Bitcoin Halving Cycle History Tells Us About BTC’s Next Move

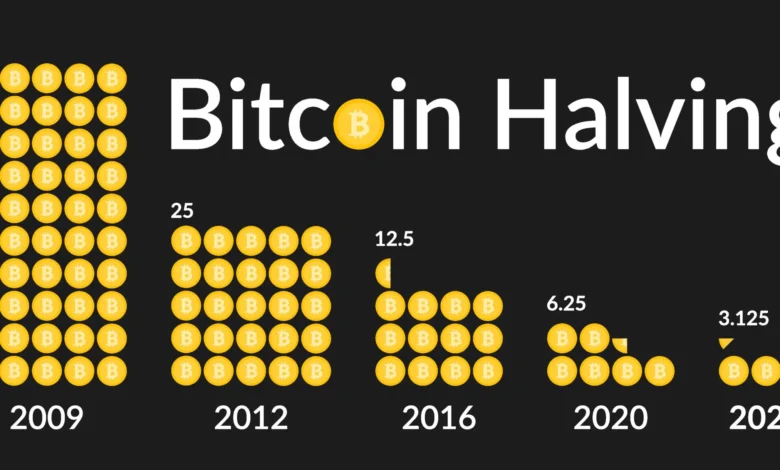

Events involving halves of the coin mark some of the most significant turning points in the Bitcoin ecosystem. By halving the block reward, these events slow down the rate of fresh BTC entering circulation, thereby tightening supply and typically initiating primary market cycles. Bitcoin halving cycle, Understanding the fluctuations in the price of Bitcoin will enable investors, traders, and enthusiasts.

It is crucial to have a perceptive understanding of what lies ahead. This work presents Bitcoin halving cycles, comparing current performance with historical post-halving intervals. Closely analyzing prior movements exposes potential indicators of the direction Bitcoin might next go.

Discovering the Bitcoin Halving Cycle

This graphic overlays Bitcoin’s price movements over various halving cycles—2012, 2016, 2020, and now 2024—enabling you to examine its performance at each stage.

The chart highlights key markers:

-

Red Dots: These indicate new all-time highs reached within each halving cycle.

-

Green Zones represent post-halving phases, historically associated with strong bullish momentum.

By tracking these visual cues, a pattern emerges that could offer clues about where the price may go after the latest halving.

What Halving Events Have Taught Us

Let’s look at the three completed halving cycles:

-

2012 Halving: The event sparked Bitcoin’s rise from ~$12 to over $1,000 by late 2013. The growth cycle led to a parabolic rally about 12–18 months after the halving.

-

2016 Halving: This halving triggered a price jump from ~$650 to nearly $20,000 in 2017, solidifying Bitcoin’s role as a mainstream asset.

-

2020 Halving: Bitcoin surged from ~$9,000 to an all-time high of $69,000 in 2021, with institutional investors increasing their presence in the market.

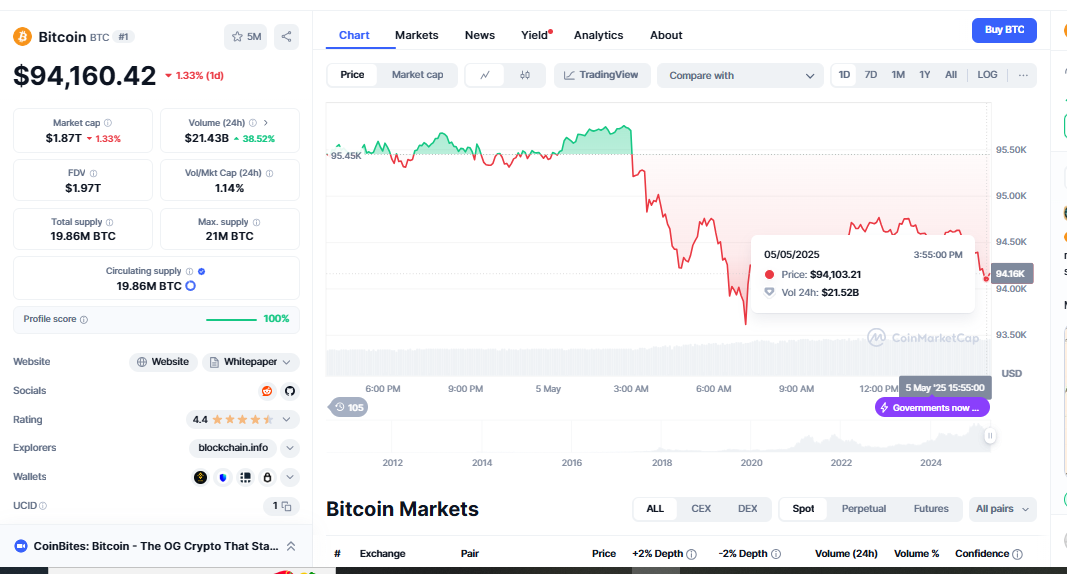

- 2025 Halving: Today’s price in bitcoin is $94,000.

Key takeaway: Every halving event has historically led to a bull cycle, typically reaching its peak within 12–18 months.

A Familiar Post-Halving Moment May 2025

As of May 2025, we are entirely in the post-halving zone; consequently, the event in 2024 has happened. Historically, this era marks the start of faster development. One thing that never changes: prices always rise after a price decrease, even if the maturity, control, and acceptance of a market characterize each cycle. Analysts and long-term buyers are closely looking at the charts. Based on historical data, Bitcoin may still have a significant advantage.

The Value of Divining Bitcoin Splits

The goal of the halving event is to reduce inflation in the Bitcoin economy, not just to create a spectacle. The benefits from mining Bitcoin are halved every four years, which means fewer coins are used overall. Prices usually start to soar when this shortage effect combines with rising demand.

Understanding half cycles of Bitcoin will help you in several different ways. First, it provides investors with easier access points by enabling them to predict when these events are occurring. Second, it lessens the effects of trading dependent on emotions, encouraging people to trust the approach instead of reacting impulsively to short-term market fluctuations. At last, it helps with long-term planning by letting buyers build plans based on past performance.

Guideline on Following a Cut

Making it over the phase after halving demands a well-defined plan. Many who aim to cling to Bitcoin for the long term are still progressively raising their holdings since they believe the price will follow the trend set in earlier rounds. Setting particular profit targets will help you stick to a plan in erratic markets and avoid making judgments based on feelings.

Another vital thing is resisting the desire to hunt the market out of fear of losing out (FOMO). You should remain focused and apply your plan. Monitoring institutional interest, market mood, and blockchain activity will also provide clues about Bitcoin’s path.

How technology and data have lowered expectations

Real-time market data, artificial intelligence-powered trading tools, and on-chain analytics help monitor Bitcoin’s behavior during the halving cycle more easily. Many traders base their decisions on tools such as historical price overlays, blockchain activity tracking, and market sentiment analysis.

These instruments let traders base decisions on facts and probabilities instead of emotions. Bitcoin Price Crash 2025, This feature is particularly crucial during periods following a halving, as volatility is common.

Never miss the following item.

Perhaps we are living through a turning point in Bitcoin’s history. Historically, things might improve over the following six to twelve months. If you trade Bitcoin, be current and know how rounds of halving affect the market.

See us for weekly market trends, halving processes, and Bitcoin news summaries. Whether you trade long-term or momentarily, knowledge of the Bitcoin halving cycle will help you handle the crypto market’s highs and lows.

Summary

Halving cycles show trends one can believe, even if they do not guarantee future events based on how Bitcoin has behaved for over 10 years. The chart shows something seasoned buyers know: the best may still be to come. We follow the period after the halving.