Spark Price Prediction 2025, 2026-2030 Expert SPK Analysis

The cryptocurrency market’s attention has increasingly turned toward innovative DeFi protocols, making Spark Price Prediction 2025, 2026-2030 a crucial topic for investors seeking the next breakthrough opportunity. Spark (SPK) has emerged as a compelling investment proposition, combining cutting-edge DeFi infrastructure with robust tokenomics that could drive substantial price appreciation over the coming years.

Understanding Spark Price Prediction 2025, 2026-2030 requires examining the protocol’s unique position in the rapidly evolving decentralized finance landscape. As a comprehensive DeFi infrastructure protocol managing over $3.5 billion in stablecoin liquidity across six blockchain networks, Spark addresses core industry challenges including fragmented liquidity, unstable yields, and underutilized stablecoin reserves.

The Spark Price Prediction 2025, 2026-2030 analysis reveals compelling growth potential driven by increasing DeFi adoption, protocol improvements, and expanding market integration. Current market forecasts suggest significant upside potential, with expert predictions ranging from conservative growth scenarios to explosive appreciation that could transform SPK into a major DeFi powerhouse.

Understanding Spark (SPK): The Foundation of Price Predictions

What is Spark Protocol?

SPK is the governance and staking token of Spark, a comprehensive DeFi infrastructure protocol managing over $3.5 billion in stablecoin liquidity across six blockchain networks. The protocol solves critical DeFi problems including fragmented liquidity, unstable yields, and underutilized stablecoin assets through innovative technological solutions.

SPK is the native governance and staking token of Spark. Designed with a long-term vision for sustainability, decentralization, and ecosystem alignment, SPK enables protocol governance, protocol security via staking, and reward distribution to participants. This utility-focused approach provides fundamental value that supports long-term price appreciation.

Core Technology and Market Position

The Spark protocol operates across multiple blockchain networks, creating a unified DeFi infrastructure that optimizes capital allocation and yield generation. This multi-chain approach positions SPK uniquely in the competitive DeFi landscape, providing diversification benefits and reducing single-chain risks.

The protocol’s focus on real-world asset integration and stablecoin optimization addresses growing institutional demand for DeFi solutions. This institutional appeal could become a significant driver in the Spark Price Prediction 2025, 2026-2030 as traditional finance increasingly embraces decentralized protocols.

Spark Price Prediction 2025, 2026-2030: Expert Analysis and Forecasts

Short-Term Price Predictions for 2025

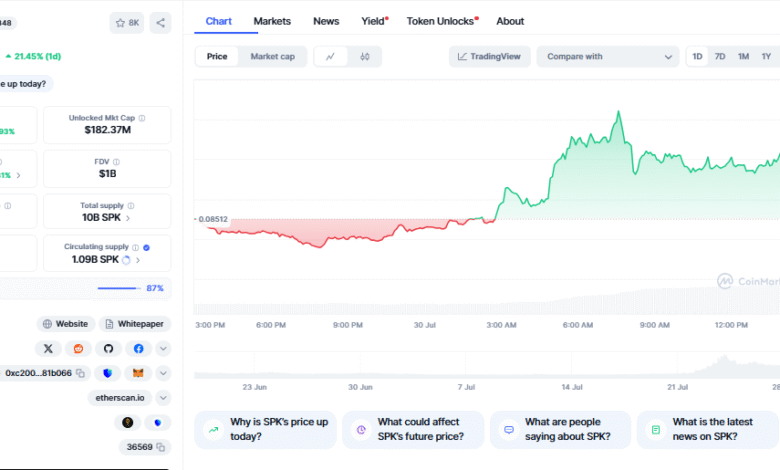

Market forecasts predict that Spark will hit the price target of 0.1250816 in 2025, representing substantial growth from current levels. Bullish SPK price prediction for 2025 is $0.125064 to $0.257955, indicating strong potential for investors positioning early in the cycle.

The wide range in 2025 predictions reflects the inherent volatility in cryptocurrency markets and the emerging nature of the Spark protocol. Conservative estimates suggest modest growth, while bullish scenarios anticipate significant protocol adoption and market expansion driving higher valuations.

