Bitcoin’s Bullish Momentum Builds on Institutional Confidence

Once again, Bitcoin ($BTC) has experienced significant growth, rising from $74,500 to approximately $85,663. The most recent price rise shows a Bitcoin Bullish Builds, showing how attitudes are changing worldwide and could point to a more consistent development phase for the most valuable currency in the world than just a fleeting fluctuation.

A major economic change—the delay of global taxes for ninety days—occurred simultaneously with the recovery. Currently, this political action has lessened economic uncertainty; both traditional and cryptocurrency markets have recovered trust. As the future of the Earth becomes less certain, Bitcoin is showing strength, and traders are paying heed.

Big Players Keep Buying BTC

An analytical tool used on-chain, Santiment claims that traders are beginning to display moderate but steadily rising optimism. But it’s not only about attitudes; great money most definitely underlines it. Many still consider Bitcoin (BTC) a wise long-term investment since Michael Saylor and MicroStrategy, his company, keep buying it.

Big institutional players piling in during uncertain times frequently indicate long-term strategic confidence rather than short-term speculation. Bitcoin Price Hits, They frequently point to Others copying these steady buys, helping the market feel more confident, keeping prices constant, and increasing investor interest.

Exchange BTC Balances Fall — A Bullish Signal

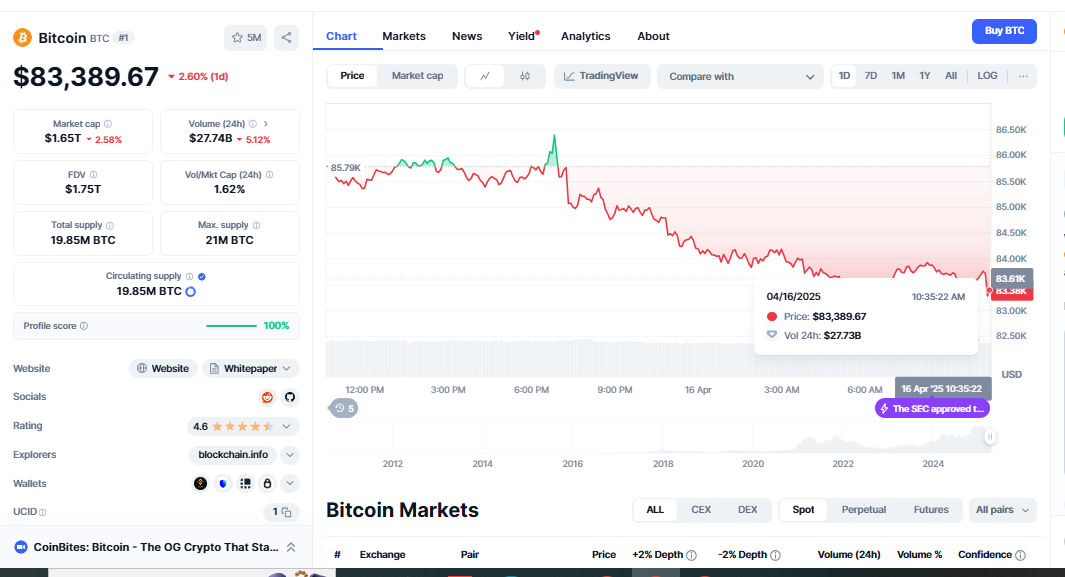

The amount of Bitcoins stored on centralised exchanges is one crucial metric that analysts closely monitor. Currently, this figure is declining. BTC price today: $83,389.67. Since there is less BTC on exchanges, moving assets to cold storage or private wallets usually reduces the incentive to sell.

This inclination suggests that holders are preparing for long-term conditions rather than selling if prices rise shortly. Given the recent market volatility, this situation is especially important. Diminished supply and growing demand usually create the environment for continuous development.

Profitable Holders Create Price Stability

An additional important figure is the current 100% of profitable Bitcoin holders. Making money helps keep prices constant since it makes people less likely to sell quickly.

This development and the dropping exchange reserves indicate a better basis for Bitcoin’s price. Apart from a technical bounce, we could also see the start of an increasing long-term trend.

What’s Fueling the BTC Bullish Trend?

Several factors are aligning to support Bitcoin’s positive momentum:

-

Rebound from key support: $74.5K was a launchpad for the current rally.

-

Macro policy shift: The 90-day tariff pause reduced global market stress.

-

Institutional accumulation: Major players are continuing to build their BTC positions.

-

Decreased selling pressure: Exchange reserves are falling, indicating less intent to sell.

-

Trader sentiment is improving: Data shows rising optimism across the board.

These aren’t just speculative moves. They represent a broader shift in market psychology and positioning, potentially laying the groundwork for a Bitcoin breakout soon.

Is Bitcoin Heading Toward New Highs?

Although every market has volatility, all indicators point to Bitcoin moving into a steadier, expansion-oriented phase. Macro conditions are strengthening, institutional interest is still great, and important technical signs are encouraging.

Having said that, traders should monitor the resistance levels between $86k and $88k and seek volume confirmation for further upward movements. Bitcoin Bullish Builds, A clear break above $88K could allow retesting all-time highs.