Solana Eyes $160 Breakout on Bullish Momentum and DeFi Surge

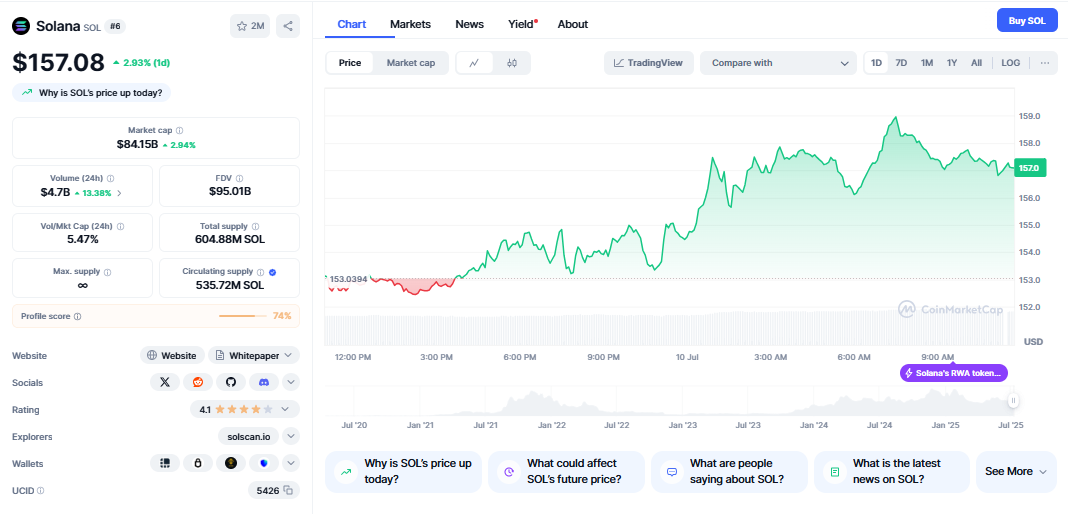

Solana has captured significant market attention with its recent price surge toward the $160 resistance level, marking a crucial technical milestone for the blockchain network. The live Solana price prediction is USD 158.66 with a 24-hour trading volume of USD 4,916,493,438.92, demonstrating substantial trading activity as investors position themselves around this critical price point.

Solana is trading at $153.01, attempting to break above the 100-day EMA ($156.51) and 200-day EMA ($159.04), which represent significant technical resistance levels that have historically influenced price movements. The confluence of these moving averages around the $160 level creates a technical battleground where bullish momentum faces its most significant test.

The technical chart on the weekly time frame shows a bullish engulfing pattern, which suggests a strong momentum favouring buyers. This candlestick pattern indicates that Solana is ready to continue its uptrend after nearly two weeks of correction and sideways movement. This pattern formation provides fundamental support for the bullish thesis while highlighting the importance of maintaining current price levels.

Algorithmic Price Predictions

Professional analysts and algorithmic trading systems have provided optimistic forecasts for Solana’s near-term performance. Based on our algorithmically generated price prediction for Solana, the price of SOL is expected to increase by 5.93% in the next month and reach $160.06 on Aug 8, 2025. Additionally, Solana’s price is forecasted to gain 23.12% in the next six months and reach $186.03 on Jan 5, 2026.

Our Solana forecast says it’s good to buy Solana right now. On July 3, 2025, almost all technical analysis indicators signalled bullish signals, while other indicators signalled bearish signals, indicating a general Bullish sentiment among Solana price predictions. This mixed but predominantly bullish sentiment reflects the complexity of current market conditions, where technical indicators suggest potential upside despite broader market uncertainties.

The convergence of multiple technical indicators around the $160 level creates a significant decision point for market participants. Breaking above this resistance could trigger algorithmic buy signals and momentum-driven purchases, potentially accelerating price appreciation toward higher targets.

DeFi Ecosystem Growth

Solana’s decentralised finance ecosystem has experienced remarkable growth, providing fundamental support for price appreciation beyond technical analysis. Solana’s DeFi TVL hit $17.5B, led by new protocols like JTO, KMNO, and Jupiter. Retail users and yield farmers (not institutions) are driving Solana’s ecosystem expansion, indicating organic growth rather than speculative institutional flows.

This substantial total value locked represents a significant milestone for the Solana ecosystem, demonstrating real utility and adoption that extends beyond speculative trading. The retail-driven nature of this growth suggests sustainable demand for Solana-based applications and services, creating a foundation for long-term price appreciation.

The emergence of new protocols and increasing activity within the DeFi space indicate continued innovation and development on the Solana blockchain. This ecosystem expansion provides multiple value propositions for SOL token holders, including staking rewards, governance participation, and transaction fee benefits.

Institutional Interest and ETF Developments

The $585 million staking unlock could lead to sell-offs, undermining the ETF’s price-supporting effect. Historical data shows large unlocks often trigger 10-20% price drops in altcoins. While the ETF is structured to comply with current laws, evolving SEC policies on crypto staking could impact future market dynamics.

