HOME Token Launches on Binance & Bitget with Gasless DeFi

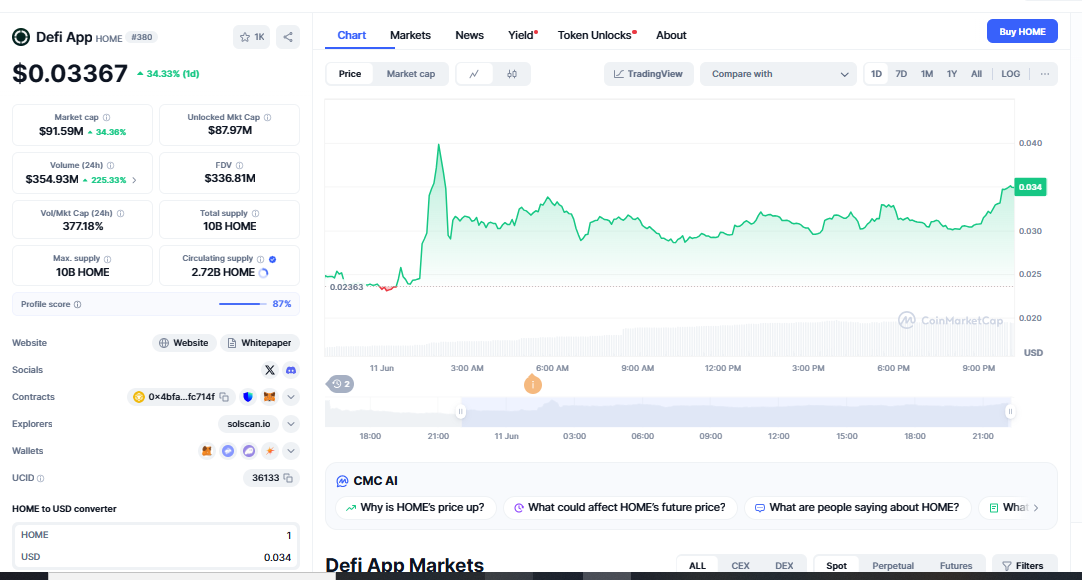

Today is a significant day for decentralised finance, as Binance Alpha & Futures and Bitget now offer DeFi App’s primary token, HOME. This launch, scheduled for June 10, 2025, at 11:00 AM UTC, will usher in a new era of seamless cross-chain trading with no gas fees, KYC restrictions, or powerful perpetual contracts within a SuperApp environment that allows users to maintain their assets. HUMA Token on Bitget, Only 5% of HOME’s supply is in circulation; therefore, short-term liquidity and long-term value are both expected. Initial pricing predictions were $0.02–$0.05, but analysts expect it to rise to $0.30 or higher.

What Makes HOME a Game-Changer in the DeFi-CeFi Merge?

DeFi. App created HOME, a governance token with more. The primary function of a crypto-native SuperApp is to simplify token transfers and asset management. It enables gasless swaps, eternal trading, and yield farming over EVM-compatible networks. HOMER eliminates bridging costs and handles transaction execution internally, allowing non-technical users to move across multi-chain liquidity pools safely and efficiently. DeFi.app had over 350,000 users and $11 billion in trade volume before token production due to this novel approach. Once, it was one of the top five DEXs by volume.

Decentralised protocols’ openness and freedom are combined with centralised exchanges’ KYC-free onboarding, easy-to-use interface, and quick execution. HOME token holders can vote on governance, yield, and platform spending. Community involvement is linked to platform growth.

Strategic Binance Alpha & Futures Listings: A Reliable Start

HOME launches on Binance Alpha at 11:00 UTC on June 10. At 11:30 UTC, a USDT-settled perpetual contract with 50 times leverage will launch. Binance’s Alpha ecosystem tests promising early-stage assets. Since listing, FHE, Gork, and RESOLV have done nicely. Adding a futures market increases liquidity and attracts professional traders.

Bitget also accepted HOME/USDT deposits and placed them in its Innovation Zone with other projects it supports. Bitget selects promising DeFi-native coins and enables complex order types, such as gasless swaps and farming, in an institutional-like context. Both CEXs allow deposits before trading to ensure liquidity. This helps prevent slippage and spreads early.

Tokenomics and a limited rollout boost Home’s growth

HOME tokenomics emphasises scarcity. HOME token DeFi launch: only 5% of the supply will be coined and distributed at launch. This approach limits token supply to real-world use, reducing inflation and demonstrating the government’s financial planning. Initial pricing estimations put HOME’s launch price between $0.02 and $0.05. These estimates are supported by 24-hour transaction volumes exceeding $116 million and a market capitalisation of nearly $90 million.

Supporters expect HOME to reach $0.30. In this forecast, people will continue to use it, there will be treasury-backed awards, yield farming will persist, and a SuperApp will make DeFi more accessible. The lack of tokens, hype surrounding the launch, and great usefulness all contribute to boosting prices.

Gas-Free and KYC-Free: Easy On-Chain Engagement

HOME’s best feature is petrol-free transactions and KYC-free access. End customers find it easier. HOME combines gas sponsorship and account abstraction to execute swaps and perpetual trades for users without native gas tokens or wallet funding. New users can join more easily and have a similar experience to centralised systems. Binance claims HOME operates “with zero gas fees, no bridges and full self-custody.”

Removing KYC procedures makes onboarding easier, allows for global use, protects privacy, and simplifies regulators’ jobs. This addresses regulators’ concerns regarding data privacy and identity theft. It will enable emerging nations and privacy-conscious individuals to use it quickly.

Bright contract-based account abstraction ensures cross-chain atomicity, MEV protection, and a unified user experience in HOME’s intelligent routing. These characteristics make DeFi. app a pioneer in user-first infrastructure. Institutional guardians of emerging on-chain legibility, like Fireblocks, which introduced EIP-7702 for gasless wallet transactions, tell this story.

New DeFi with Professional Infrastructure

HOME stands apart by offering spot and permanent contracts simultaneously. Trading on Binance Futures and Bitget, which supports perpetual contracts, begins at 11:30 UTC. HOME token DeFi launch, Advanced traders can utilise 50x leverage on HOME/USDT. The contracts use the HOME token smart contracts for cross-chain collateral. This simplifies EVM work.

This infrastructure provides real-time margin control and perpetual funding mechanisms with a margin limit of ±2%. This boosts protocol income through funding rates and liquidity through arbitrage, drawdown hedging, and speculation. Users can maintain control and decentralisation with institutional mechanisms like conditional orders and stop-loss.

CEX Listings Impact Trust, Liquidity, and the Ecosystem

HOME’s listings on Binance and Bitget indicate its trustworthiness and potential for increased traffic. These platforms undergo audits, legal evaluations, and community evaluations. HOME token DeFi launch, Their backing shows retail and institutional investors that HOME is real, safe, and scalable.

Centralised exchange listings increase global visibility through fiat gateways, API integration, and order types. They enable secondary market participation and prevent liquidity fragmentation. ZKJ Token Staking, CEX listings can help build volume and momentum, as seen with FHE and Gork.