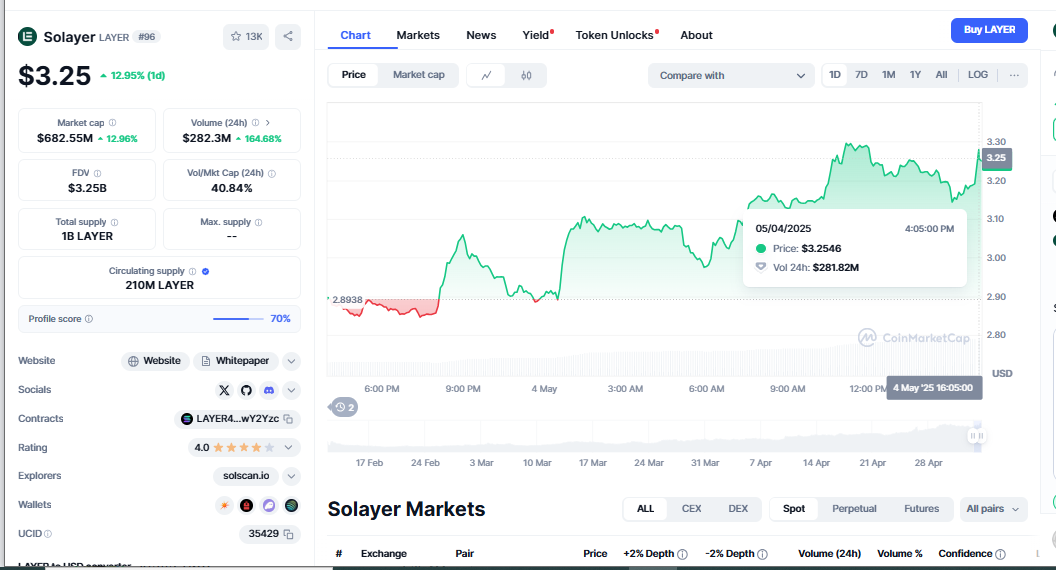

$LAYER Eyes Breakout at $3.15 Amid Bullish Chart Patterns

Recovering from a recent loss, the $LAYER currency has drawn considerable support and progressively reverted to $3.15. Traders seek evidence of an altcoin market recovery; why does this comeback occur? $LAYER Eyes Breakout at $3.15. Present pricing indicates a favorable continuance, suggesting that $LAYER is due for another increase.

Analysis of market structure and dynamics

During fluctuations in the crypto market, the $LAYER chart reveals a noticeable trend. The $LAYER chart analyzes early indicators such as bullish flags or cup-with-handle arrangements. Both signs point to an impending upsurge before the price swings again. Usually, sideways consolidation moves swiftly upward. The flag pattern begins to emerge at this point.

Usually, confirmation sends one soaring above the consolidation zone. The cup-and-handle design features a rounded bottom and a slight return that creates the handle before breakout. This tendency implies that unless they break constraints, prices will grow slowly.

These models fit today’s $LAYER action.

The increase in support shows buyers’ confidence, and the climb to $3.15 validates its applicability as a transient cap. Should traffic for the token rise, it might generate additional revenue.

Notable Indices to View: These signs indicate whether a pattern ends in rejection or a breakthrough. A daily closing over $3.15 signals a significant increase in interest. Proof of breakthroughs depends on volume. Usually, considerable price increases suggest that people will buy in speculation and continuation.

Apart from the picture, the performance of $LAYER will be determined by the state of the market. Rising Bitcoin could benefit cryptocurrencies such as $LAYER. Although their setups differ, many cryptocurrencies follow if Bitcoin drastically retraces.

Watch also how $LAYER responds to fresh support level testing. Salespeople protecting this space contribute to the impression that momentum is growing strongly. Breaking that support calls for review and challenges the optimistic view.

Approach to trading and risk control

Please review your current holdings. Raise your stop losses to lock in winnings and let trading space grow. One has to wait patiently for a door. Look for a break above $3.15 with volume backing. Arriving after confirmation lowers false breaks.

This configuration facilitates the trading of $LAYER and cryptocurrencies. Watch closely how important pricing levels change. Excellent risk control is vital. Plan your stop-loss and never risk more than what a transaction allows you to lose. Sometimes, emotional decisions cause trading mistakes.

Try not to overlook foundations.

While technology solutions like $LAYER’s are essential, long-term success also depends on firm foundations. You ought to look past the graph. Think about the elements controlling the $LAYER value. Are the layers expanding in size or number? What are people working on? How valuable is the currency, and how many people have it?

Stories of the market change fast. Strong teams backing actual initiatives help them succeed under challenging conditions. Supported technological breaks cover more ground. $LAYER Eyes Breakout at $3.15, Those who perceive events from both sides will find long-term value more readily than consumers and traders.

Knowledge Investors Need Should be

Short- and long-term players could profit from the recent increase in $LAYER and a fresh chart pattern. Strong confirmation mixed with price-breaking support can start a more general action. $MEME Token Skyrockets, Price decline and resistance holding can lead to a support test or further stability.

The Notes Final and Action Alert Layer is significant. Its technical approach, excellent support recovery, and close proximity to local highs indicate a potentially significant development. One can determine if a breakout or regression will occur by observing price activity near the $3.15 support zone and monitoring momentum changes.