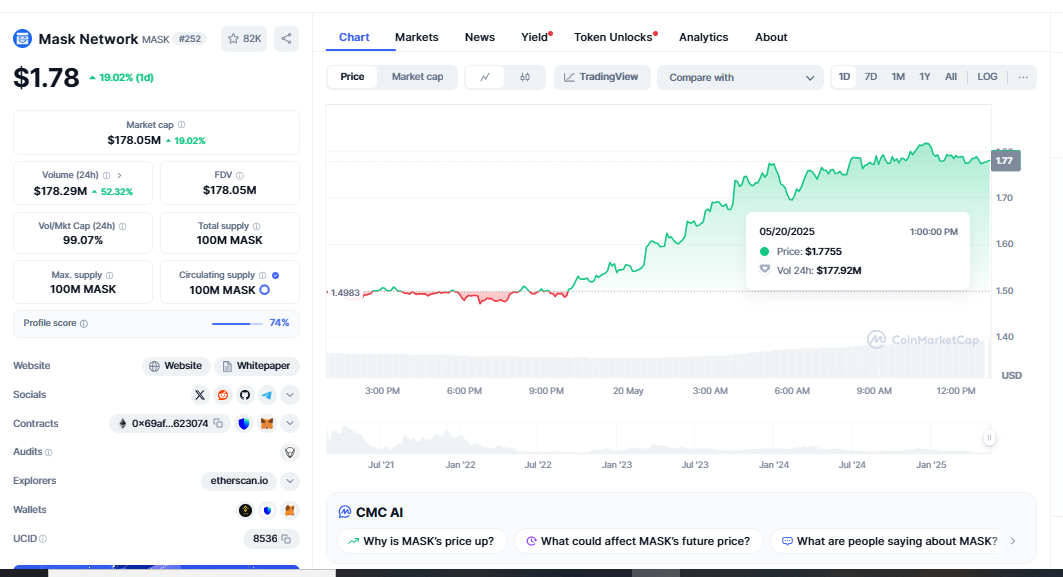

$MASK Price Prediction, Will the Rebound Break or Fail?

Crypto buyers are intrigued by the recent surge in $MASK, but there are still questions about how strong and long-lasting this rise will be. Buyers have hope since the $MASK price dropped a horrible 64% but has since recovered 80%. $MASK price prediction. On the other hand, closer inspection of the technical layout reveals that it still requires caution. A rising broadening wedge is forming; this chart pattern is observed to be chaotic and may be negative. It taints the present movement of pricing.

This wedge pattern is evident when markets are volatile and immediately before significant losses. The structure usually shows that the trend is running out of steam, although occasionally it causes upward breaks. The present bounce is pretty good, although it does not yet show evidence of a complete trend reversal. Traders should closely watch this wedge’s top and bottom edges to decide on the following significant action.

Changing the tech and the main tiers

To determine the future direction of $MASK, we must decide if the price can transcend the higher resistance trendline or fall below the lower support. If a successful finish over the $1.73 level shows that the price is once more climbing, targets of $1.80, $2.00, or even $2.30 might be reached. These price zones provide notable degrees of resistance depending on psychological barriers and historical swing highs.

On the other hand, if the price goes below the $1.53 support zone, the positive story will be refuted, and the price may drop considerably further. Should the price pass this lower level, $MASK might sell off quickly. The pricing ranges are from $1.45 to $1.24. These levels also show technical support areas and past price movement during the last leg down.

Although evidence is still needed

The recent rise in volume suggests that people are engaged in market trading. Onyxcoin (XCN) Price Surges, Substantial volume and positive candlestick patterns would encourage a breakout, therefore reflecting the genuine interest of consumers. Without this proof, even a brief gain above resistance could be a false breakout, quickly returning down.

Indices of the Undecision of the Market Moving Forward: The Relative Strength Index (RSI) and Average Convergence Divergence (MACD), two momentum indicators, are starting to show signs of a likely attitude change among individuals. Stronger RSI readings suggest that investors are looking to buy once more. Still, it does not quite fall in the pricey range. This indicates that there can still be development chances if buyers maintain pressure.

The MACD is also becoming positive, even if the histogram is still small, suggesting that the bullish trend is still in the early stages. If the MACD and signal lines cross over, traders should pay close attention since this will guide their understanding of the future trend direction. Taken together, volume, movement, and the behavior of the candlesticks will equip you with the information needed to act with confidence.

Industry status and more general crypto trends

One should take the $MASK arrangement into account from the standpoint of the whole cryptocurrency market. While Bitcoin and Ethereum seem to be drawing together, money is flocking into mid-cap and lower-cap altcoins. Usually, this works out well for tokens like $MASK that have been overdone but nevertheless have a lot of community involvement or story potential.

Increasing numbers of cryptocurrency traders are seeking underpriced assets with clear technical trends. One suitable example of this kind of asset is $MASK. Its recent partial recovery piques more interest, even if it is not yet a clear sign of a trend reversal. If the market feels better and Bitcoin stabilizes, more people could acquire altcoins like $MASK.

Still, a very important component is surprise. The upward broadening wedge pattern points to most likely whipsaws and more natural price volatility. Traders should be disciplined and avoid situations just because of hearsay or excitement.

Strategically looking ahead and managing risk

If you consider entering, the current structure makes a compelling case—but only if you have confirmed breakdown or breakout signs. Those who enter too early run too much risk, especially considering the history of erroneous swings in this trend. Particularly in a market as fast-changing as the crypto market, one should be patient and gather data.

Any approach to trading with $MASK should prioritize risk control. After well-defined technical levels, traders should use stop-loss techniques to protect themselves from unanticipated market fluctuations. Your appropriate position size and constant observation of volume changes will help you maximize prospective gains and control losses.

Watch the wedge and trade the break.

After a sharp fall, $MASK has shown a great return; future occurrences are uncertain. Given a rising spreading wedge, prices will likely stay unstable, with notable swings on both sides. A confirmed breach over $1.73 could start a new upward trend, producing more increases. On the other hand, a break below $1.53 would bring fresh lows and the loss of current increases.

Traders should be alert, rely on consistent technical indications, and wait to trade until they are positive. Timing, attention, and the ability to change always define success in crypto trading. $PORTAL Tests $0.0708, you should now check out the interesting chart for $MASK. Still, only strong activity will reveal whether the bulls or bears will rule the upcoming round.