Alpaca Finance on Binance, Boost Crypto Yields with $ALPACA

The Alpaca Finance system, which is based on the Binance Smart Chain and operates in a decentralized manner, allows users to participate in leveraged yield farming. Leading DeFi player Alpaca Finance links average people with complex financial techniques by providing a simple platform that best uses cash and maximizes achievable returns. The protocol’s native token, $ALPACA, runs its surroundings and allows users control over its operations and several means of income via farming and staking.

Alpaca Finance and Farming Leveraged Yield

Standard yield farming requires a large financial outlay to generate any profit. However, users of Alpaca Finance can boost their earnings by borrowing money. Therefore, users can borrow additional assets to farm, which increases their chances of winning and their exposure. Someone with limited cryptocurrency, for example, can borrow more using Alpaca’s platform to grow their farming position. This strategy allows larger investors to compete equally with smaller ones. The result opens everyone to more possibilities for yield farming.

Made with Binance Smart Chain

One of Alpaca Finance’s strongest points is its foundation on the Binance Smart Chain. For frequent DeFi events, Binance Smart Chain is perfect since it boasts low transaction costs and quick block times. Alpaca benefits from this efficiency by allowing users to make fast, low-cost transactions, which is especially advantageous for those who manage multiple professions, lend money, or engage in farming. Solana’s Agave v2.2, This infrastructure reduces the issues resulting from other blockchains’ high gas fees and slow confirmation times, promoting Alpaca’s aim of making banking more accessible to everyone.

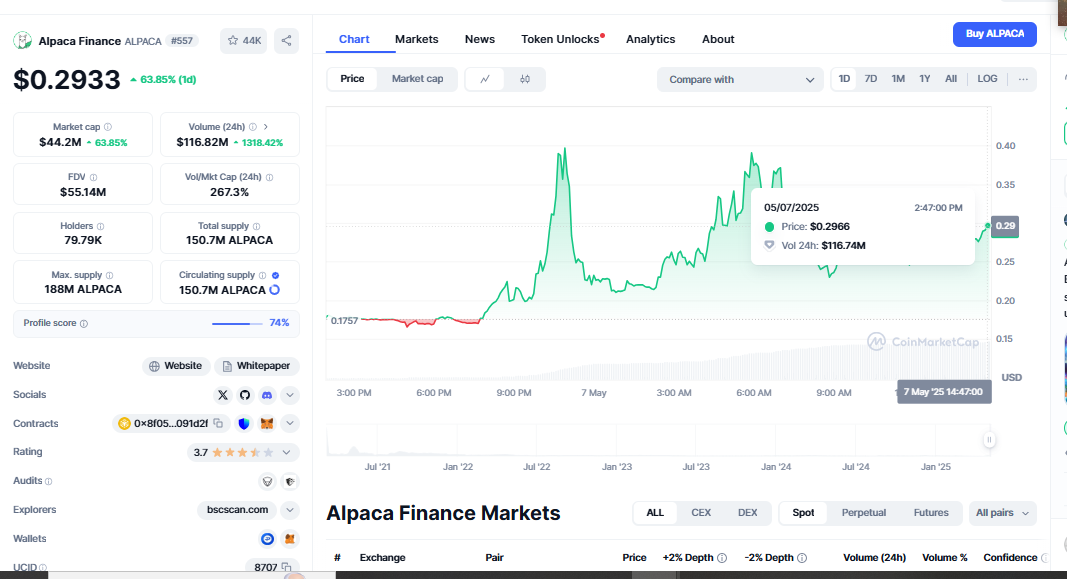

What Does $ALPACA Do and How Much Does It Pay?

Built upon the Alpaca Finance ecosystem is the utility token and governance token known as $ALPACA. Token holders can vote on governance issues like adding new product features or modifying protocol parameters. This provides the community with a direct say in how the platform progresses. Aside from governance, $ALPACA is utilized to incentivize consumers to take part. To earn more $ALPACA, you can lend assets, farm using leverage, or stake the token. These all have built-in rewards. As more individuals use the platform, $ALPACA is likely to become more valuable and in higher demand, which might enhance its long-term worth.

Alpaca Loans for Farmers and Lenders

The alpaca ecosystem is built so that both lenders and yield farmers can benefit from it. Cryptocurrency lenders can put their money into the platform and earn interest without doing anything. Those wishing to expand using borrowed money can then borrow against these deposits. Conversely, farmers use these borrowed resources to expand their businesses and increase their profits above what they could have from just their funds. The process has many safety elements incorporated into it that assist in keeping everyone safe. These cover low borrowing restrictions, automatic liquidation systems, and real-time monitoring.

Why Does Alpaca Finance Differentiate?

Alpaca Finance has distinguished itself among a crowded field of DeFi ventures by combining creative ideas, robust security methods, and community-first governance. Many other security companies have reviewed the platform to guarantee the integrity of its smart contracts. Through announcements, new product introductions, and governance ideas, Alpaca’s development team is open and active, always updating the community. Both crypto experts and beginners will find the platform intriguing because of its simple interface and detailed instructions.

Earning with Alpaca: farming, staking, and more

Mining is one of the main methods that users of Alpaca Finance can use to make money. Users get a part of the protocol fees and extra incentives by locking down $ALPACA coins, therefore motivating long-term ownership of the token. Leveraged yield farming—the main offering of the platform—allows users to borrow against their assets, hence increasing yields. Those who are comfortable with more risk in exchange for the possibility of better returns may find this method most suited. Furthermore, included in the protocol are automated vaults and alliances that provide further means for users to interact with the ecosystem and vary their approaches.

An expanding ecosystem and future perspective

Alpaca Finance is poised to spearhead the growth of distributed finance. Thanks to its emphasis on capital efficiency, user freedom, and risk-managed approaches, Alpaca is a well-known and recognized name in the DeFi community. The team is actively adding additional products, cross-chain integrations, and yield optimization tools to enhance the protocol’s value. Alpaca Finance on Binance Smart Chain, These developments will probably increase the usage of $ALPACA, make it more liquid, and increase its value even more.

Summary

Alpaca Finance is making income farming smarter and simpler. The platform provides long-term opportunities for both lenders and growers because it is built on the Binance Smart Chain and places a strong emphasis on community-driven innovation. The $ALPACA token is the key to a complete community of income-generating strategies, not only a token. This is the time to investigate Alpaca Finance and join the throng of people eager to maximize their crypto investments on a platform that is tested, safe, and expanding.