The introduction of Solana ETF products represents a significant development for institutional adoption and mainstream investment access. However, the timing of staking unlocks creates potential short-term selling pressure that could temporarily offset ETF-driven demand. Understanding these dynamics becomes crucial for investors analysing the $160 resistance level.

Institutional interest in Solana reflects growing recognition of its technical capabilities and ecosystem development. The blockchain’s high throughput, low transaction costs, and growing developer community have attracted attention from traditional financial institutions seeking exposure to next-generation blockchain technology.

Technical Analysis and Price Targets

Technical analysts identify a bull flag pattern on the daily chart, suggesting potential for a rally toward $300 in the near term. This pattern typically indicates continuation of the previous uptrend after a brief consolidation. The formation of this bullish pattern provides additional technical support for the case that SOL can break above the $160 resistance level.

Institutional interest, rising network activity, and bullish technical patterns provide a strong foundation for potential price appreciation. However, the cryptocurrency market’s volatility and external economic factors introduce uncertainties that could impact SOL’s performance. This analysis acknowledges both the bullish technical setup and the inherent risks associated with cryptocurrency investments.

The $160 level represents more than just a psychological barrier; it coincides with significant technical resistance that has historically influenced Solana’s price movements. A decisive break above this level could trigger momentum-driven buying and algorithmic trading strategies programmed to capitalise on technical breakouts.

Fundamental Drivers and Network Activity

In July, CME Solana futures crossed $4B in volume, and RWAs on Solana surged to $418M with 631% user growth in 30 days. If momentum holds, the SOL price could target $200–$240 by Q4 2025. These fundamental metrics demonstrate increasing institutional interest and real-world asset tokenisation on the Solana blockchain.

The surge in futures trading volume indicates growing institutional participation and sophisticated trading strategies around Solana. This increased liquidity and market depth provide additional support for price discovery and reduce the impact of large trades on market volatility.

Real-world asset tokenisation represents a significant growth driver for blockchain adoption, as traditional financial instruments increasingly migrate to digital platforms. Solana’s technical capabilities make it an attractive platform for these applications, creating sustainable demand for network usage and SOL tokens.

Price Projections and Growth Scenarios

According to the technical analysis of prices expected in 2025, the minimum cost of will be $151.97. The maximum level that the SOL price can reach is $157.34, though these conservative projections may not fully account for the recent momentum and ecosystem developments driving current price action.

More optimistic scenarios suggest significantly higher price targets based on continued ecosystem growth and institutional adoption. In the first half of 2025, the Solana price will climb to $261; in the second half, the price will add $59 and close the year at $320, which is +92% of the current price. These projections reflect the potential for substantial appreciation if current growth trends continue.

The wide range of price predictions reflects the inherent uncertainty in cryptocurrency markets. However, technical analysis, fundamental developments, and market sentiment all contribute to price discovery. The $160 level serves as a critical test of market confidence in Solana’s long-term value proposition.

Network Scalability and Technological Advantages

Fast. Decentralised. Scalable. Energy efficient. Solana can power thousands of transactions per second, providing technological advantages that support its position as a leading blockchain platform. These technical capabilities create sustainable competitive advantages that justify higher valuations compared to less scalable alternatives.

The blockchain’s ability to process high transaction volumes at low costs makes it attractive for applications requiring frequent interactions, including DeFi protocols, gaming platforms, and micropayment systems. This utility creates organic demand for SOL tokens beyond speculative trading.

Solana’s energy efficiency compared to proof-of-work blockchains addresses environmental concerns that increasingly influence institutional investment decisions. This technological advantage positions Solana favourably for long-term adoption as environmental, social, and governance (ESG) factors become more important in investment analysis.

Trading Volume and Market Liquidity

The substantial trading volume accompanying Solana’s approach to $160 indicates strong market interest and provides liquidity for both buyers and sellers. High trading volumes typically support price movements by reducing the impact of large trades and facilitating efficient price discovery.

Market liquidity becomes particularly important during periods of high volatility, as adequate liquidity helps prevent excessive price swings and provides stability for investors seeking to enter or exit positions. The current trading volume levels suggest sufficient market depth to support continued price appreciation.

Increased liquidity also attracts institutional investors who require the ability to execute large trades without significantly impacting market prices. This institutional participation can provide additional stability and support for higher price levels.

Summary

The continuous development of applications and services within the Solana ecosystem provides fundamental support for token valuation. However, New partnerships, protocol launches, and technological improvements create positive catalysts that can drive price appreciation beyond technical analysis.

Recent developments in the Solana ecosystem, including the growth of DeFi protocols and the emergence of new use cases, demonstrate the platform’s evolution from a technical experiment to a mature blockchain ecosystem. This maturation process supports higher valuations and increased investor confidence.

The network’s ability to attract developers and entrepreneurs indicates long-term sustainability and growth potential. However, a thriving developer community creates continuous innovation and improvement, providing ongoing value creation for SOL token holders.