Cryptocurrency Price Today July 28 Bitcoin Dips Live Market Updates

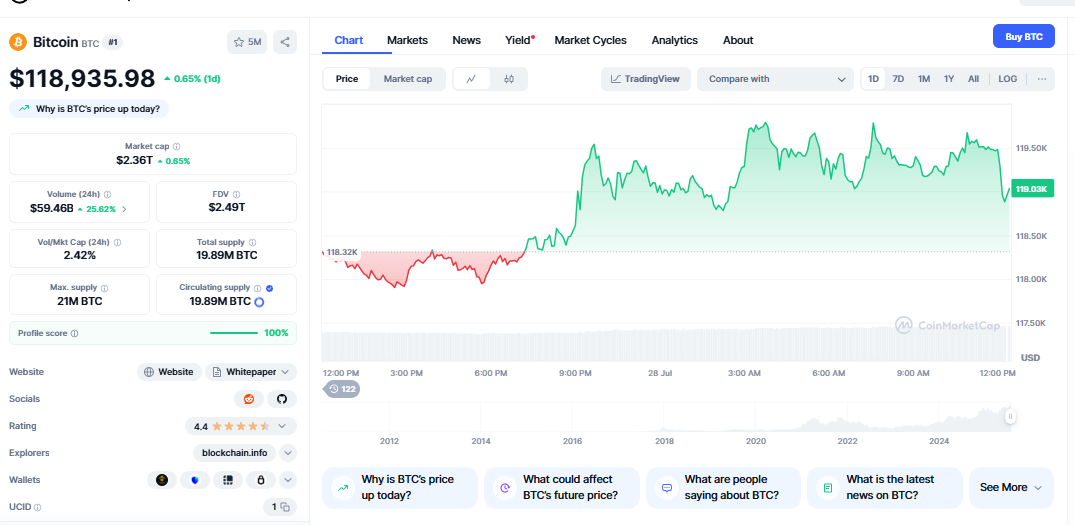

The cryptocurrency price today July 28 Bitcoin dips have captured investor attention as digital assets experience notable volatility amid shifting market dynamics and institutional movements. Bitcoin is currently trading at $119,265.02, representing the average price over the last 24 hours as of July 28, 2025, highlighting the significant price action that has characterized this trading session. Despite recent pullbacks from earlier highs, the broader cryptocurrency market continues to demonstrate resilience, driven by strong underlying fundamentals and increasing institutional adoption. This comprehensive analysis examines the current market conditions, explores the factors driving today’s price movements, and provides insights into potential future trends for Bitcoin and major altcoins as we navigate through this critical trading period.

Current Bitcoin Price Movement and Market Analysis

Bitcoin (BTC) has already set the tone for Q4 2025, surpassing its previous all-time high to reach $122,379.00 on July 14, before entering the current consolidation phase. The recent price action reflects typical market behavior following significant rallies, where profit-taking and technical corrections create temporary downward pressure.

Bitcoin is currently trading at approximately $118,010, down 0.40% for the day, with a price range of $119,273 to $117,103 in the last 24 hours. This relatively narrow trading range suggests consolidation rather than panic selling, indicating that institutional and retail investors remain confident in Bitcoin’s long-term prospects.

The trading volume has shown mixed signals, with BTC’s 24-hour trading volume declining slightly to $71.16 billion (-0.53%), indicating reduced activity compared to previous sessions. This volume decline often accompanies consolidation periods as market participants assess the next directional move.

Technical Analysis of Bitcoin’s Price Action

Bitcoin has broken above the $116 level and is now retesting the 20-day EMA band at approximately $115,000. If it dips below this mark, it could retrace further, suggesting that traders and algorithmic systems are closely watching key technical levels.

The current price structure indicates that Bitcoin is navigating between critical support and resistance levels. Technical analysts are monitoring the $115,000-$116,000 range as a key battleground that could determine short-term price direction.

Market sentiment indicators continue to show mixed readings, with some suggesting cautious optimism while others point to potential consolidation before the next major move. The interplay between technical levels and fundamental factors will likely determine Bitcoin’s trajectory in the coming days.

Altcoin Performance Amid Market Volatility

Ethereum’s Market Position

Ethereum has demonstrated relative strength compared to Bitcoin during this correction phase, maintaining key support levels while showing signs of institutional accumulation. The recent ETF approvals and growing DeFi ecosystem continue to provide fundamental support for ETH prices.

The Layer 2 solutions and upcoming network upgrades have created positive sentiment around Ethereum’s long-term scalability and utility, helping to buffer some selling pressure during broader market corrections.

Solana’s Resilient Performance

Throughout July, Solana has been performing stably, with the value of the cryptocurrency remaining close to the $180 mark and showing growth of approximately 10-11 percent per week. This performance highlights Solana’s growing market position and investor confidence in its ecosystem.

As of July 25, 2025, SOL is trading at $184.28 and has a market cap of $99.20B, demonstrating significant market capitalization that positions it among the top cryptocurrencies by valuation.