Long-term price prospects diverge: Estimates vary from $0.089 to $0.30 by 2025, with the variance reflecting different assumptions about market conditions, adoption rates, and competitive positioning. These predictions establish a baseline for understanding potential investment returns.

Medium-Term Outlook: 2026-2027 Forecasts

Based on your prediction that Spark will change at a rate of 5% every year, the price of Spark would be $0.10 in 2026, though this conservative estimate may underestimate the protocol’s growth potential given its expanding ecosystem and utility.

Technical analysis suggests 2026-2027 could represent a critical inflection point for SPK price appreciation. Protocol maturation, increased institutional adoption, and enhanced utility could drive valuations beyond linear growth models. The Spark Price Prediction 2025, 2026-2030 analysis indicates this period may witness accelerated growth as the protocol reaches critical mass.

Market dynamics during 2026-2027 will likely be influenced by broader DeFi sector growth, regulatory clarity, and institutional cryptocurrency adoption. These macroeconomic factors could significantly impact the realized price performance compared to current predictions.

Long-Term Projections: 2028-2030

2030 forecasts range from $0.25 to as high as $0.74, with speculative goals of $1–$3 in the event of creator economy integration and widespread adoption. These ambitious targets reflect the protocol’s potential to capture significant market share in the expanding DeFi ecosystem.

The higher-end predictions for 2030 assume successful integration with emerging trends like the creator economy, NFT marketplaces, and next-generation DeFi applications. Such integration could exponentially increase SPK demand and utility, justifying premium valuations.

Conservative scenarios for 2030 still project meaningful appreciation, with $0.13 in 2030 representing steady growth from current levels. Even these modest projections suggest SPK could outperform many traditional investments over the forecast period.

Technical Analysis for Spark Price Predictions

Chart Patterns and Technical Indicators

Spark has flipped from an extended bearish structure into a powerful upside breakout, resetting its multi-year price structure. As technicals strengthen and key volume signals support the move, the outlook for SPK into 2030 appears constructive. This technical transformation provides strong foundation for bullish price predictions.

Current technical indicators suggest SPK has established a new base level following recent market volatility. The protocol’s ability to maintain support levels during broader market corrections demonstrates underlying strength that could drive future appreciation.

Volume analysis reveals increasing institutional and retail interest in SPK, with trading patterns suggesting accumulation by long-term holders. This accumulation behavior typically precedes significant price movements and supports optimistic Spark Price Prediction 2025, 2026-2030 scenarios.

Market Sentiment and Momentum

Per our technical indicators, the current sentiment is Bearish while the Fear & Greed Index is showing 74 (Greed), indicating mixed signals that could present buying opportunities for contrarian investors. Market sentiment often lags fundamental developments, suggesting current pessimism may not reflect the protocol’s true potential.

The disconnect between technical sentiment and greed indicators suggests market participants are unsure about short-term direction but remain optimistic about long-term potential. This uncertainty often precedes significant price movements as consensus builds around fundamental value.

Fundamental Analysis Supporting Price Predictions

Protocol Growth and Adoption Metrics

Spark’s impressive management of over $3.5 billion in stablecoin liquidity demonstrates real utility and market demand for the protocol’s services. This substantial liquidity base provides revenue streams that support token value and fund protocol development.

The multi-chain deployment strategy positions Spark to benefit from growth across different blockchain ecosystems. As individual chains experience adoption waves, Spark can capture value from multiple sources, diversifying risk and maximizing growth opportunities.

User adoption metrics show steady growth in protocol interaction, with increasing numbers of addresses participating in governance and staking activities. This growing user base creates network effects that typically accelerate as protocols approach critical mass.

Competitive Landscape Analysis

Spark’s focus on stablecoin optimization and real-world asset integration differentiates it from purely speculative DeFi protocols. This practical approach appeals to institutional users seeking stable, predictable returns rather than high-risk, high-reward speculation.

The protocol competes primarily with other DeFi infrastructure projects, but its comprehensive approach and multi-chain strategy provide competitive advantages. Few competitors offer similar breadth of services combined with the scale of liquidity management.

Regulatory compliance and transparency initiatives position Spark favorably compared to more anonymous or compliance-resistant protocols. As regulations evolve, compliant protocols may capture market share from less cooperative competitors.

