Gate.io Lists BOOM Perpetual Contracts to Expand DeFi Trading

In a strategic move to enhance its decentralised finance (DeFi) trading offerings, Gate.io, one of the world’s leading centralised crypto exchanges, has officially listed BOOM perpetual contracts on its futures trading platform. This development underscores the growing convergence between traditional derivatives infrastructure and DeFi innovation, unlocking new opportunities for traders seeking to leverage decentralised assets with sophisticated financial tools.

The listing of BOOM perpetual contracts positions Gate.io at the forefront of derivative-based DeFi exposure, as traders can now engage with BOOM without owning the asset directly. This not only boosts trading flexibility but also introduces deeper liquidity, increased leverage options, and advanced portfolio strategies. For both seasoned crypto investors and institutional participants, this move marks a pivotal shift in how decentralised protocols can be accessed via centralised platforms.

What is BOOM and why does It Matter?

BOOM is an emerging digital asset that operates within the broader DeFi ecosystem. Designed to function as both a governance and utility token, BOOM plays a critical role in powering decentralised applications, community-led finance, and smart contract execution. Its rapid adoption across decentralised exchanges (DEXs), lending platforms, and DAOs has made it a token of interest for traders and developers alike.

Unlike many speculative tokens, BOOM is backed by tangible utility in real-world applications within Web3. This includes staking mechanisms, liquidity incentives, and DAO voting rights. With the addition of perpetual contracts, BOOM is now entering a more mature phase of price discovery, driven by leveraged futures trading rather than spot market speculation alone.

Gate.io’s Strategic Role in Perpetual

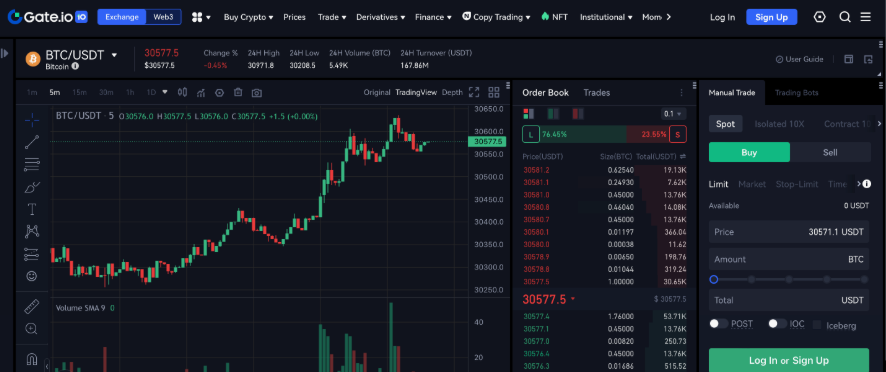

Gate.io has consistently demonstrated leadership in supporting innovative crypto derivatives, including perpetual swaps and inverse contracts. The exchange is recognised for its robust trading infrastructure, low latency, and high liquidity across spot and futures markets. By listing BOOM perpetual contracts, Gate.io extends its mission to democratise access to next-generation financial tools while strengthening the integration between centralised and decentralised financial ecosystems.

The newly launched perpetual contract allows traders to go long or short on BOOM with leverage, thus opening up arbitrage strategies, hedging possibilities, and speculative opportunities without requiring physical settlement. This is particularly significant as institutional-grade traders and market makers increasingly seek exposure to trending DeFi tokens like BOOM, but require the precision and risk controls only derivative instruments can provide.

Furthermore, Gate.io ensures that risk management tools such as cross-margin and isolated-margin settings are available for BOOM futures, enabling retail and professional users to tailor their risk exposure with precision. These trading enhancements reflect Gate.io’s broader commitment to building secure and advanced trading environments for crypto-native assets.

Implications of the DeFi and Derivatives Markets

The listing of BOOM perpetual contracts on Gate.io comes at a time when the DeFi derivatives market is experiencing exponential growth. As of mid-2025, the total value locked (TVL) in DeFi derivatives protocols has surpassed $10 billion, according to data from DefiLlama. This growth is being fuelled by increasing demand for leverage, yield strategies, and non-custodial risk management tools.

By enabling perpetual exposure to BOOM, Gate.io is effectively bridging a critical infrastructure gap. Traders who were previously limited to spot exposure on decentralised exchanges. Such as Uniswap or Balancer can now amplify. They position or hedge their risk more efficiently. This hybrid model—where DeFi tokens gain centralised derivative support—suggests. A future where the boundaries between CEX and DEX trading models become increasingly fluid.

Another significant implication is the potential for price stabilisation. With perpetual contracts, the influx of both long and short positions often leads to more accurate price discovery and reduces volatility. This benefits the BOOM ecosystem by attracting institutional capital and reducing the risks associated with purely speculative price action.

Institutional Interest and BOOM’s Market Trajectory

Institutional adoption continues to play a central role in the crypto derivatives market. Firms like Greyscale, Galaxy Digital, and Jump Crypto are expanding. Their exposure to digital assets is not only through spot ETFs. Custody solutions, but also via derivatives and DeFi assets. BOOM, with its expanding use cases and now with futures trading access, is positioned to capture. The interest of funds seeking alpha in a tokenised world.

Moreover, the increasing interoperability between BOOM. Other blockchains—especially Ethereum Layer 2s like Arbitrum and zkSync—position it as a token well-aligned with the evolving infrastructure of the decentralised web. This could drive more listings, integrations, and partnerships across both centralised and decentralised platforms, further cementing its role in the future of programmable finance.

Summary

The listing of BOOM perpetual contracts on Gate.io signals. A broader evolution in how decentralised finance tokens are integrated into the global trading infrastructure. With improved liquidity, trading flexibility, and institutional interest. BOOM is well-positioned for a dynamic future in the DeFi and crypto derivatives market. Gate.io’s proactive approach in supporting such listings is not only valid. BOOM’s legitimacy but also reaffirms the growing synergy between centralised exchanges and decentralised assets.

As crypto markets mature and trading strategies become more complex. Tools like perpetual contracts will continue to be vital in shaping efficient, scalable, and accessible digital finance. Gate.io’s initiative to list BOOM futures ensures that traders. At all levels can confidently navigate the next chapter of DeFi evolution.