Meme Coin Market Hits $63.6B Amid 2025 Volatility and Hype

The Meme market cap today is $63.6 billion, a 6.5% change in the last 24 hours. This substantial market valuation reflects the continued evolution of cryptocurrency speculation and community-driven digital assets that have captured mainstream attention. In a report on Thursday, DWF Labs revealed that the meme coin market cap skyrocketed over 500% in 2024 following a change in how investors perceive their value, especially among the younger generation.

The meme coin sector has experienced significant volatility throughout 2025, with major tokens like Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE) leading market sentiment shifts. Top meme coins extended recent losses on Wednesday, with the segment’s market capitalisation standing at $54.41 billion, a decline of over 20% in the past month. This fluctuation demonstrates the inherent volatility characteristic of meme-based cryptocurrencies, where social media trends and community sentiment drive price movements more than traditional fundamental analysis.

Dogecoin Price Analysis

Dogecoin remains the flagship meme cryptocurrency, maintaining its position as the most recognisable and widely adopted token in the category. If the meme coin closes above $0.1710, it could reverse the downfall and target the $0.20 psychological mark. Technical analysis reveals critical support and resistance levels that traders monitor closely for potential breakout scenarios.

The cryptocurrency’s price action has been influenced by broader market conditions, regulatory developments, and high-profile endorsements from influential figures in technology and entertainment. Dogecoin’s established infrastructure, including widespread exchange support and merchant acceptance, provides fundamental backing that distinguishes it from newer meme coin entries.

Current market sentiment surrounding Dogecoin reflects mixed signals, with bullish scenarios dependent on maintaining key support levels and bearish outlooks triggered by breaks below established technical thresholds. The token’s correlation with Bitcoin and broader cryptocurrency market movements continues to influence short-term price trajectories.

Shiba Inu Market Dynamics

Shiba Inu has evolved beyond its initial meme coin origins, developing a comprehensive ecosystem that includes decentralised finance applications, non-fungible token marketplaces, and layer-2 scaling solutions. The Shiba Inu edges higher by less than 1%, holding at the $0.000010 psychological support after printing four consecutive bearish candles last week.

The token’s technical analysis reveals important price levels that could determine future momentum. Similar to PEPE, Shiba Inu rallied above a key descending trendline and the 50-day SMA in the past 24 hours. If it holds these levels as support, it could continue its charge to tackle the $0.00001612 resistance. This technical development suggests potential for continued upward momentum if current support levels hold.

Shiba Inu’s ecosystem development, including the ShibaSwap decentralised exchange and upcoming layer-2 blockchain Shibarium, provides utility beyond speculative trading. These technological developments create additional value propositions that may support long-term price appreciation independent of meme coin market cycles.

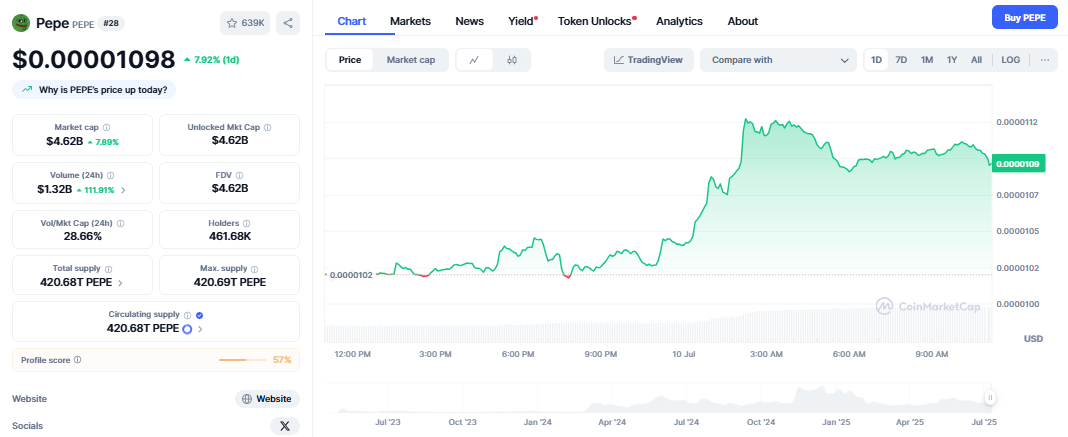

Pepe Token Technical Analysis

Pepe has emerged as a significant player in the meme coin space, capturing attention through social media virality and community engagement. On the other hand, a potential close below the 50-day EMA at $0.00001158 will undermine the recovery chances in Pepe. In such a case, the extended decline could target the $0.000010 psychological mark.