Market Drivers Influencing Spark Price Predictions

DeFi Sector Growth Trends

The broader DeFi sector continues expanding, with total value locked approaching all-time highs across multiple protocols and chains. This sector growth creates a rising tide that benefits well-positioned protocols like Spark.

Institutional DeFi adoption accelerates as traditional financial institutions explore yield generation and capital efficiency opportunities. Spark’s focus on stablecoin management and risk mitigation appeals directly to institutional requirements.

Cross-chain interoperability becomes increasingly important as the multi-chain ecosystem matures. Spark’s multi-chain presence positions it to benefit from this trend, potentially capturing value from protocol bridges and cross-chain activities.

Regulatory Environment Impact

Regulatory clarity in major markets could significantly boost institutional DeFi adoption, benefiting protocols with strong compliance frameworks. Spark’s transparent governance and operational approach align with emerging regulatory expectations.

Stablecoin regulation may actually benefit protocols like Spark that provide infrastructure for compliant stablecoin operations. Regulatory requirements could eliminate competitors while strengthening compliant protocols’ market positions.

The evolution of cryptocurrency taxation and accounting standards will likely favor protocols with clear utility and transparent operations. Spark’s governance token model provides clearer tax treatment compared to more speculative cryptocurrency projects.

Risk Factors and Potential Challenges

Technology and Security Risks

Smart contract vulnerabilities remain a persistent risk for all DeFi protocols, including Spark. While the protocol has undergone audits, the complexity of multi-chain operations increases potential attack surfaces.

Blockchain network risks, including congestion, high fees, and potential hard forks, could impact Spark’s operations across its supported chains. Diversification across multiple chains mitigates but doesn’t eliminate these risks.

Competition from established protocols with greater resources and market recognition could limit Spark’s growth potential. Success requires continuous innovation and strategic partnerships to maintain competitive positioning.

Market and Economic Risks

Cryptocurrency market volatility could significantly impact SPK price regardless of fundamental developments. Bear markets have historically compressed valuations across all cryptocurrency projects, which could impact the Spark Price Prediction 2025, 2026-2030 scenarios.

Interest rate changes and macroeconomic conditions influence demand for yield-generating DeFi protocols. Rising traditional yields could reduce DeFi appeal, while economic uncertainty might increase demand for decentralized alternatives.

Regulatory crackdowns or unfavorable legislation could impact the entire DeFi sector, affecting Spark regardless of its compliance efforts. Regulatory risk remains elevated for all cryptocurrency and DeFi investments.

Investment Strategies for Spark (SPK)

Long-Term Accumulation Approach

Dollar-cost averaging into SPK positions allows investors to benefit from volatility while building exposure to the protocol’s long-term growth potential. This strategy aligns well with the Spark Price Prediction 2025, 2026-2030 timeframe.

Staking SPK tokens provides additional returns while supporting protocol security and governance. Staking rewards could enhance total returns beyond price appreciation alone, making long-term holding more attractive.

Portfolio allocation should consider SPK’s correlation with broader cryptocurrency markets and DeFi sector performance. Diversification across different cryptocurrency categories and traditional assets remains important for risk management.

Read More: Spark Price Prediction 2025, 2026-2030 Expert SPK Analysis

Active Trading Considerations

Short-term trading strategies require careful attention to technical indicators and market sentiment. SPK’s volatility creates opportunities for active traders, but also increases risk for unprepared participants.

News and development announcements can create significant price movements in SPK. Staying informed about protocol updates, partnerships, and industry developments helps inform trading decisions.

Risk management becomes crucial for active trading, with stop-losses and position sizing helping limit downside exposure. The Spark Price Prediction 2025, 2026-2030 provides context for long-term trends but doesn’t guarantee short-term performance.

Future Developments and Catalysts

Protocol Upgrades and Roadmap

Planned protocol improvements could significantly impact SPK valuation by enhancing utility and user experience. Upcoming developments should be monitored for their potential effect on price predictions.

Integration with additional blockchain networks could expand Spark’s addressable market and liquidity sources. Each new chain integration represents a potential catalyst for increased adoption and token demand.

