Pump.fun Token Investment Strategy Guide Expert 2025 Strategies and Tips

The cryptocurrency landscape has witnessed explosive growth in meme coin trading, and this comprehensive Pump.fun token investment strategy guide provides essential insights for maximising your investment potential. As the leading Solana-based meme coin launchpad, Pump. Fun has revolutionised how investors approach early-stage token opportunities, creating unprecedented access to potentially lucrative investments.

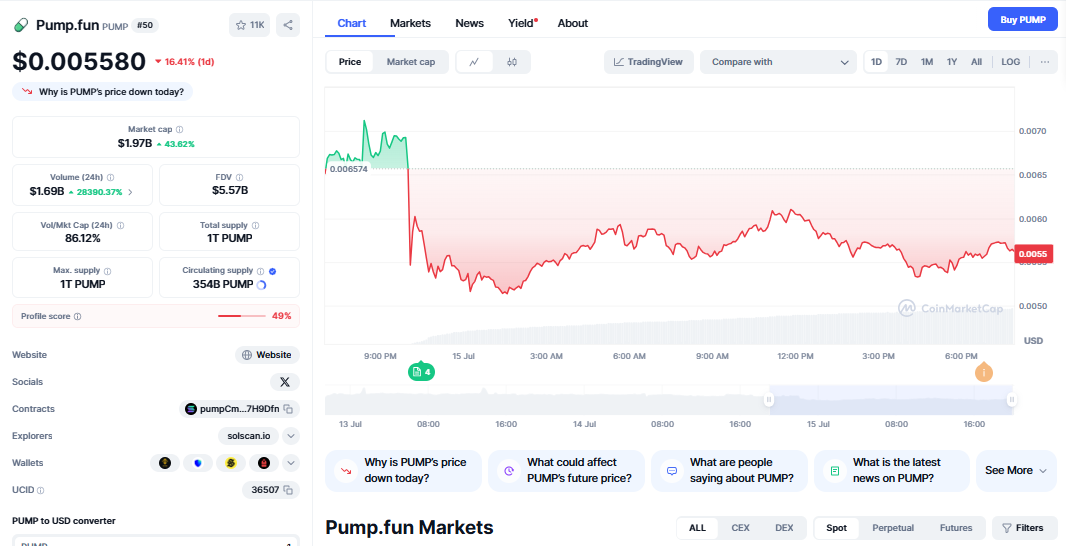

With over 6 million meme coins launched on the platform and daily trading volumes exceeding $750 million, Pump.fun represents a significant opportunity for savvy investors. However, success requires strategic planning, risk management, and deep understanding of the platform’s unique bonding curve mechanism. This investment strategy guide examines proven techniques, risk mitigation strategies, and advanced trading approaches that can help you navigate the volatile world of meme coin investing.

The platform’s fair launch model and automated liquidity provision create distinct advantages over traditional token launches. Understanding these mechanics is crucial for developing effective investment strategies that capitalize on market inefficiencies while protecting your capital from excessive risk exposure.

Understanding Pump.fun Platform Mechanics

Pump.fun operates on a unique bonding curve system that automatically manages token pricing and liquidity provision. When tokens are created, they begin with zero market capitalisation and gradually increase in price as more investors purchase them. This mechanism ensures fair distribution while creating predictable price dynamics that informed investors can exploit.

The platform’s graduation system requires tokens to reach a $69,000 market cap before transitioning to Raydium for traditional DEX trading. This threshold creates natural filtering mechanisms that separate successful projects from failed launches. Understanding this graduation process is essential for timing entry and exit points effectively.

Key platform features include:

- Fair launch mechanism with no presales

- Automated bonding curve pricing

- Built-in liquidity provision

- Social features for community building

- Transparent token metrics and analytics

- Seamless Solana wallet integration

Pump.fun Token Investment Strategy Guide: Core Principles

Fundamental Analysis for Meme Coins

While traditional fundamental analysis may seem irrelevant for meme coins, certain factors significantly impact success probability. Strong communities, memorable branding, and viral potential create sustainable value propositions that extend beyond mere speculation. Analyzing these qualitative factors helps identify tokens with genuine growth potential.

