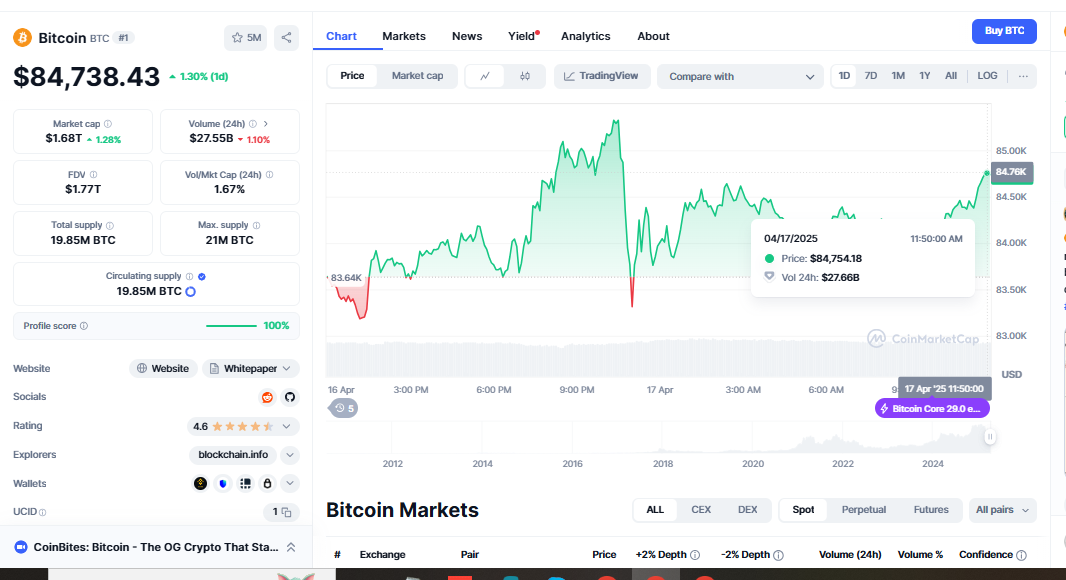

Bitcoin Price Outlook BTC Trades Near $85K, Eyes $88K Breakout

Bitcoin (BTC) is trading at a price close to what most people consider it worth, below $85,000. Even though there is some volatility, the price has been very stable, which indicates that it is more likely to be a period of consolidation than a major breakout in one direction. Bitcoin Price Outlook: Investors and traders closely monitor the charts to ascertain whether Bitcoin is ready for more stalling or will take a positive move.

Bitcoin Market at the Present Moment

The cryptocurrency market is currently a place where people should exercise caution. As a result of investors’ unease regarding changes in regulations, interest rates, and global events, Bitcoin continues to maintain its strength without experiencing much movement. The volume has calmed down a little over the last several sessions, and Bitcoin continues to trade within the same range as before.

Big investors appear to be holding on to what they already have rather than rapidly increasing their investments. There has also been a decline in retail involvement. Bitcoin Price Prediction, As seen by the statistics and transaction patterns of large blockchain exchanges, people are adopting a “wait and see” mentality.

Technical Outlook: Consolidation Continues

Regarding analysis, Bitcoin is moving sluggishly, with support at $82,000 and resistance at $88,000. However, even though there have been a few brief spikes, the price is still having a difficult time climbing. The Relative Strength Index (RSI) is stable and close to 50. This supports the hypothesis that the process of pricing consolidation is still ongoing.

The Moving Average Convergence Divergence (MACD), which is not diverging an excessive amount, is another piece of evidence that there has been little change. Even though bulls will require a significant event to raise the price above $88,000 for an extended period, the 50-day exponential moving average (EMA) supports this.

Institutional Interest Still a Factor

Although Bitcoin’s short-term volatility is still relatively low, institutional investment is a positive sign for the cryptocurrency’s long-term outlook. Bitcoin exchange-traded funds (ETFS) have received new money from traditional banks ever since more were approved; nevertheless.

This has not yet resulted in meaningful price action inside the Bitcoin market. In particular, money such as BlackRock’s IBIT only comes in at a slightly reduced rate. This would imply that institutional investors are very optimistic but cautious about their investments.

On-Chain Activity and Wallet Behaviour

Blockchain metrics demonstrate that the state of health is relatively low. There has been no change in wallet behaviour; an increasing number of individuals keep their money for an extended period. However, the number of new wallets established is still lower than when it peaked. This indicates that the public’s interest has not yet reached its full potential. If wallet expansion is resumed and transaction volume increases, this could suggest that things are starting to gain momentum again.

What to Watch Next?

The $88,000 resistance zone remains critical. If BTC breaks and holds above this level, a push toward $90,000–$92,000 could follow quickly. On the other hand, a failure to breach this ceiling may lead to a retest of $82,000, or even a drop toward the $78,000 support region.

Key Levels to Monitor:

-

Resistance: $88,000, $90,000

-

Support: $82,000, $78,000

-

Bullish trigger: Sustained close above $88,000

-

Bearish trigger: Breakdown below $82,000

Summary

Bitcoin is trading close to fair value and needs a catalyst to define its next significant action. While principles reflect modest accumulation and cautious hope, technologies suggest consolidation. Whether you trade long-term or short-term, now is a good moment to remain vigilant, control risk, and prepare for the breakout that might influence BTC’s Q2 path.