Partnership announcements with major DeFi protocols or traditional financial institutions could accelerate adoption and validate the protocol’s approach. Strategic partnerships often trigger significant price movements in cryptocurrency markets.

Ecosystem Expansion Opportunities

Creator economy integration and widespread adoption represent significant growth opportunities that could drive SPK toward the higher end of price predictions. These use cases could dramatically expand the protocol’s addressable market.

Real-world asset tokenization continues gaining traction, potentially creating new opportunities for Spark’s infrastructure and services. This trend could provide additional revenue streams and token utility.

Institutional DeFi products and services represent a massive growth opportunity that aligns with Spark’s capabilities and positioning. Success in institutional markets could accelerate the Spark Price Prediction 2025, 2026-2030 timeline.

Comparative Analysis with Similar Protocols

Peer Protocol Performance

Comparing SPK’s performance and valuation metrics with similar DeFi infrastructure protocols provides context for price predictions. Leading protocols often trade at premium valuations that could represent upside potential for Spark.

Market capitalization analysis reveals SPK’s current positioning relative to competitors and potential room for growth. Protocols with similar utility and smaller market caps have historically achieved significant appreciation.

Token utility and governance features comparison shows Spark’s competitive positioning and potential advantages. Superior tokenomics and utility could justify premium valuations compared to less functional governance tokens.

Market Share and Growth Potential

The DeFi infrastructure market continues expanding, providing growth opportunities for well-positioned protocols like Spark. Market share gains could accelerate price appreciation beyond linear growth models.

Network effects in DeFi protocols create winner-take-most dynamics in specific niches. Spark’s early positioning in stablecoin infrastructure could result in disproportionate benefits from sector growth.

Conclusion

The Spark Price Prediction 2025, 2026-2030 analysis reveals compelling investment potential driven by strong fundamentals, real utility, and expanding market opportunities. With expert forecasts ranging from conservative growth to explosive appreciation reaching $1-$3, SPK represents one of the most interesting DeFi infrastructure plays for the coming decade.

The protocol’s management of over $3.5 billion in stablecoin liquidity, multi-chain deployment strategy, and focus on real-world asset integration position it uniquely in the competitive DeFi landscape. Technical analysis supports bullish sentiment, while fundamental developments continue strengthening the investment thesis.

FAQs

Q1: What are the most realistic Spark Price Prediction 2025, 2026-2030 targets?

A: Based on expert analysis, realistic SPK price targets range from $0.125-$0.258 for 2025, with 2030 projections between $0.25-$0.74. Conservative estimates suggest $0.10 by 2026 and $0.13 by 2030, while bullish scenarios project $1-$3 if creator economy integration succeeds. These predictions depend on protocol adoption and broader DeFi market growth.

Q2: What factors could drive SPK price higher than current predictions?

A: Key catalysts include successful creator economy integration, major institutional partnerships, additional blockchain network deployments, and significant increases in managed stablecoin liquidity. Regulatory clarity favoring compliant DeFi protocols and breakthrough innovations in real-world asset tokenization could also accelerate price appreciation beyond current forecasts.

Q3: How does Spark’s utility support long-term price predictions?

A: SPK serves as both a governance and staking token for a protocol managing over $3.5 billion in stablecoin liquidity across six blockchains. This real utility creates sustainable demand drivers including staking rewards, governance participation, and protocol fee sharing. The multi-chain infrastructure approach provides diversified revenue streams supporting token value.

Q4: What are the main risks to Spark price predictions through 2030?

A: Primary risks include smart contract vulnerabilities, increased competition from established DeFi protocols, regulatory restrictions on DeFi activities, and broader cryptocurrency market volatility. Technical risks from multi-chain operations, potential blockchain network issues, and changes in stablecoin regulations could also impact price performance negatively.

Q5: Should investors consider SPK for long-term portfolios based on these predictions?

A: SPK offers compelling long-term potential with price predictions showing consistent growth through 2030, though investments should be sized appropriately within diversified portfolios. The protocol’s real utility, substantial liquidity management, and multi-chain positioning provide fundamental value supporting price appreciation. However, cryptocurrency investments remain high-risk and require careful consideration of individual risk tolerance.