Community engagement metrics provide valuable insights into token viability. Active social media presence, engaged Discord communities, and organic growth patterns indicate strong foundations for price appreciation. Tokens with manufactured or bot-driven engagement typically fail to maintain momentum beyond initial pumps.

Branding quality and meme potential directly correlate with viral success. Tokens with professional artwork, catchy names, and relatable themes tend to outperform generic alternatives. The cultural relevance and timing of meme concepts significantly impact their market reception and sustainability.

Technical Analysis Strategies

Technical analysis remains crucial for timing entries and exits in Pump.fun investments. The bonding curve creates predictable price patterns that skilled traders can exploit through strategic positioning. Understanding volume patterns, support levels, and momentum indicators improves timing accuracy significantly.

Volume analysis provides early indicators of genuine interest versus artificial pumping. Sustainable price increases typically correlate with increasing volume, while artificial pumps often display volume spikes followed by rapid declines. Monitoring these patterns helps distinguish between organic growth and manipulation.

Chart pattern recognition helps identify optimal entry and exit points. Common patterns include accumulation phases, breakout formations, and distribution periods. Understanding these patterns within the context of Pump.fun’s bonding curve mechanics provides significant trading advantages.

Risk Management Framework

Effective risk management forms the foundation of successful Pump.fun investing. The platform’s high volatility and speculative nature require strict position sizing and loss limitation strategies. Never risk more than 1-2% of your total portfolio on any single token, regardless of conviction level.

Stop-loss strategies must account for the platform’s unique mechanics. Traditional stop-losses may not work effectively due to low liquidity and high volatility. Instead, consider time-based exits or percentage-based profit taking to protect capital while maintaining upside exposure.

Diversification across multiple tokens reduces concentration risk while maintaining exposure to potential winners. The low entry costs on Pump.fun enable investors to spread risk across numerous opportunities, improving overall risk-adjusted returns through portfolio diversification.

Advanced Investment Strategies for Pump.fun Tokens

Early Detection and Sniping Techniques

Identifying promising tokens early provides significant advantages in Pump.fun investing. Monitoring new launches, analyzing initial market reactions, and quick decision-making capabilities separate successful investors from the crowd. Developing systematic approaches to early detection improves investment outcomes substantially.

Social media monitoring tools help identify trending topics and viral content before they impact token prices. Twitter, Telegram, and Discord communities often signal emerging opportunities hours or days before significant price movements. Automated monitoring systems provide competitive advantages in fast-moving markets.

Launch timing analysis reveals optimal entry windows for new tokens. Understanding market cycles, peak activity periods, and investor behavior patterns helps time entries for maximum impact. The first few hours after launch often provide the best risk-reward opportunities for skilled investors.

Bonding Curve Optimization Strategies

The bonding curve mechanism creates unique arbitrage opportunities that skilled traders can exploit. Understanding price discovery mechanics, liquidity dynamics, and graduation thresholds enables strategic positioning that capitalizes on market inefficiencies.

Market making strategies involve providing liquidity at strategic price points while capturing spread profits. This approach requires deep understanding of bonding curve mathematics and careful risk management to avoid adverse selection and impermanent loss.

Graduation timing strategies focus on tokens approaching the $69,000 market cap threshold. These transitions often create significant price volatility and volume spikes that create profitable trading opportunities for prepared investors.

Community Building and Social Strategies

Active community participation enhances investment performance through improved information flow and early opportunity identification. Engaging with token communities provides insights into development progress, marketing initiatives, and potential catalysts that impact token performance.

Network effects within the Pump.fun ecosystem create compounding advantages for active participants. Building relationships with successful traders, developers, and influencers provides access to exclusive opportunities and market intelligence that improves investment outcomes.

Social proof strategies involve identifying and following successful traders and investors within the ecosystem. Learning from their approaches, timing, and decision-making processes provides valuable insights that can be adapted to your investment strategy.

Risk Assessment and Management Techniques

Platform-Specific Risks

Pump.fun’s unique structure creates specific risks that investors must understand and manage. Smart contract risks, platform stability issues, and regulatory uncertainties could impact token values and platform functionality. Staying informed about platform developments helps anticipate and manage these risks.

Liquidity risks emerge from the bonding curve mechanism and low trading volumes. Tokens may become difficult to sell during market stress, creating potential losses for investors unable to exit positions. Understanding liquidity dynamics helps avoid problematic situations.

