Saros Finance DLMM v3: Revolutionizing DeFi with Flexibility

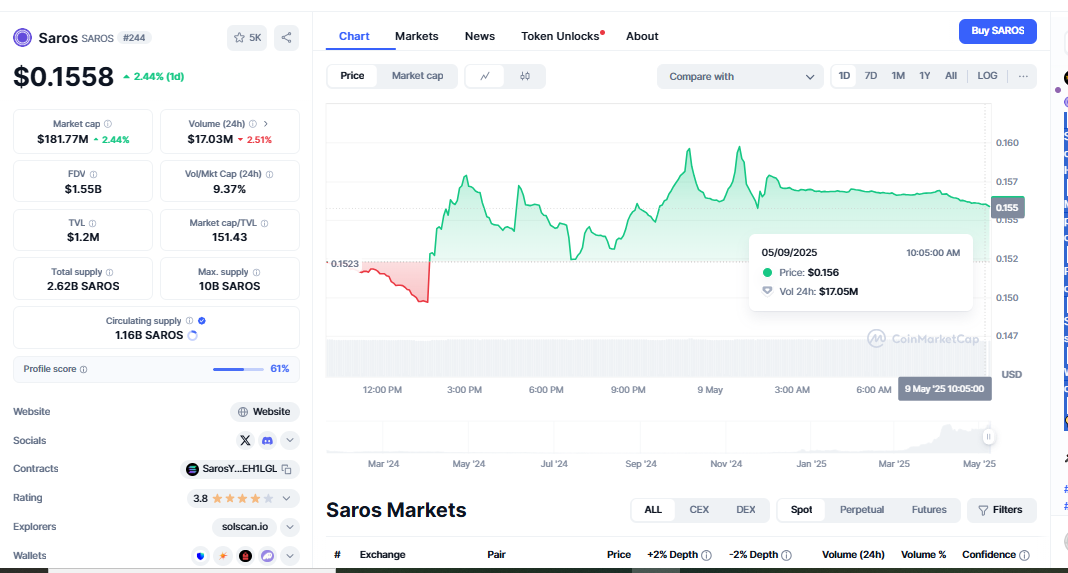

With its Dynamic Liquidity Market Maker (DLMM) v3 release, Saros Finance has advanced boldly in distributed finance (DeFi). Offering an enhanced experience in flexibility, reliability, and scalability, this most recent update promises to solve some of the fundamental problems experienced by traders and liquidity providers in the DeFi space. With the SAROS token making notable progress—up 16% this week—it’s evident. This creative update is already attracting interest and changing the DeFi ecosystem.

DLMM v3 Unlocks Liquidity Flexibility

The release of DLMM v3 represents a significant change in Saros Finance’s liquidity strategy. The most beneficial aspect of DLMM v3 for liquidity providers is its capacity to maximise returns through dynamic changes. Liquidity providers used to be limited to strict policies, but with DLMM v3. They now have the freedom to customise their liquidity distribution to fit changing market conditions. Maximising income depends on this adaptability, particularly in a market as erratic and volatile as DeFi.

The new approach helps liquidity providers better modify their tactics based on real-time data and trends, enabling them to make wise decisions to significantly increase their potential rewards. Providers can reduce slippage by maximising the distribution of liquidity throughout. The several price ranges capture more trading activity and generate more fees.

Forecasting Stable Trade Using DLMM v3

A more stable trading experience is one of the main improvements that DLMM v3 brings. One of the most challenging issues in the DeFi industry has been the erratic character of price swings, particularly in significant trades or market changes. These price swings often cause slippage—that is, the change in the price a trader expects to pay or receive throughout the execution of their order.

Reducing price volatility and guaranteeing more consistent price movements help DLMM v3 squarely address this issue. This improves consumers’ whole trading experience and liquidity providers. Reducing the possibility of slippage would help traders enter and leave positions more confidently, ensuring that their trades will be carried out at prices closer to their expectations.

This makes Saros Finance a far more appealing platform for traders. It allows them to use a more consistent, smoother trading environment, which helps to reduce one of the main drawbacks in DeFi markets.

DLMM v3: Ready for Growth

Still another area where DLMM v3 excels is scalability. DeFi platforms’ expansion and the addition of more users mean that handling increasing transaction volumes without sacrificing speed becomes crucial. Conventional liquidity models can find it difficult to match spikes in activity, which might cause delays, failed transactions, or even price inefficiencies.

Saros Finance has tackled this difficulty by ensuring DLMM v3 can scale effortlessly and manage more transactions with negligible latency. The platform’s infrastructure is meant to control projected surges in trading volume and increased market activity. As the DeFi market keeps expanding, this scalability guarantees Saros Finance’s capacity to offer a dependable and quick trading environment.

This is especially crucial given the increasing number of institutional and retail investors pouring into DeFi. Maintaining the larger DeFi ecosystem functional and accessible will depend critically on platforms like Saros Finance, which can manage large transaction volumes and preserve a smooth user experience.

SAROS Token on the Rise

The market performance of the SAROS token is another sign that Saros Finance is on the right track. The token has witnessed a 16% rise in just one week, signifying investor confidence in the platform’s direction and promise-delivery capacity. The changes implemented with DLMM v3 help explain some of this increase since traders and liquidity providers swarm the platform to benefit from its improved features.

The Saros Finance ecosystem is changing, so the SAROS token will probably expand more as well. Investors are increasingly seeking DeFi platforms with actual value, so Saros Finance’s developments in liquidity management and scalability help it be a successful competitor in this field.

DLMM v3: Shaping the Future of DeFi

One instance of how the DeFi scene constantly changes is Saros Finance’s release of DLMM v3. Platforms like Saros Finance are defining what is to come. They pay increasing attention to enhancing liquidity provision, lowering volatility, and guaranteeing scalability. Although the DeFi sector is still in its early years, ideas like DLMM v3 are helping to define distributed finance going forward.

DeFi seems bright as Saros Finance keeps broadening its products and drawing fresh users. Improved trading conditions, liquidity management tools, and seamless scalability will guarantee Saros Finance stays at the forefront of this fast-changing field.

Conclusion

The release of DLMM v3 and the subsequent expansion of the SAROS token indicate. Saros Finance is progressively playing a significant role in the DeFi network. The clear benefits for traders and liquidity providers are more freedom, consistent trading, and scalability. Platforms like Saros Finance that offer creative ideas will flourish as the DeFi sector expands. Saros Finance is the DeFi platform you should search for if you want one that will enable you to maximise returns and negotiate the complexity of liquidity supply.