The price of Solana (SOL) has increased by 3.40% in the last 24 hours and by 3.50% in the past 7 days, demonstrating strong momentum despite broader market uncertainty.

Other Major Altcoins

XRP price has suffered one of the most severe declines among major cryptocurrencies, plummeting 17% over two trading sessions, indicating that regulatory concerns and market dynamics continue to affect different cryptocurrencies in varying ways.

The altcoin market exhibits divergent performance patterns, with some tokens maintaining their strength while others undergo more significant corrections. This divergence suggests that investors are becoming more selective and focusing on projects with strong fundamentals and straightforward utility.

Institutional and Market Sentiment Factors

Institutional Investment Trends

Institutional demand remains strong, with firms like Metaplanet and MicroStrategy continuing to accumulate large amounts of BTC, providing a foundation of support that helps stabilize prices during correction periods.

The continued institutional adoption represents a significant shift from previous market cycles, where retail sentiment dominated price movements. This institutional presence creates more stable price floors and reduces the likelihood of extreme downward volatility.

The outlook for the crypto market remains fundamentally optimistic, underpinned by robust institutional demand via ETFs fuels price discovery, suggesting that current price corrections may be viewed as temporary adjustments rather than trend reversals.

Market Psychology and Fear & Greed Index

The technical indicators suggest that the current market feeling is neutral Bearish 29%, with a Fear & Greed Index score of 72 (Greed), indicating that despite price corrections, investor sentiment remains relatively optimistic.

This mixed sentiment often characterizes transitional periods, during which markets consolidate gains before determining the next major directional move. The relatively high greed reading suggests that investors are not panicking despite recent price declines.

Cryptocurrency Price Today July 28 Bitcoin Dips

The current market correction should be viewed within the broader context of Bitcoin’s remarkable performance throughout 2025. The cryptocurrency has demonstrated unprecedented institutional adoption and regulatory acceptance, creating a more mature market structure than previous cycles.

Factors Contributing to Today’s Price Movement

Several factors contribute to the current price dynamics in cryptocurrency markets. Profit-taking by institutional investors who accumulated positions at lower levels creates natural selling pressure. Additionally, technical correction patterns following significant rallies are a normal part of market behavior that helps establish new support levels.

Macroeconomic factors, including central bank policies and traditional market movements, continue to influence cryptocurrency prices. However, the correlation between crypto and traditional markets has decreased as the asset class matures and develops independent price discovery mechanisms.

Short-term Price Outlook

Market analysis anticipates a positive trend for Bitcoin in July, with the forecasted price range indicating potential recovery from current levels. Technical analysis suggests that the current consolidation phase may be preparing for the next leg of the upward trend.

Bitcoin may recover from the recent dip if key support near $102,000–$104,000 holds; however, current prices, which are well above these levels, suggest strong market support at higher valuations.

Long-term Price Predictions and Market Outlook

Expert Price Forecasts for 2025

Analysts predict a year-end target of $120,000 to $140,000 in 2025, depending on continued institutional interest and a stable macroeconomic environment. These projections assume continued institutional adoption and favorable regulatory developments.

Digital Coin Price suggests an average price of $210,644.67 for 2025, with peaks potentially reaching $230,617.59, representing significantly bullish long-term expectations that extend well beyond current price levels.

The Bitcoin price has the potential to reach $200,000 by the end of 2025, according to some analysts who factor in continued institutional demand and potential supply constraints resulting from halving effects.

Altcoin Growth Potential

The price of Solana (SOL) is predicted to increase by 18–22% and may reach $175–$182 by the end of July 2025, showing that altcoins continue to present significant growth opportunities despite current market corrections.

According to Solana price predictions for 2025, the altcoin might reach a maximum of $400 by 2025, suggesting that alternative cryptocurrencies may experience more dramatic price appreciation than Bitcoin due to their smaller market capitalizations and growth potential.

Risk Factors and Market Considerations

Regulatory Environment

The regulatory landscape continues to evolve globally, with different jurisdictions adopting varying approaches to cryptocurrency oversight. Positive regulatory developments, such as ETF approvals and institutional frameworks, support higher valuations, while restrictive policies can create temporary selling pressure.

Investors should closely monitor regulatory announcements from major economies, as these can have a significant impact on market sentiment and short-term price movements.

Market Volatility Management

Cryptocurrency markets remain inherently volatile, necessitating the use of effective risk management strategies. Position sizing, diversification across various cryptocurrencies, and understanding personal risk tolerance are crucial for achieving successful long-term investing.

The current correction presents opportunities for dollar-cost averaging strategies, enabling investors to accumulate positions at lower prices while mitigating entry timing risk.

Technology and Adoption Trends

Blockchain technology continues advancing with improvements in scalability, security, and user experience. These technological developments support long-term value creation and adoption across various use cases beyond simple value storage.

The integration of artificial intelligence, DeFi protocols, and traditional financial services creates new utility and demand drivers that support long-term price appreciation across the cryptocurrency ecosystem.