The token’s price movements demonstrate typical meme coin volatility patterns, with rapid appreciation followed by consolidation phases. However, if the PEPE price finds support around its 50-day EMA at $0.0000113, it could extend the recovery to retest its daily resistance level at $0.0000121. These technical levels serve as important benchmarks for traders analyzing potential entry and exit points.

Market sentiment surrounding Pepe reflects the broader meme coin ecosystem’s dependency on social media trends, celebrity endorsements, and community-driven marketing campaigns. The token’s relatively newer market presence compared to Dogecoin and Shiba Inu creates both opportunities for significant growth and risks associated with lower liquidity and established market presence.

Meme Coin Trends and New Market Entrants

SPX’s 21% 7d gain outpaced DOGE (+0.3%) and SHIB (-0.1%), with its $1.4B cap now ranking 5th in memecoins. This performance demonstrates how newer meme coins can achieve significant market capitalizations and compete with established tokens through community building and strategic marketing.

The meme coin landscape continues evolving with new tokens emerging regularly, each attempting to capture unique market niches or cultural moments. SPX 6900 has formed a rounding bottom pattern while Gigachad is showing signs of accumulation. Launch Coin is approaching oversold conditions, with RSI approaching 30; hence, a rebound could take it toward $0.29.

Market participants increasingly focus on tokens that combine meme appeal with technological innovation or specific use cases. This trend suggests potential consolidation in the meme coin space, where tokens offering genuine utility beyond speculative trading may achieve more sustainable long-term growth.

Technical Analysis Tools and Trading Strategies

Meme coins Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE) register a bright start to the week, concurrent with the broader cryptocurrency market recovery. This correlation demonstrates how meme coins often move in tandem with broader market trends, providing opportunities for technical analysis applications.

Moving averages, relative strength index (RSI), and support/resistance levels remain valuable tools for meme coin analysis, despite the additional complexity introduced by social media influence. Traders often combine traditional technical indicators with sentiment analysis tools that monitor social media engagement and community activity.

Volume analysis becomes particularly important for meme coins, as unusual trading activity often precedes significant price movements. Monitoring on-chain metrics, including wallet distribution and transaction patterns, provides additional insights into potential market developments.

Platform Accessibility and Trading Infrastructure

Trading memecoins in 2025 has never been easier, especially with platforms like the CoinDCX App. The interface is clean and fast and lets me buy, sell, or swap memecoins like PEPE, DOGE. Improved trading infrastructure has made meme coin access more convenient for retail investors, contributing to increased market participation.

Major cryptocurrency exchanges have expanded their meme coin listings, providing greater liquidity and price discovery mechanisms. This increased accessibility has contributed to mainstream adoption while also introducing new risks associated with inexperienced traders entering volatile markets.

Decentralised exchanges have become important venues for meme coin trading, particularly for newer tokens that may not yet have centralised exchange listings. These platforms provide early access to emerging projects while requiring users to understand additional technical complexities and risks.

Summary

Successful meme coins rely heavily on community engagement and viral marketing campaigns that create sustained interest and trading activity. Social media influence, celebrity endorsements, and grassroots marketing efforts often determine which tokens achieve lasting market presence versus short-term speculation.

The role of influencers and content creators in meme coin promotion raises questions about market manipulation and investor protection. Understanding these dynamics becomes crucial for investors seeking to evaluate the sustainability of community-driven price movements.

Meme coin communities often develop unique cultures and internal governance structures that influence token development and market strategy. These social aspects create additional layers of analysis beyond traditional financial metrics when evaluating investment opportunities.