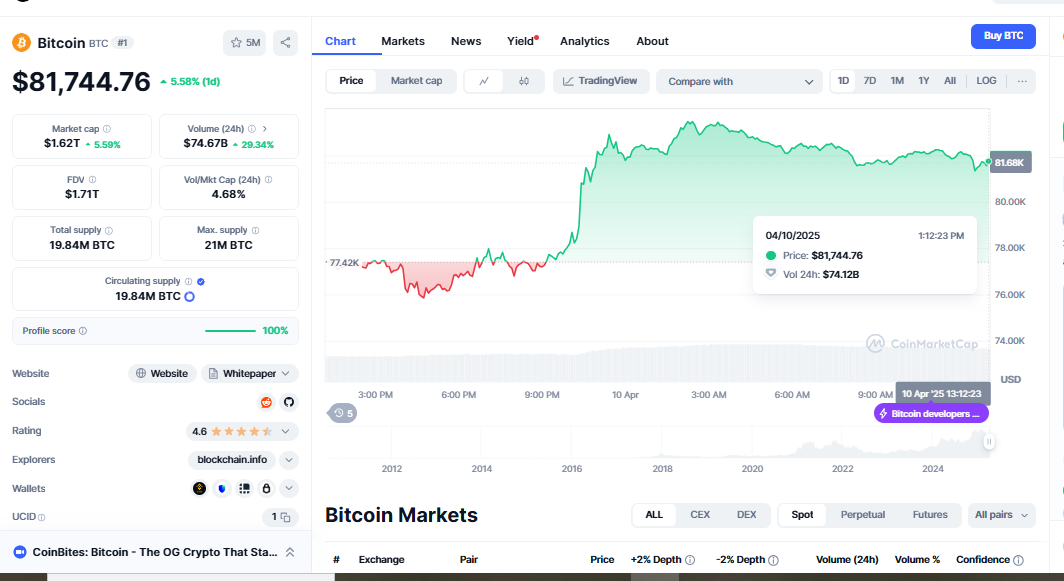

Bitcoin Price Hits $81,678.58 on April 10, 2025 Amid Market Surge

Ethereum (ETH) is worth $81,678.58 USD as of April 10, 2025. Though the global financial scene constantly changes, its price captures Bitcoin’s value and power. Following a murky beginning to the year, Bitcoin has consistently been above $80,000. This surge has attracted new attention from both personal and business consumers.

The most recent rise in Bitcoin values results from a complicated mix of economic principles, rising demand for digital assets, and major blockchain innovations. Bitcoin price April 10, 2025. Besides showing its value as a perilous investment, the coin acts as a long-term buffer against financial risk.

Market Trends Supporting Bitcoin’s Strength

Over the past few weeks, more institutions adopting Bitcoin and investors becoming more confident in it have increased its value. Daily trading on global platforms follows major financial companies’ increased crypto portfolio additions. Although there is more activity, traditional markets remain under financial pressure. This situation has driven a change toward dispersed value stores.

The overall state of the economy has also been important. Worries about inflation, devalued currencies, and postponed interest rate cuts have tempted assets like Bitcoin. Conversely, on-chain data shows that long-term users are buying more Bitcoin than selling it, suggesting they still believe in its long-term expansion prospects.

Several technical analysts claim that Bitcoin gets a lot of support somewhere around the $80,000 mark. Its recent rise from a low point in late March to its present value has increased buying pressure. Bitcoin price on April 10, 2025. Many analysts think a breakout toward the $85,000–$90,000 range could soon happen if the trend continues.

Future Expectations and Thoughtful Notes

As Bitcoin keeps rising above significant support levels, the market remains just mildly optimistic. Previous patterns indicate that Bitcoin’s availability may be declining and its price fluctuation may increase, especially in light of the second halving event scheduled for later this year. Historically, Halving cycles have produced notable benefits; many investors think that 2025 will be another important year for Bitcoin’s growth.

Hazards still exist even if everything is running smoothly. Rule changes could cause long-term instability, especially from big markets like the US and Europe. Although the long-term trend is still rising, more individuals are utilizing cryptocurrencies, and the systems supporting them are improving.

Some analysts have declared that Bitcoin will hit or exceed $100,000 before 2025 ends. The current state of the economy shapes this projection, the fact that more money is entering institutions, and the rising recognition of Bitcoin as both a financial asset and a technological advance.

What Today’s Price Means for Investors?

Nowadays, the price level of Bitcoin is crucial for customers to think about how suited the coin is for their portfolios. Those already possess Bitcoin can use the present environment to track trends, estimate their suitable risk level, and improve their strategies. For those just beginning their journey with cryptocurrencies, some preparation helps one understand the current price movement. Some investors are lessening the effect of volatility by employing long-term tactics.

We should include dollar-cost averaging instead of trying to time short-term highs and lows. Bitcoin’s current actions show it is a high-growth promise and a tumultuous market player. Those who wish to interact with the asset in a constructive way have to keep current with changes in regulations, new technologies, and the overall state of the economy.

Summary

The value of Bitcoin on April 10, 2025—$81,678.58—demonstrates its resilience in a culture where money fluctuates quickly. Bitcoin Price Hits: People still have strong opinions about the market, even with regular fluctuations. As more companies adopt Bitcoin, the whole economy is shifting, and an upcoming halving event marks a major turning point for Bitcoin.

Now is the time to act, regardless of your experience as an investor or with cryptocurrencies. Watch the market closely, study as much as possible, and make smart judgments to help you reach your financial goals. Then, consider how well Bitcoin matches your financial position. This approach will keep you ahead as the digital industry matures.