Regulatory risks affect the entire meme coin ecosystem, with potential implications for platform operations and token values. Monitoring regulatory developments and maintaining compliance awareness helps prepare for potential market disruptions.

Portfolio Management Strategies

Effective portfolio management requires balancing risk and reward across multiple Pump.fun investments. Position sizing, diversification, and rebalancing strategies help optimize returns while managing downside risk exposure.

Profit-taking strategies ensure you capture gains from successful investments while maintaining exposure to continued upside. Systematic approaches to profit realization help overcome emotional decision-making and improve long-term returns.

Loss limitation techniques protect capital during unsuccessful investments. Setting clear exit criteria and maintaining discipline during declining markets prevents small losses from becoming devastating to overall portfolio performance.

Psychological and Behavioral Considerations

Emotional management represents a critical component of successful Pump.fun investing. The platform’s high volatility and speculative nature create intense psychological pressures that can lead to poor decision-making. Developing emotional discipline and systematic approaches helps maintain objectivity.

FOMO (Fear of Missing Out) drives many poor investment decisions in meme coin markets. Understanding this psychological tendency and implementing systematic decision-making processes helps avoid impulsive investments that typically result in losses.

Confirmation bias affects investment analysis and decision-making. Seeking contradictory information and maintaining objective analysis helps identify potential problems before they impact investment performance significantly.

Advanced Trading Techniques and Tools

Automated Trading Systems

Developing automated trading systems can improve execution speed and remove emotional bias from investment decisions. These systems can monitor multiple tokens simultaneously, execute trades based on predefined criteria, and manage risk automatically.

Bot-assisted trading provides advantages in fast-moving markets where manual execution may be too slow. However, these tools require careful development and testing to ensure they perform as expected during various market conditions.

API integration enables sophisticated trading strategies that leverage real-time market data and automated execution. Understanding technical requirements and risk management protocols is essential for successful automation implementation.

Analytics and Monitoring Tools

Comprehensive analytics tools help identify market trends, track token performance, and monitor portfolio health. These tools provide insights that manual analysis might miss, improving overall investment decision-making quality.

Real-time monitoring systems alert investors to significant market movements, new opportunities, and potential risks. These systems enable rapid response to changing market conditions and help capture time-sensitive opportunities.

Performance tracking tools measure investment success across multiple metrics, helping identify strengths and weaknesses in your investment approach. Regular analysis of these metrics enables continuous strategy improvement and optimization.

Market Making and Liquidity Provision

Advanced investors can profit from providing liquidity and market making services within the Pump.fun ecosystem. These strategies require significant capital and sophisticated risk management but can generate consistent returns in volatile markets.

Spread capture strategies involve buying at bid prices and selling at ask prices, capturing the difference as profit. This approach requires careful risk management and deep understanding of market microstructure.

Arbitrage opportunities exist between Pump.fun and other exchanges, particularly during token graduations. These opportunities require quick execution and sophisticated monitoring systems to identify and capture profits.

Long-Term Investment Approaches

Ecosystem Development and Growth

Understanding Pump.fun’s long-term development roadmap helps identify investment opportunities that align with platform growth. As the ecosystem expands, certain tokens and strategies may become more valuable and profitable.

Platform upgrades and new features create opportunities for early adopters who understand their implications. Staying informed about development progress helps position investments to benefit from ecosystem improvements.

Market maturation trends suggest that successful tokens will increasingly require genuine utility and community support. Adjusting investment strategies to focus on these factors helps prepare for evolving market conditions.

Sustainable Investment Practices

Developing sustainable investment practices ensures long-term success in the Pump.fun ecosystem. This includes maintaining proper risk management, continuous learning, and adaptation to changing market conditions.

Environmental and social considerations increasingly impact investment decisions. Understanding these factors helps identify tokens with better long-term prospects and alignment with evolving investor preferences.

Regulatory compliance becomes increasingly important as the market matures. Maintaining awareness of legal requirements and best practices helps avoid potential issues and maintains sustainable investment approaches.

Building Your Pump.fun Investment Portfolio

Strategic Asset Allocation

Developing appropriate asset allocation strategies helps balance risk and reward across your Pump.fun investments. Consider factors including risk tolerance, investment timeline, and overall portfolio objectives when determining allocation percentages.

