Bitcoin Whale Accumulation Fuels Bullish Outlook for 2025

Since the start of March, Bitcoin whales have been assembling covertly over 100,000 BTC. Usually, purchasers with a lot of money engage in this large-scale purchase since they are hopeful about future price movement. Whale accumulation has historically preceded significant upward developments; hence, this new event is substantial for those monitoring the market. Wealthy investors buy when things are not too wild, before the rest of the market does. Their latest behavior gives the impression of preparation for something more significant, which would benefit the market.

Up to 2025, the price of Bitcoin should climb.

For Bitcoin, things seem better and better as we approach 2025. The amount of brand-new Bitcoin has dropped after the most recent halving event slashed miners’ rewards. Bitcoin Whale Accumulation, This supply shortage usually helps keep prices rising over time, particularly in cases with constant or rising demand.

Simultaneously, it seems as though both big and small investors are showing increasing interest. Increasing numbers of banks are providing Bitcoin products, and many view BTC as a means of shielding oneself from economic volatility. Given the ongoing impact of inflation and volatility on global markets, many investors are once again considering Bitcoin as a distributed approach to retaining wealth.

Demand inside institutions and the age of the market

Furthermore, the clarity of the policies will influence the image in 2025. More institutional involvement could result from more straightforward guidelines for crypto assets implemented in the US and Europe. These businesses are growing more law-abiding and confident, so their involvement could significantly affect the price of Bitcoin.

More Bitcoin ETFs and custodial services make it simpler for normal investors to enter the market without dealing with digital wallets or exchanges. This announcement marks a significant turning point toward development for the crypto market and might result in long-term expansion.

Events to monitor in the following months

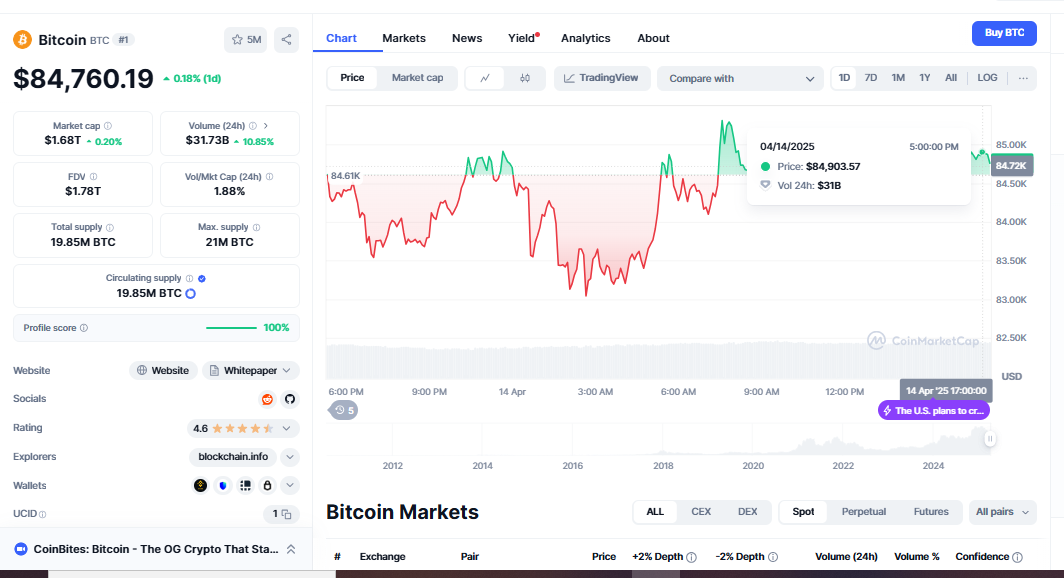

From a technical standpoint, traders are closely monitoring essential support zones. Going up stronger would make sense based on a clear break above current highs. Many analysts believe that, given whales’ continued buying and the state of the economy overall remaining robust, it is feasible to reach $100,000 BTC in the next 12 to 18 months.

Still, the road upward could not be simple. The crypto market’s high degree of volatility still defines it. Short-term corrections, profit-taking, or more significant economic issues could all lead to temporary pullbacks—those who wish to ride this potential wave must control risk and arrange their strategic posture.

What Should Investors Know?

The present whale population indicates something long-term holders and active traders should consider. It reveals that some of the strongest players in the market are confident in their actions. Whether Bitcoin reaches new all-time highs or stays steady for a bit longer, this accumulation phase may set the next major trend.

If you’re already in the market, you could reconsider your strategy. Bitcoin Whale Accumulation, You might want to stay updated even if you’re not currently involved, so you can seize opportunities when they present themselves.

Last Notes: Is a Bull Run approaching?

Less supply, more accumulation, institutional momentum, and resurgent retail interest are starting to align. Though 2025 is considered a likely breakout year, there is no telling where Bitcoin will land. Bitcoin Price Prediction 2025: Will prices remain flat first, or will there be a significant rise? Share your thoughts, watch the market, and prepare for one of Bitcoin’s most important events.