Bitcoin Soars Past $82.7K Amid US-China Tensions and ETF Buzz

Rising above $82,700, Bitcoin (BTC) strongly indicates investors’ growing need for distributed assets in geopolitical uncertainty. Conventional markets are unstable and cautious as a new surge is underway, with increasing trade fears between the US and China causing fluctuations. Bitcoin Soars Past $82.7K Regular investors are removing money from stocks and currencies whose value changes depending on world events. At the same time, Bitcoin is improving as a digital safety net against unstable economic times.

Geopolitical Pressure Ignites Bitcoin’s Momentum

The past few weeks, new threats of tariffs, trade restrictions, and diplomatic standoffs have escalated tensions between the United States and China. Recent events have motivated buyers to seek more consistent and safer solutions, leading to a slowdown in the global financial markets. Once solely associated with gold, Bitcoin is now gaining attention as a global hedge.

Unlike fiat money, Bitcoin is dispersed, not under government control, and has a defined supply. This choice is realistic in mixed economic times, when the market’s surroundings are changing quickly. Many view the increase in Bitcoin’s price as evidence that investors are shifting their focus in anticipation of potentially significant global events.

Institutional Adoption Accelerates the Rally

Besides geopolitical factors, institutional demand remains the key force raising Bitcoin’s value. Hedge funds, family offices, asset managers, and several other approaches are among the intriguing investments in Bitcoin. ETFs and spot market products have allowed firms like BlackRock and Fidelity to promote more cryptocurrencies.

This reflects their belief in Bitcoin’s long-term worth. As more conventional institutions embrace digital assets, Bitcoin is becoming more well-known in mainstream finance. Demand rises as a result, which, together with the limited supply of Bitcoin, drives rapid price movement and reinforces the positive narrative.

Bitcoin as a Modern Safe Haven Asset

Although its erratic character has drawn criticism in the past, Bitcoin is being observed from several angles these days. Its value is becoming increasingly tempting as the world economy negotiates rising prices, devaluing currencies, and increasing political danger. It runs on a transparent blockchain system that cannot be stopped, printed, or changed by central banks.

It shields against currency inflation. These elements will appeal to both small and large investors looking to guard against changes in the general state of the economy. Given that interest rates slow down, real estate’s performance is unclear, but Bitcoin’s worth in different portfolios becomes clearer.

To what height could Bitcoin soar?

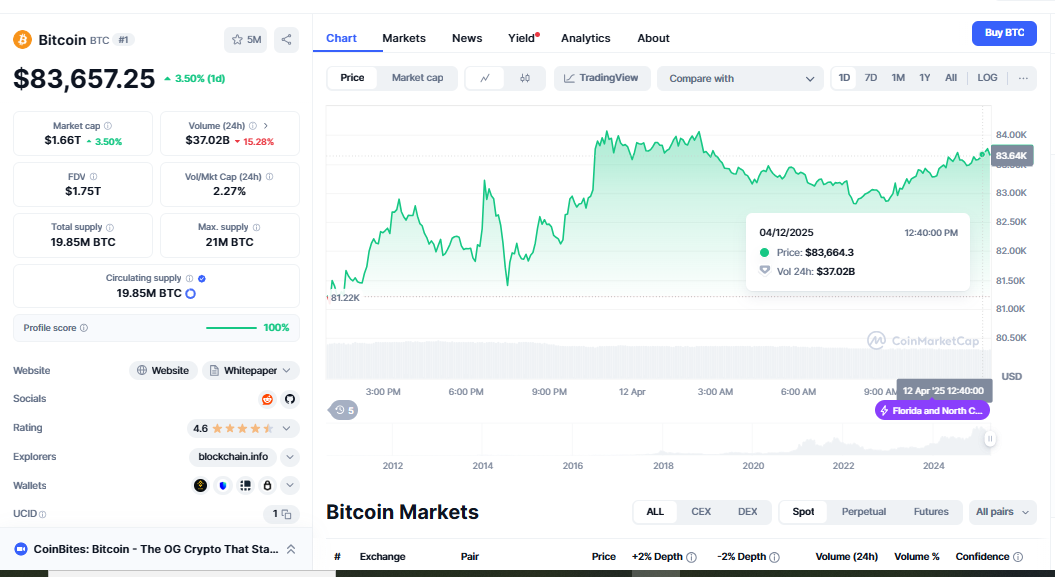

Once more, we are excited about pricing goals based on the current Bitcoin price of $82,000. Some think that if world tensions increase and institutional flows continue, Bitcoin Soars Past $82.7K may set all-time highs. However, we still advise investors to exercise caution. One encounters continuous steep declines in the still very volatile crypto market.

Using stop-loss orders and other techniques will allow traders who wish to make money for a short period to safeguard their gains. Bitcoin Hits $80,527, Long-term investors would want things to remain the same. Since world events are altering the dynamics of markets, the next several weeks could be quite crucial.

What This Means for the Crypto Market

BTC usually charts the path of the other cryptocurrencies. Already, its increase boosts confidence in altcoins. Other well-known coins like Ethereum and Solana have witnessed double-digit rises. This increasing tendency may indicate the beginning of a fresh bull cycle driven by consumer enthusiasm, institutional interest, and changes in the world economy. Investors should stay informed and up-to-date as Bitcoin enters a potentially explosive era. Right at the junction of geopolitics, finance, and technology, there is more action than ever.