Sector diversification within meme coins helps reduce concentration risk while maintaining exposure to different themes and trends. Understanding various meme categories and their typical performance patterns improves allocation decisions.

Geographic and temporal diversification helps reduce exposure to specific market conditions or regional preferences. Spreading investments across different periods and cultural contexts improves overall portfolio resilience.

Performance Monitoring and Optimization

Regular performance monitoring enables continuous improvement of your investment strategy. Tracking key metrics, analyzing successes and failures, and adjusting approaches based on results helps optimize long-term performance.

Benchmarking against relevant indices and peer performance helps evaluate investment effectiveness. Understanding relative performance provides insights into strategy strengths and areas for improvement.

Continuous learning and adaptation ensure your investment approach remains effective as market conditions evolve. Staying informed about new developments, strategies, and tools helps maintain competitive advantages.

Market Timing and Cyclical Strategies

Understanding Market Cycles

Pump.fun markets experience distinct cyclical patterns that create opportunities for strategic investors. Understanding these cycles helps time entries and exits for optimal performance while avoiding periods of excessive risk.

Seasonal patterns in meme coin interest create predictable opportunities for prepared investors. Monitoring these patterns and adjusting strategies accordingly helps improve timing and performance outcomes.

Macroeconomic factors influence meme coin markets through their impact on risk appetite and speculative investing. Understanding these relationships helps anticipate market movements and adjust strategies appropriately.

Entry and Exit Strategies

Developing systematic entry and exit strategies removes emotional bias and improves investment outcomes. These strategies should account for Pump.fun’s unique mechanics while maintaining flexibility for changing market conditions.

Dollar-cost averaging strategies help reduce timing risk while building positions gradually. This approach works particularly well for tokens with strong fundamentals and long-term potential.

Profit-taking strategies ensure you capture gains from successful investments while maintaining exposure to continued upside. Systematic approaches help overcome emotional decision-making and improve long-term returns.

Conclusion

This comprehensive Pump.fun token investment strategy guide provides the essential framework for building a successful investment approach in the dynamic world of meme coin trading. Success requires combining technical analysis, risk management, community engagement, and strategic thinking to navigate the platform’s unique opportunities and challenges.

The key to long-term success lies in developing systematic approaches that remove emotional bias while maintaining flexibility for changing market conditions. By implementing proper risk management, diversification strategies, and continuous learning practices, investors can build sustainable approaches that capitalize on Pump.fun’s growth potential.

Remember that meme coin investing involves significant risks, and past performance doesn’t guarantee future results. However, with proper preparation, strategic thinking, and disciplined execution, investors can build profitable portfolios while managing downside risk effectively.

FAQs

Q1. What is the best investment strategy for Pump.fun tokens?

The most effective strategy combines early detection, proper risk management, and systematic profit-taking. Focus on tokens with strong communities, viral potential, and professional branding while never risking more than 1-2% of your portfolio on any single token. Use technical analysis for timing and maintain disciplined exit strategies.

Q2. How much should I invest in Pump.fun tokens?

Limit your total Pump.fun exposure to 5-10% of your cryptocurrency portfolio, with individual token positions never exceeding 1-2% of your total portfolio. This approach balances growth potential with risk management, ensuring that losses from unsuccessful investments don’t significantly impact your overall financial health.

Q3. What are the main risks of investing in Pump.fun tokens?

Primary risks include extreme volatility, liquidity constraints, smart contract vulnerabilities, regulatory uncertainty, and the speculative nature of meme coins. Many tokens fail to maintain value after initial pumps, and the platform’s experimental nature creates additional technical and operational risks.

Q4. How do I identify promising Pump.fun tokens early?

Monitor social media trends, analyse community engagement metrics, evaluate branding quality, and track launch timing patterns. Look for tokens with organic growth, professional presentation, and cultural relevance. Avoid tokens with obvious bot activity or manufactured engagement.

Q5. What tools do I need for a successful Pump.fun investing?

Essential tools include portfolio tracking software, social media monitoring systems, technical analysis platforms, and automated alert systems. Consider using trading bots for execution speed and analytics tools for performance tracking. Always maintain proper security measures and backup systems.