Solana ($SOL) Breakout: Bullish Surge and Network Growth

Solana ($SOL), often known as the “Ethereum killer”, is one of the most active and fastest blockchain networks in the world of cryptocurrencies. Due to its speed, low transaction fees, and extensive ecosystem of decentralised apps (dApps), Solana Breakout has maintained its momentum and surpassed Layer 1 competitors in daily active addresses and on-chain transactions. This rise indicates that a significant number of people are using it, developers are interested, and investors are confident, rather than simply guessing.

Technical analysis has supported SOL’s bullish breakout over the last few weeks, which has helped it continue its upward trend. Individual and institutional traders have been warned by a breakout from a descending triangle pattern and rising momentum indicators. $ASRR: Solana’s AI Utility is gaining the attention of the crypto community again because resistance has been converted into support, and new price targets are within reach.

Technical Analysis of $SOL Breakout

Solana broke out of a descending triangle pattern, which indicates that it will continue to decline, but once it breaks, it will start to rise. Technical traders use a yellow circle on the price chart to indicate that the breakout’s powerful bullish candle is genuine.

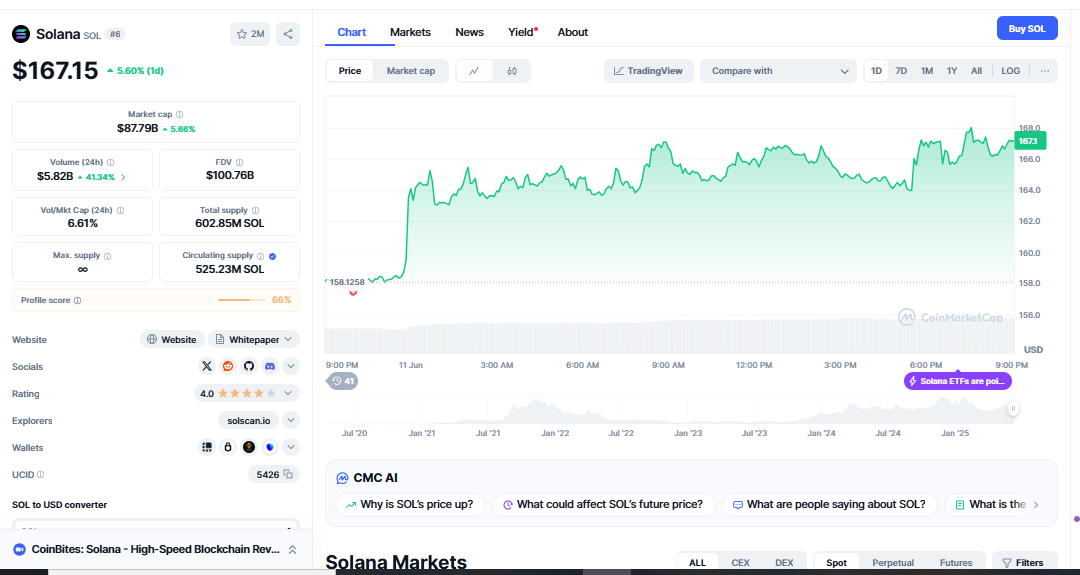

This breakout is significant because the price has broken through resistance levels at $159.95 and $164.53. These levels used to be price ceilings, but now they are support. This beneficial change in structure makes it more likely that momentum is based on facts rather than speculation.

Supporting signs make this view stronger. The RSI is 63.51, indicating that the market is strong but not overly overbought. This allows prices to continue rising, especially for those in the market, such as Solana.

Solana has the most daily active addresses

Solana’s strength extends beyond chart patterns and technical signals; it also encompasses on-chain activity. Artemis and Messari’s most recent data suggest that Solana has more daily active addresses and transactions than any other Layer 1 chain, including Ethereum, Binance Smart Chain, and Avalanche.

This increase is planned. With its unique Proof of History (PoH) and Proof of Stake (PoS) systems, Solana can handle more than 65,000 transactions per second with little delay. It allows you to do a variety of things, such as interacting with high-frequency DeFi protocols and quickly minting NFTs, for almost no cost.

Solana has attracted developers and users due to partnerships with Jupiter Exchange, Marinade Finance, and Magic Eden. Solana’s relationships with Coinbase, Binance, and Circle for USDC payments have enabled it to reach more traditional banking and business applications.

Next, we’ll look at $SOL resistance targets.

As Solana strengthens, traders are eyeing $180.86 and $187.27 as potential levels of resistance. Price goals are big psychological and technological challenges. If they break, Solana might go back to the $200 range, which it last saw in 2021.

According to IntoTheBlock’s on-chain data, a significant amount of SOL was purchased between $160 and $170. The price is breaking out above this level because whale accumulation is increasing and exchange inflows are decreasing. It could hit $180 or higher.

The way people feel about the market is changing. The rise in open interest in SOL perpetual contracts with derivatives indicates that institutions are actively involved. Funding rates that are neutral to slightly positive indicate. That long positions are healthy and that no excessive leverage is being used.

Growth and Innovation by Developers

Solana is superior to the competition because it is technically sound and boasts a large developer community. Thanks to developer financing from Anchor Framework and Solana Labs, this network features hundreds of new applications. Saga Phone and Solana Mobile Stack (SMS) demonstrate how mobile-first crypto is transitioning from internet wallets to real-life applications.

Solana’s zk-rollup compatibility and development towards stronger validator decentralisation, using Jump Crypto’s Firedancer, demonstrate its commitment to becoming scalable and robust. These improvements make Solana a stronger candidate for a fast chain and a long-lasting blockchain.

SOL vs. Other Layer 1 Chains

Solana differs from Ethereum in that it has high gas fees and long block times. BNB Chain because it is too centralised. Solana finds a good balance between scalability, decentralisation, and security. Ethereum leads in terms of total value locked (TVL) and institutional adoption. But Solana is catching up in terms of user engagement and transaction volume.

Avalanche and Fantom, on the other hand, have used incentives and yield farming to keep users active. Solana Breakout Signals organic growth appears to be driven by games (such as Star Atlas), NFTs and decentralised social networks like Dialect and Helium.