Pi Network Price Outlook, Mainnet Launch May Trigger Breakout

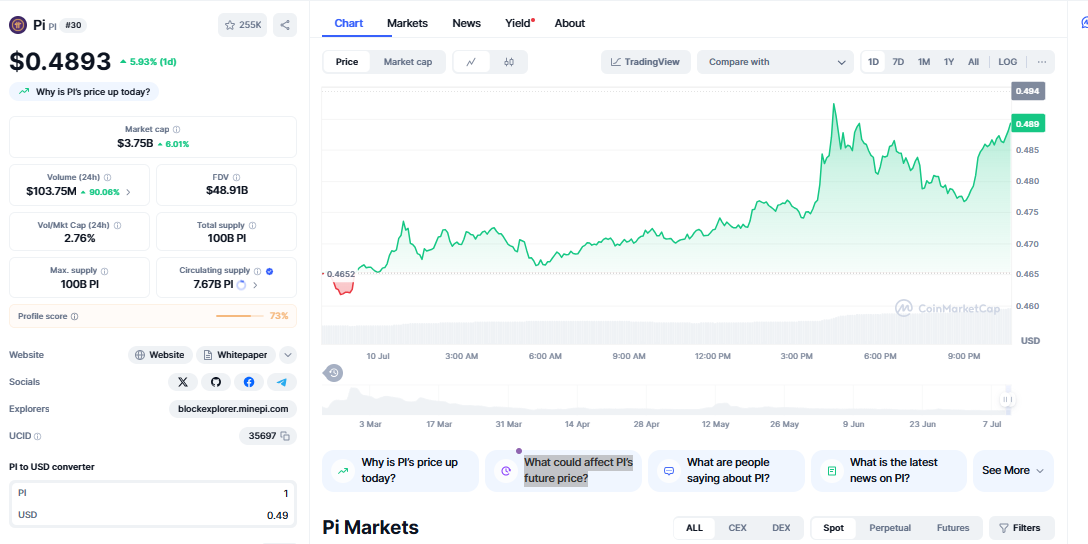

The cryptocurrency market continues to evolve with innovative projects capturing investor attention, and Pi Network stands as one of the most intriguing developments in the blockchain space. PI’s price flatlines at $0.46, but shrinking volatility hints at a breakout, creating uncertainty about the factors that will drive its future valuation. Understanding the complex interplay of technological, regulatory, and market forces that could influence Pi’s trajectory is crucial for investors, developers, and blockchain enthusiasts seeking to navigate this emerging ecosystem.

Pi Network’s unique approach to cryptocurrency adoption through mobile mining has created a massive user base, but the transition from testnet to mainnet introduces numerous variables that could significantly impact future price movements. The project’s success depends on multiple interconnected factors, ranging from technical implementation to regulatory compliance and market acceptance.

Mainnet Launch and Network Maturation

The most significant factor affecting Pi’s future price is the successful transition to a fully operational mainnet. Pi Network has provided a significant update to pioneers on its progress towards the Open Network launch, targeting Q1 2025, marking a crucial milestone in the project’s development. This transition represents far more than a technical upgrade; it fundamentally changes how Pi tokens can be used, traded, and integrated into the broader cryptocurrency ecosystem.

The mainnet launch involves several critical phases that will directly impact Pi’s valuation. The upcoming open mainnet phase will remove the firewall that currently restricts external connectivity. This transition is expected to unlock major functionalities such as external wallet transfers, exchange listings, and real-world applications. Each of these capabilities introduces new use cases and liquidity mechanisms that could drive significant price appreciation.

The timing and execution of the mainnet launch are particularly important given current market conditions. According to the developers, the mainnet launch will also happen when the external factors are supportive and when there are enough applications in the ecosystem. This strategic approach suggests that Pi’s price will be influenced not only by internal development milestones but also by broader market sentiment and cryptocurrency adoption trends.

Know Your Customer Verification

The integrity of Pi Network’s user base represents a fundamental factor in determining future price stability and growth potential. As of the latest updates, over 12 million users have been verified, moving closer to the 15 million target necessary for the mainnet launch. This KYC verification process is crucial for establishing Pi’s legitimacy and ensuring that the network’s value is support by real users rather than automated accounts.

The verification process directly impacts Pi’s circulating supply and market dynamics. As of June 26, 2025, PI has a circulating supply of 7.535 billion out of a maximum supply of 100 billion, but the actual tradeable supply depends on how many verified users successfully migrate their tokens to the mainnet. This migration process creates a natural supply constraint that could support price appreciation if demand remains strong.

The quality of the user base also influences Pi’s long-term value proposition. Unlike traditional cryptocurrencies that rely primarily on speculative trading, Pi Network’s success depends on building a functional ecosystem where users actively engage with the platform for real-world transactions. The verification process ensures that this ecosystem is built on a foundation of legitimate participants rather than speculative accounts.

Ecosystem Development and Real-World Adoption

The development of practical applications and real-world use cases represents another crucial factor in Pi’s future price trajectory. PiFest saw engagement with: More than 125,000 total registered sellers—including 58,000 active sellers; Use of the community-built Map of Pi app by over 1.8 million Pioneers. This ecosystem development demonstrates that Pi Network is successfully transitioning from a theoretical concept to a practical payment platform.

The geographic distribution of Pi’s adoption provides insights into its global potential. The 2025 edition, held in March, saw strong participation across local businesses, especially in Asia and Africa. Events like PiFest help bridge the gap between digital assets and everyday spending, reinforcing Pi’s role as a practical medium of exchange. This geographic diversity suggests that Pi could benefit from different regional economic conditions and regulatory environments.