Trading Strategies for Current Market Conditions

Short-term Trading Approaches

Active traders may consider range-trading strategies that capitalize on the current consolidation pattern. Identifying key support and resistance levels allows for tactical position management during volatile periods.

Momentum traders should watch for breakouts above recent highs or breakdowns below key support levels, which could signal the next significant directional move in cryptocurrency prices.

Long-term Investment Considerations

Long-term investors may view current price levels as opportunities for accumulation, particularly for cryptocurrencies with strong fundamental prospects and growing adoption. Dollar-cost averaging strategies help mitigate timing risk while building positions gradually.

Portfolio diversification across different cryptocurrency sectors, including DeFi tokens, gaming coins, and infrastructure projects, can help capture various growth themes while managing single-asset risk.

Read More: Cryptocurrency Price Today July 28 Bitcoin Dips Live Market Updates

Market Infrastructure and Liquidity Analysis

Exchange Activity and Volume Patterns

Cryptocurrency exchange activity remains robust despite price corrections, with major platforms reporting steady trading volumes and user engagement. This sustained activity indicates continued investor interest and market participation.

Institutional trading platforms have experienced increased activity as professional investors adjust their positions based on both technical and fundamental analysis. This institutional presence helps provide market liquidity during volatile periods.

Derivatives and Options Markets

The derivatives market for cryptocurrencies continues expanding, providing additional tools for risk management and price discovery. Options activity often provides insights into market sentiment and expected price ranges.

Futures markets help establish forward-looking price expectations and allow for more sophisticated trading strategies that can benefit from both upward and downward price movements.

Global Economic Context and Crypto Markets

Macroeconomic Influences

Global economic conditions, including inflation rates, central bank policies, and currency fluctuations, continue to influence cryptocurrency markets. Bitcoin’s role as a potential hedge against currency debasement supports long-term demand.

Geopolitical events and economic uncertainty often drive increased interest in decentralized digital assets as alternative stores of value and payment systems.

Central Bank Digital Currencies (CBDCs)

The development of central bank digital currencies worldwide creates both opportunities and challenges for private cryptocurrencies. While CBDCs may compete with some cryptocurrency use cases, they also validate the underlying blockchain technology and digital payment concepts.

Future Market Catalysts and Events

Upcoming Technical Developments

Planned network upgrades, scaling solutions, and protocol improvements across major blockchain networks could serve as positive catalysts for price appreciation. Ethereum’s continued development and the expansion of Bitcoin’s Lightning Network represent significant technical progress.

Institutional Product Launches

Additional cryptocurrency ETF approvals, custody solutions, and institutional investment products could drive increased demand and price stability. These products make cryptocurrency exposure more accessible to traditional investors.

Adoption Milestones

Corporate adoption announcements, payment integration partnerships, and government acceptance of cryptocurrencies as legal tender continue serving as positive catalysts for market growth.

Conclusion

The cryptocurrency price today July 28 Bitcoin dips represent a natural correction phase within a broader bullish trend that has characterized 2025. While short-term volatility creates uncertainty, the fundamental drivers supporting cryptocurrency adoption remain strong, including institutional demand, technological improvements, and growing mainstream acceptance.

Investors should view current market conditions through a long-term lens, recognizing that temporary price corrections often create opportunities for strategic accumulation. The cryptocurrency market’s maturation, evidenced by institutional participation and regulatory clarity, suggests that current price levels may represent attractive entry points for patients.0t investors.

FAQs

Q1. Why is Bitcoin experiencing a dip on July 28, 2025?

Bitcoin’s current dip represents normal market correction following its recent all-time high of $122,379 on July 14. Technical profit-taking, consolidation patterns, and temporary volume decreases are typical after significant rallies. The correction allows the market to establish new support levels before potentially resuming its upward trend.

Q2. What are the key support levels to watch for Bitcoin today?

Key support levels include the $115,000-$116,000 range, which represents the 20-day EMA band, and the $102,000-$104,000 zone mentioned by analysts as critical long-term support. Current prices well above these levels suggest strong market foundations despite short-term volatility.

Q3. How are altcoins performing compared to Bitcoin today?

Altcoin performance is mixed, with Solana showing strength at $184.28 and gaining 3.40% in 24 hours, while XRP has declined significantly by 17% over recent sessions. This divergence suggests that investors are increasingly interested in projects with strong fundamentals and active development.

Q4. Should investors buy the dip in cryptocurrency prices today?

Investment decisions should be based on individual risk tolerance and investment goals. Current price levels may present opportunities for dollar-cost averaging strategies, but investors should conduct thorough research and consider their financial situation before making purchases during volatile periods.

Q5. What are the price predictions for Bitcoin by the end of 2025?

Analysts predict Bitcoin could reach $120,000-$140,000 by year-end 2025, with some forecasts suggesting potential for $200,000 or higher. These predictions depend on continued institutional adoption, favorable regulatory developments, and stable macroeconomic conditions supporting cryptocurrency demand.