Ethereum ETFs See $92M Inflows as Bitcoin Loses $346M

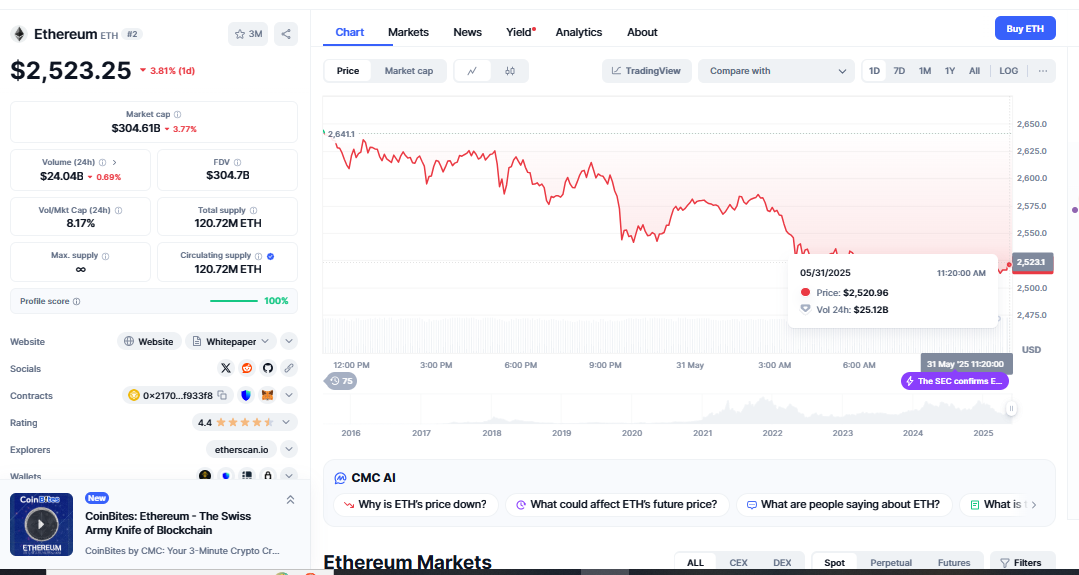

The bitcoin market continues to display significant indicators when viewed through the lens of institutional flows. May 29 was not unusual. Significant developments in Bitcoin and Ethereum exchange-traded funds (ETFs) revealed the evolving opinions of professional investors. Those who watch the market pay close attention to the subtle yet significant variations in capital allocation. Ethereum ETF inflows, nearly $92 million have arrived in Ethereum ETFs, while over $346 million has departed Bitcoin ETFs.

Bitcoin ETFs Register $346.8 Million in Net Outflows

On May 29, a significant amount of bitcoin departed the market after roughly 3,220 BTC were sold via various ETFs. Among the daily withdrawals in the past few weeks, this was one of the most significant net losses—$346.8 million. The action implies that some market players could be temporarily shifting their money or minimizing their risk. Institutions often take profits or reduce their exposure Ethereum Weekly Breakout, when prices have surged significantly or when the overall state of the economy is unknown.

These outflows first seem concerning, but taken holistically, they are not cause for concern. Still viewed as a long-term asset by many institutional buyers. The present decline could be a result of a strategy shift rather than a widespread change in attitude. Furthermore, it seemed as though investors were gradually reducing their exposure, possibly in preparation for future macroeconomic data or Federal Reserve comments, rather than selling out of panic.

Ethereum ETFs Record $91.9 Million in Net Inflows

While Ethereum ETFs experienced great demand, Bitcoin saw net selling. Purchased throughout that period, over 34,290 ETH generated a net profit of $91.9 million. This significant occurrence demonstrates people’s confidence in Ethereum’s value, particularly with increasing discussion of a spot Ethereum ETF approved in the US.

The gains indicate that investors are becoming increasingly favorable toward Ethereum’s role in distributed finance (DeFi) and its potential as an asset that may yield income through staking. Ethereum continues to benefit from being the foundation for many of the Web3 ecosystems. Institutional interest appears to be increasing as staking infrastructure evolves and becomes more straightforward to operate.

This behavior also aligns with the broader narrative of Ethereum as a programmable layer of the blockchain economy, which differs from the function of value that Bitcoin serves. Investors are considering ETH as more than just a cryptocurrency asset, as the Ethereum network continues to improve in terms of scalability and transaction speed. They view it as a means of investing in a dynamically evolving digital economy.

Flows Reveal Market Sentiment Beyond Price Action

While many people study price charts, ETF flows are often a more accurate gauge of institutional sentiment. The discrepancy between Bitcoin’s outflows and Ethereum’s inflows on May 29 revealed a crucial theme: capital is being transferred depending on the degree of chance and risk present, rather than abandoning the crypto scene entirely.

Usually, thinking long-term, institutions do not make decisions on resource allocation based on impulse. According to the shifting flows, some investors are reducing their Bitcoin holdings while others are reallocating their money to Ethereum, likely anticipating new regulations and protocol enhancements. These developments are deliberate and intentional, demonstrating how the market is precisely adjusting to changing circumstances, not randomly.

The disparity occurs during a period when the price of Bitcoin has been somewhat constant. Institutions seem to be preparing for possible causes of instability rather than reacting to it. This covers not just ETF approvals but also general economic factors that can influence the risk profile of assets in the next months.

Institutional Quietude Is Strategic, Not Passive

These movements stand out for their subtlety, among other things. Institutions are quietly implementing their strategies through ETF allocations rather than publicizing them. Ethereum ETF inflows. These trading flows tell the true narrative of the market, even if price variations generate press coverage.

This demonstrates the need to pay attention to ETF data since it provides us with a unique view of the behavior of actual money. Conversely, institutional traders tend to be more forward-looking and less reactive. Their strategies depend on long-term theme bets, regulatory signals, and basic analysis. The increasing wealth of Ethereum suggests that people believe it is not only safe but also expanding in its role within the crypto ecosystem.

What do investors and traders monitor?

The current fluctuations in the flows of Bitcoin and Ethereum ETFs present both opportunities and cautions for traders and investors. Bitcoin’s decline shouldn’t be interpreted as a sign of weakness, even if Ethereum seems to be gaining popularity. Rather, it might be a decent break in a lengthier bullish cycle.

Monitoring Ethereum ETF inflows, on-chain behavior, and legislative developments will become very crucial from now on. Should Ethereum continue attracting institutional money and the U.S. Securities and Exchange Commission approve an ETH ETF on the spot market, the money flow might quicken even faster. In the same vein, if macroeconomic uncertainty were to vanish, Bitcoin may swiftly recover the lost money and resume its normal movement.

Summary

May 29 taught the realm of crypto ETFs several lessons. The market made plain that institutional tastes were shifting, with approximately $92 million arriving in Ethereum and more than $346 million departing Bitcoin. These acts reveal how significant companies are preparing for what lies ahead in the realm of digital assets, therefore transcending mere daily noise.

The narrative runs in the lines, not only in the charts. Ethereum Bullish Momentum, Those who own cryptocurrencies should consider where their money is going, rather than following the advice of others. This will probably enable them to perform better in the subsequent stage of the crypto cycle.