Ethereum ETF Inflows Signal Strong Institutional Confidence

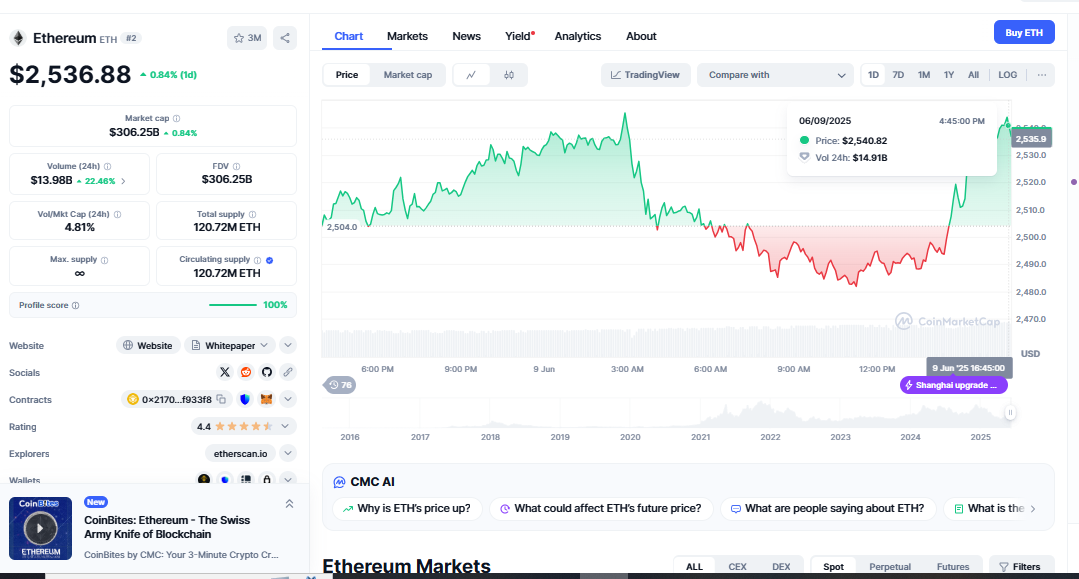

Ethereum ETFs raised $837.4 million in 15 days. This is a peak time for institutional interest in Ethereum. Ethereum ETF inflows, This steady climb suggests Ethereum is becoming more recognized as a key part of the decentralized web’s architecture, not just that prices will rise.

These ETF fluctuations show the market is more than hopeful. They suggest that major banks and financial institutions have rethought Ethereum. Ethereum, once considered a high-risk investment, is now viewed as a vital foundation for banking, identity verification, and Web3 applications. Money from conventional finance (TradFi) supports the idea that Ethereum is a vital aspect of the digital economy, not just a currency.

As Web3 Infrastructure Grows, Ethereum

Ethereum has expanded since its launch. The network now supports DeFi, NFTs, DAOs, and Layer 2 scaling options. Ethereum’s technological and economic promise is becoming apparent as institutional money flows into ETH ETFs.

Ethereum is unusual among high-risk investments since it has been utilized in real-world applications. Over 41.98 million Ethereum transactions occurred in May, the most in a year. This growth in on-chain activity isn’t just market hysteria; it shows that technology is improving and more people are adopting it. Smart contracts, coin transfers, and rollup settlements are filling Ethereum’s base layer. All of this makes the platform more valuable over time.

ETFs have seen sustained inflow for 21 days, the longest this year. This is impossible. Institutional workers frequently do things precisely. As Ethereum becomes more essential for digital assets, their interest in Ethereum-backed ETFs implies they believe in Ethereum’s future.

Several factors suggest market prices may break out

Inflows and transaction counts are good indicators, but how people feel, the amount of available money, and the physical setup of the market frequently affect price activity. The Ethereum market may rise soon. ETH has been consistent for weeks, but it’s accelerating. This is partially because ETFs encourage buying.

These events prompt us to question whether Ethereum will reach a new high. Analysts are becoming more confident. Prices are expected to rise due to strong on-chain metrics, significant demand for ETFs, and growing economic interest in decentralized technologies. Transaction costs are decreasing, and throughput is increasing as Layer 2 ecosystems and Ethereum continue to improve. These direct changes improve Ethereum’s global settlement layer.

TradFi supports Ethereum’s economic theory

The fact that ordinary banks now accept Ethereum is important to its success. People who previously opposed digital assets are now buying ETH ETFs and other regulated vehicles. Setting up the team is planned, not a guess.

Regular banks aren’t programmable, decentralized, or modular like Ethereum. Institutional investors who invest in Ethereum gain access to a programmable money ecosystem that can support the next generation of financial goods and services and protect themselves against the decline of fiat currencies and economic uncertainty.

In the long term, this change will significantly impact Ethereum’s value. More diverse portfolios will contain ETH, making it easier to trade, less volatile, and more important. Since ETH is institutionalized, it is more respected and useful.

Can Ethereum handle the next round?

Ethereum is no longer just for crypto-natives. The network is at a crucial point where money, clear regulations, and institutional interests intersect. If ETFs continue to stream in, prices may break through mental boundaries and reach a new high.

Investors must be cautious. Markets are nevertheless affected by legislation, monetary policy, and global economic uncertainty. Ethereum’s greatest strength is its adaptability. Long-term sustainability is improving due to a rising environment, a dedicated developer community, and institutional backing.

Summary

Ethereum has lost its riskiness. ETH is becoming a significant component of the decentralized economy. ETFs are flooding the market, utilization is at record highs, and institutional investors are confident. Ethereum’s story is too important to ignore for investors, coders, and fund managers.