The development of decentralised applications and smart contracts on Pi’s network will create additional utility and demand drivers. With increased liquidity, Pioneers can buy, sell, or use Pi for payments, while the launch also opens doors for dApps, smart contracts, and merchant adoption. Each new application adds functionality to the network and creates additional reasons for users to hold and use Pi tokens.

Market Sentiment and Institutional Interest

Traditional market dynamics continue to play a significant role in Pi’s price development, particularly regarding institutional adoption and mainstream acceptance. ChatGPT predicts that major altcoins like XRP, Solana and Pi Coin will set fresh price records by the end of the year, reflecting growing recognition of Pi’s potential within the broader cryptocurrency community.

The correlation between Pi’s price and broader market trends affects investor sentiment and trading patterns. Pi Coin price prediction: daily volumes drop below $100 million and indicate lower interest from whales, suggesting that large investor participation remains limited. This dynamic could change dramatically once Pi gains access to major exchanges and institutional trading platforms.

The project’s unique approach to distribution and mining has created a different investor profile compared to traditional cryptocurrencies. Rather than relying primarily on early adopters and institutional investors, Pi Network has built a grassroots community that could provide more stable demand patterns. However, this also means that price appreciation may depend more on utility and adoption than on speculative trading.

Technical Analysis and Price Patterns

Current technical indicators provide insights into potential price movements and market sentiment. The technical chart on the weekly time frame shows a bullish engulfing pattern, which suggests a strong momentum favoring buyers. This candlestick pattern indicates that Pi Network is ready to continue its uptrend after nearly two weeks of correction and sideways movement. These technical patterns suggest that Pi’s price may be poised for significant movement as key resistance levels are test.

Price prediction models incorporate various scenarios based on different adoption and development outcomes. By the end of July 2025, Pi Network (PI) is projected to trade within the $0.40–$0.52 range, influenced by token unlock dynamics and any major network developments. These projections reflect the uncertainty surrounding Pi’s development timeline and the potential impact of various catalysts.

The volatility characteristics of Pi Network differ from many established cryptocurrencies due to its unique distribution model and user base. Long-term price stability will depend on the successful development of utility-driven demand rather than speculative trading patterns. This fundamental difference could lead to more sustainable price appreciation if the project successfully executes its roadmap.

Regulatory Environment and Compliance

The regulatory landscape surrounding cryptocurrency projects continues to evolve, with potential implications for Pi Network’s future operations and price development. The project’s approach to compliance and regulatory engagement will significantly influence its ability to achieve mainstream adoption and institutional acceptance.

Pi Network’s mobile mining model presents unique regulatory considerations compared to traditional proof-of-work cryptocurrencies. The project’s emphasis on user verification and identity confirmation aligns with regulatory trends toward increased transparency and accountability in the cryptocurrency space. This proactive approach to compliance could provide competitive advantages as regulatory frameworks become more defined.

The global nature of Pi Network’s user base introduces additional regulatory complexity, as the project must navigate different jurisdictions and compliance requirements. Success in key markets could drive significant adoption and price appreciation, while regulatory challenges could constrain growth and limit trading opportunities.

Competition and Market Positioning

Pi Network operates in an increasingly competitive landscape where numerous projects are vying for user attention and adoption. The project’s unique value proposition of mobile mining and accessibility differentiates it from traditional cryptocurrencies, but this advantage must be maintained as competitors develop similar approaches.

The success of other Layer-1 blockchain projects provides both opportunities and challenges for Pi Network. Successful projects demonstrate market demand for innovative blockchain solutions, while unsuccessful projects highlight the risks associated with new cryptocurrency ventures. Pi’s ability to differentiate itself and execute effectively will be crucial for maintaining its competitive position.

The integration of Pi Network with existing financial systems and payment platforms could significantly enhance its utility and adoption prospects. Partnerships with established financial institutions or payment processors could provide legitimacy and accessibility that drive mainstream adoption and price appreciation.

Supply and Demand Dynamics

The tokenomics of Pi Network create unique supply and demand dynamics that will influence future price movements. The gradual release of tokens through the verification and migration process creates a controlled supply expansion that could support price stability during the transition period.

The relationship between active users and token circulation will be crucial for maintaining healthy market dynamics. Unlike cryptocurrencies with fixed supply schedules, Pi’s token distribution depends on user engagement and verification completion. This creates a direct link between platform success and token supply, potentially leading to more organic price development.

The development of staking mechanisms and other token utility features could create additional demand drivers that support price appreciation. These features would provide users with incentives to hold tokens rather than immediately selling them, potentially reducing selling pressure and supporting price stability.

Economic Factors and Macroeconomic Trends

Broader economic conditions and macroeconomic trends will continue to influence Pi Network’s price development, particularly as the project gains mainstream adoption. Inflation rates, currency stability, and economic growth in key markets could affect demand for alternative payment systems and store-of-value assets.

The growing interest in financial inclusion and alternative financial systems could benefit Pi Network’s adoption prospects. Economic instability in traditional financial systems could drive increased interest in decentralised alternatives, potentially supporting Pi’s price and adoption.

The development of central bank digital currencies and their impact on the broader cryptocurrency ecosystem could influence Pi’s market position. The project’s ability to differentiate itself from government-issued digital currencies will be crucial for maintaining its unique value proposition.