Solana Surpasses Ethereum in DeFi Fees, Signals Bullish Reversal

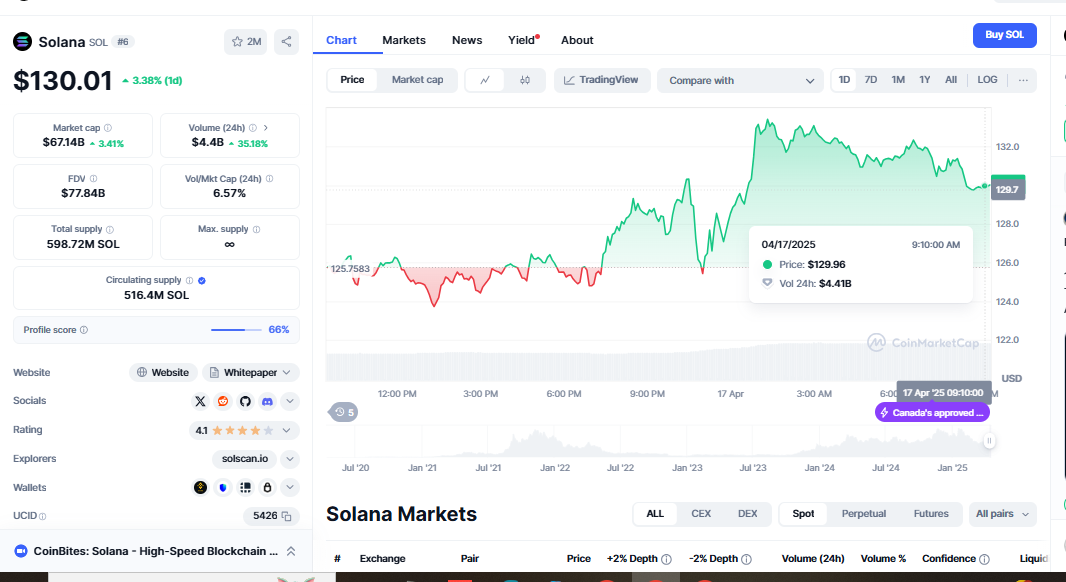

Solana (SOL) is getting better after a rough first quarter. Rising above many other top-tier cryptocurrencies, the asset’s value grew more than 20% this week, surpassing $130. Today, the trading coin Solana is priced at $130. More importantly, Solana surpasses Ethereum regarding on-chain underpinnings and technical price movement.

Solana Surpasses Ethereum in Lifetime DeFi Fees

One of the most significant developments this week is Solana overtaking Ethereum in cumulative DeFi transaction fees. Solana is leading in this crucial metric for the first time since both ecosystems launched.

Here’s a breakdown of total lifetime DeFi fees:

-

Solana: $2.56 billion

-

Ethereum: $2.27 billion

This shift reflects a growing trend in on-chain activity for Solana. Developers are building, users are engaging, and more DeFi value is transacted on Solana than ever.

Technical Breakout in SOL/ETH Shows Relative Power

Solana’s SOL/ETH trading pair has broken out against Ethereum, apart from the basic fee statistics. Given this breach above a critical resistance level, Solana is starting to show more vigor than Ethereum. Technically, this is a severe warning, especially for investors who use cross-pair analysis to track money flow across Layer 1 assets.

This is more than just a passing cost increase. Solana Price Growth, It exposes a change in market attitude as well as portfolio distribution. Solana’s speed and efficiency attract customers’ and institutions’ interest as Ethereum keeps running against high pricing and increasing costs.

The Harsh Reality of Q1: A Setup for the Recovery

Her recent turnaround really stands out when you think about how horrible Solana’s first quarter of 2025 was. SOL plummeted more than thirty percent on the market and sold for less than $100 billion. The network noted a wave of “whales sell-offs,” in which large token holders pulled money from their positions.

Questions regarding Solana’s credibility and ability to keep up with the growth of Ethereum Layer 2 groups raised pressure. Everyone lost faith, and many wondered if Solana would be relevant in an industry changing quickly. This makes the current comeback not just remarkable but also vital.

Strong On-Chain Recovery in Q2

We are in Q2, and Solana’s on-chain prospects have sharply slumped. With a Total Value Locked (TVL) of $8.54 billion, the network amply demonstrates how money flows back into systems based on Solana. Buying by long-term holders once more shows that people are becoming more hopeful about Solana’s medium- to long-term future.

Aolana is in more than six months going through its most extended current growth phase. People usually understand this tendency as proof of faster price increases, especially when paired with significant macro movements and better technical signs.

Retail Activity Remains Subdued

Although Solana has good foundations and a positive breakout, retail interest is currently low. On-chain data shows that, compared to preceding years, there are the lowest new wallets generated in six months. While this could initially seem like a conundrum, it could offer a chance.

When retail consumers re-entered the market, prices moved faster historically. Already on the market are institutional capital and devoutly believing investors. Those returning individual investors might produce more significant, more long-lasting breakouts.

A Structural Reaccumulation Phase in Motion

The market’s current status suggests Solana is in a fundamental reaccumulating phase. These phases indicate calm accumulation, reduced volatility, and stronger foundations. Usually, they come before essential occurrences. Long-term investors often grab these chances by joining businesses before the general mood swings.

Solana returned from a challenging first quarter and grabbed leadership in DeFi fees. This displays the ecological resilience instead of only a bounce. The network has consistently attracted new users, programmers, and money, hence it is valuable even after the hype cycles of the last few years.

Summary

The cost seems to be constantly growing compared to where Solana is. Early signs of fresh money arriving, firm foundations, and a breakthrough versus Ethereum indicate a scene geared toward growth. Still, there is volatility, so buyers should know how to control risk.

The next measure could depend on when private investors return with more proof of shifting market conditions. Still, Solana’s most recent performance shows that conviction is resurfacing, coupled with a new sense of forward motion.