including technological competition, regulatory evolution, and potential paradigm shifts in blockchain technology. The cryptocurrency landscape’s rapid evolution makes extended forecasts inherently uncertain, requiring investors to maintain realistic expectations about future performance.

Fundamental Factors Influencing Ethereum’s Value

Several fundamental factors continue to shape Ethereum’s value proposition and market performance. The network’s position as the primary platform for decentralized finance applications, non-fungible tokens, and smart contract execution provides underlying utility that differentiates it from purely speculative assets.

Network upgrades and scalability solutions, including Layer 2 implementations and the ongoing development of Ethereum 2.0, aim to address transaction throughput limitations and reduce fees. With whale accumulation mirroring pre-2021 rally patterns and Pectra enhancing network fundamentals, technical improvements may support higher valuations.

The total value locked in Ethereum-based decentralized finance protocols serves as a key metric for network utility and adoption. Additionally, the growing ecosystem of decentralized applications built on Ethereum creates network effects that may drive long-term value appreciation.

Ethereum’s Role in the Broader Crypto Ecosystem

Ethereum’s significance extends beyond its function as a digital currency, serving as the foundation for numerous innovative applications and protocols. The network’s smart contract capabilities enable the creation of decentralised applications that can operate without a central authority, potentially disrupting traditional business models across various industries.

The growth of decentralised finance has been particularly notable, with Ethereum hosting the majority of DeFi protocols and applications. This ecosystem includes lending platforms, decentralized exchanges, yield farming protocols, and synthetic asset platforms that collectively represent billions of dollars in value.

Non-fungible tokens have also gained significant traction on the Ethereum network, creating new markets for digital art, collectibles, and other unique digital assets. These applications demonstrate Ethereum’s versatility and potential for continued innovation.

Summary

The future of Ethereum depends on numerous factors, including technological development, regulatory evolution, and market adoption. Successful implementation of planned upgrades and continued growth in decentralized applications could support higher valuations.

Competition from alternative blockchain platforms presents both challenges and opportunities for Ethereum. The network’s first-mover advantage and developer ecosystem provide competitive advantages, while innovation in competing platforms drives continued improvement.

The integration of artificial intelligence, Internet of Things devices, and other emerging technologies with blockchain networks may create new use cases and value propositions for Ethereum. These developments could drive demand and support long-term growth.