Bitcoin Dips Below $110K Amid Whale Moves and Market Volatility

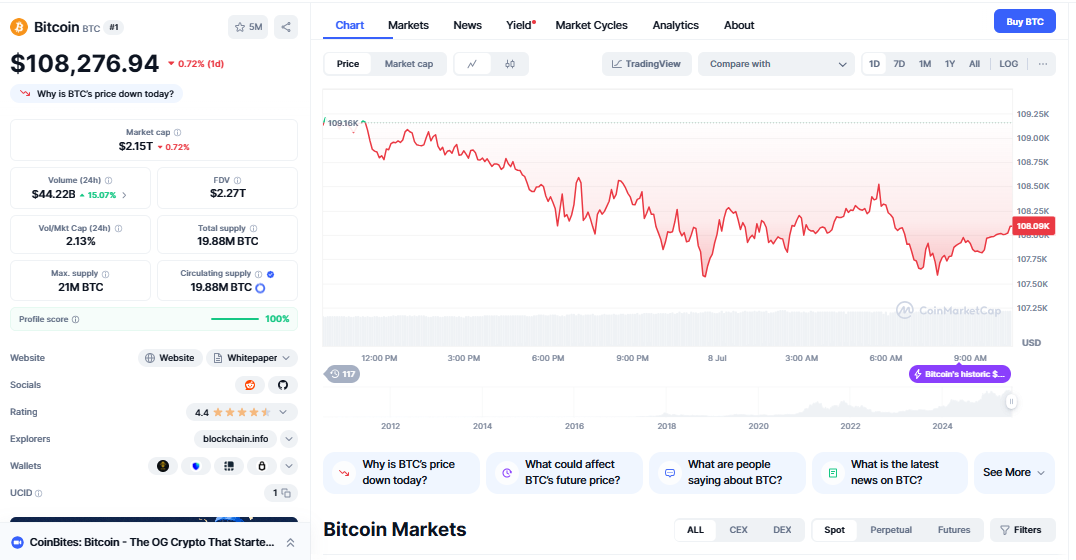

The cryptocurrency market continues to demonstrate its characteristic volatility as Bitcoin (BTC) faces downward pressure on July 8, 2025. Despite trading near historic highs around the $109,000 level, several interconnected factors are contributing to today’s price decline, creating uncertainty among investors and traders worldwide.

Bitcoin Price Action and Market Dynamics

Bitcoin’s price movement today reflects a complex interplay of technical resistance levels and fundamental market forces. The leading cryptocurrency has been consolidating just below the critical $110,000 barrier, with trading occurring in a narrow range between $107,942 and $109,717 as of July 7, 2025. This consolidation pattern suggests that both bulls and bears are testing key psychological levels, creating a delicate balance that could tip in either direction.

The current market environment showcases Bitcoin’s maturation as an asset class, with institutional involvement reaching unprecedented levels. Major corporations like Metaplanet have continued their Bitcoin accumulation strategies, recently acquiring an additional 2,205 BTC, bringing their total holdings to 15,555 BTC. This institutional buying pressure contrasts sharply with retail investor behavior, where smaller holders appear to be taking profits at these elevated price levels.

Resistance and Support Levels

From a technical perspective, Bitcoin’s price action today reveals several critical factors influencing the current decline. The $110,000 resistance level has proven to be a formidable barrier, with multiple attempts to break through this psychological threshold failing to gain sustained momentum. This resistance coincides with historical price action patterns that suggest significant selling pressure at round-number levels.

The cryptocurrency’s 50-day simple moving average continues to provide underlying support, though the exact positioning of this technical indicator remains crucial for understanding the medium-term trend direction. Trading volumes have shown some signs of weakness, which can amplify price movements in both directions when large orders enter the market.

Market volatility metrics paint an interesting picture of current sentiment. The Deribit 30-day volatility index recently hit a two-year low in July 2025, reflecting increased investor confidence in Bitcoin’s stability compared to previous years. This reduced volatility environment creates a different dynamic where smaller price movements can have outsized psychological impacts on market participants.

Institutional Activity and Whale Movements

One of the most significant factors contributing to today’s price pressure stems from whale activity patterns observed over the past several days. Large Bitcoin holders, commonly referred to as “whales,” have been engaging in substantial movements that have created selling pressure in the market. Recent data indicates that dormant whale wallets moved approximately $7.6 billion worth of Bitcoin around the Fourth of July period, contributing to market uncertainty.

This whale activity represents a double-edged sword for Bitcoin’s price dynamics. While some large holders are taking profits after significant gains, others continue to accumulate aggressively. The disparity between institutional accumulation and retail selling has created an interesting dynamic where professional investors appear to be viewing current price levels as attractive entry points, while individual investors may be more inclined to realize gains.

The institutional landscape continues to evolve, with major financial institutions and corporations increasingly viewing Bitcoin as a legitimate treasury asset. This shift in perception has fundamental implications for long-term price stability, though it can also create short-term volatility as institutions adjust their positions based on risk management protocols and market conditions.

Global Economic Factors Impacting Bitcoin

The broader macroeconomic environment plays a crucial role in Bitcoin price decline movements today. Recent economic uncertainties in the United States, particularly related to trade policies and their global implications, have created a risk-off sentiment that affects various asset classes, including cryptocurrencies. The decline in the US Dollar Index (DXY), which has dropped approximately 9% year-to-date, adds another layer of complexity to Bitcoin’s price dynamics.

Interest rate policies from major central banks, including the Federal Reserve, continue to influence Bitcoin’s appeal as an alternative investment. When traditional monetary policies create uncertainty about currency stability, Bitcoin often benefits as investors seek alternative stores of value. However, this relationship can be complex and sometimes counterintuitive, as risk-off periods can also lead to Bitcoin selling pressure.

Geopolitical tensions and their impact on global financial markets also contribute to Bitcoin’s current price action. Cryptocurrency has historically shown sensitivity to major geopolitical events, often experiencing increased volatility during periods of international uncertainty. Current Middle East tensions and their potential impact on global risk sentiment may be contributing to some of the selling pressure observed today.

Market Sentiment and Fear And Greed Index

Current market sentiment indicators provide valuable insights into the psychological factors driving today’s price action. The Fear & Greed Index, a popular sentiment measurement tool, currently displays a score of 73, indicating “Greed” levels among market participants. This reading suggests that despite today’s price decline, overall market sentiment remains relatively optimistic about Bitcoin’s prospects.

The apparent contradiction between positive sentiment indicators and declining prices often occurs during consolidation phases, where markets are digesting recent gains and preparing for the next directional move. This dynamic creates opportunities for both continued upward momentum and potential corrective moves, depending on how various market forces align.

Social media sentiment and news flow continue to play significant roles in short-term price movements. The rapid dissemination of information through digital channels means that market participants react quickly to new developments, sometimes creating amplified price movements that may not reflect underlying fundamental changes.

Regulatory Environment and Policy Implications

The regulatory landscape surrounding Bitcoin continues to evolve, with policy decisions from major jurisdictions having significant impacts on price movements. Recent developments in cryptocurrency regulation, while generally trending toward greater acceptance and clarity, can create short-term uncertainty as markets adjust to new frameworks.

The approval and continued success of Bitcoin Exchange-Traded Funds (ETFs) have fundamentally altered the investment landscape, providing traditional investors with easier access to Bitcoin exposure. This institutional infrastructure development supports long-term price stability while potentially creating new sources of volatility as ETF flows respond to market conditions.

International regulatory coordination efforts and their potential impact on Bitcoin’s global adoption remain important factors to monitor. As different jurisdictions develop their approaches to cryptocurrency regulation, the resulting patchwork of policies can create opportunities and challenges for Bitcoin’s price development.

Mining Dynamics and Network Health

Bitcoin’s mining ecosystem continues to play a crucial role in price dynamics, with hash rate changes, mining difficulty adjustments, and energy costs all contributing to the overall market environment. The network’s health metrics remain robust, with strong mining participation and continued security enhancements supporting Bitcoin’s fundamental value proposition.

Recent developments in mining technology and energy efficiency improvements have helped maintain network stability even as Bitcoin’s price has reached new highs. This technological progress supports the long-term sustainability of the Bitcoin network while potentially influencing short-term price movements through mining cost considerations.

The upcoming halving cycle implications, while still in the future, continue to influence investor psychology and long-term price expectations. Historical patterns suggest that halving events can have significant impacts on Bitcoin’s price trajectory, though the exact timing and magnitude of these effects remain subjects of ongoing market debate.

Future Price Predictions and Expert Analysis

Market analysts and financial institutions continue to provide varied perspectives on Bitcoin’s near-term price prospects. Standard Chartered recently issued a forecast suggesting that Bitcoin could surge 25% from current levels to reach a new all-time high of $135,000 by the end of the third quarter of 2025. This bullish outlook contrasts with more conservative predictions that suggest continued consolidation around current levels.

Technical analysis from various sources indicates that the Bitcoin price decline could experience significant movement in either direction from current levels. Some forecasts suggest potential upward movement to the $150,000 range within the next week, while others point to the possibility of corrective moves that could test lower support levels.

The consensus among many analysts remains cautiously optimistic about Bitcoin’s long-term prospects, with institutional adoption trends and technological developments supporting higher price targets over extended timeframes. However, the path to these higher levels may involve continued volatility and periodic corrections like the one observed today.

Summary

Today’s Bitcoin price decline reflects the complex interplay of technical, fundamental, and psychological factors that characterize mature financial markets. While the immediate catalyst for the decline may be difficult to pinpoint precisely, the combination of technical resistance at $110,000, whale activity patterns, and broader market sentiment appears to be creating selling pressure.

The cryptocurrency’s position near historic highs suggests that current price action may represent a healthy consolidation phase rather than a fundamental shift in market dynamics. The continued institutional adoption, technological improvements, and expanding use cases for Bitcoin provide a foundation for long-term price appreciation, even as short-term volatility remains a characteristic feature of the market.

Investors and traders should consider the current environment within the broader context of Bitcoin’s evolution as an asset class. While today’s price decline may create concerns among some market participants, the underlying trends supporting the Bitcoin price decline value proposition remain intact. The key to navigating this environment successfully lies in understanding the multiple factors influencing price movements and maintaining a perspective that aligns with individual risk tolerance and investment objectives.