THENA Coin Price Prediction 2026-2030 Expert Analysis and Long-Term Forecast

The cryptocurrency market continues to evolve rapidly, with innovative projects like THENA capturing significant investor attention. For those seeking comprehensive insights into THENA coin price prediction 2026-2030, this detailed analysis provides expert forecasts, technical evaluations, and market projections. As decentralised finance (DeFi) platforms gain mainstream adoption, THENA’s unique positioning in the liquidity management sector makes it a compelling investment consideration for the next decade.

Understanding long-term price predictions requires examining multiple factors, including technological development, market adoption, regulatory landscape, and ecosystem growth. THENA’s innovative approach to decentralised exchange functionality and yield optimisation positions it strategically for potential growth through 2030. This comprehensive guide explores various scenarios, expert opinions, and technical indicators to provide you with actionable insights for your investment strategy.

What is THENA Coin, and Why Does It Matter?

THENA operates as a decentralised exchange (DEX) and liquidity management platform built on the BNB Smart Chain. The protocol focuses on optimising yield generation through innovative tokenomics and governance mechanisms. The native THE token serves multiple functions within the ecosystem, including governance voting, fee collection, and liquidity provision incentives.

The project’s unique value proposition lies in its ve(3,3) tokenomics model, which encourages long-term holding and active participation in governance. This mechanism creates sustainable yield generation opportunities while maintaining protocol stability. THENA’s strategic partnerships and continuous development roadmap position it favourably for long-term growth.

Key features that distinguish THENA include:

- Advanced liquidity optimization algorithms

- Sustainable yield farming mechanisms

- Comprehensive governance framework

- Multi-token reward systems

- Strategic ecosystem partnerships

THENA Coin Price Prediction 2026-2030: Comprehensive Analysis

Market Fundamentals Driving Long-Term Growth

The DeFi sector is projected to experience substantial growth through 2030, with total value locked (TVL) potentially reaching $500 billion, according to industry analysts. THENA’s positioning within this expanding market creates multiple growth catalysts for the THE token. The protocol’s focus on liquidity efficiency and yield optimisation aligns perfectly with evolving market demands.

Institutional adoption of DeFi protocols continues accelerating, with major financial institutions exploring decentralised liquidity solutions. This trend benefits established platforms like THENA, which have demonstrated operational stability and consistent yield generation. The platform’s transparent governance model and community-driven development approach further enhance its appeal to institutional investors.

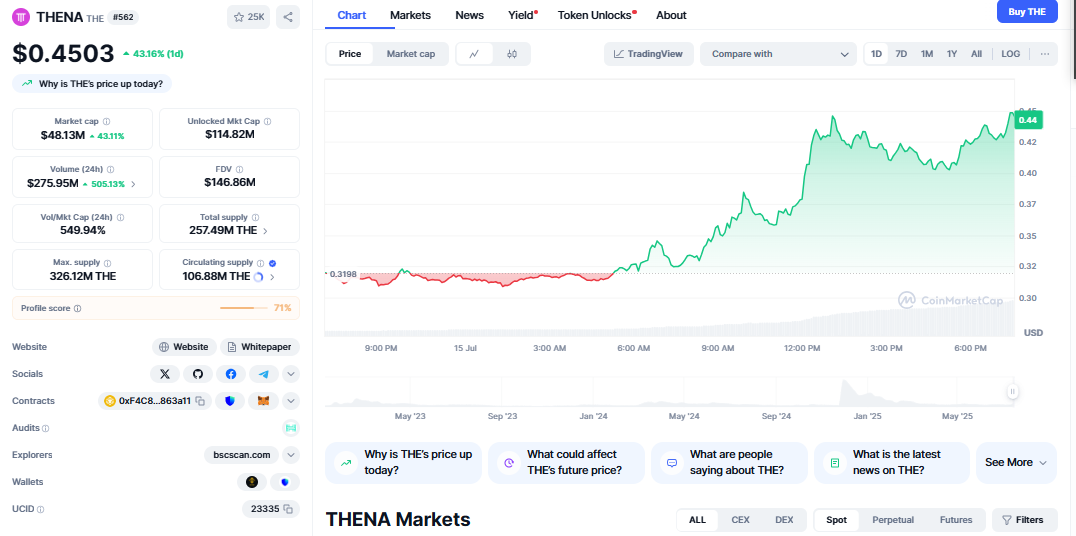

Technical Analysis for Long-Term Projections

Technical indicators suggest THENA’s price trajectory will be influenced by several key factors through 2030. The token’s supply mechanics, including emission schedules and burning mechanisms, create deflationary pressure that could support price appreciation. Additionally, the platform’s revenue-sharing model provides fundamental value backing for token holders.

Historical performance analysis indicates a strong correlation between THENA’s price movements and broader DeFi market trends. The token has demonstrated resilience during market downturns while capturing significant upside during bullish periods. This pattern suggests potential for sustained growth aligned with DeFi sector expansion.

Year-by-Year Price Predictions: 2026-2030

THENA Price Forecast for 2026

Based on current market dynamics and the development roadmap, THENA could potentially reach $2.50 to $4.00 by 2026. This projection assumes continued DeFi adoption, successful protocol upgrades, and a maintained market leadership position. The price range reflects various scenarios from conservative to optimistic market conditions.

Key catalysts for 2026 include:

- Enhanced cross-chain functionality

- Institutional partnership announcements

- Regulatory clarity improvements

- Ecosystem expansion initiatives

THENA Price Outlook for 2027-2028

The mid-term forecast suggests THENA could achieve $4.50 to $7.50 by 2028, driven by matured DeFi infrastructure and increased mainstream adoption. This period may witness significant protocol enhancements, including advanced yield strategies and expanded token utility.

Market maturation during this timeframe could lead to more stable price movements with reduced volatility. The token’s fundamental value proposition should become more apparent as the DeFi ecosystem evolves beyond speculative trading toward utility-driven adoption.

THENA Long-Term Projection for 2029-2030

Conservative estimates place THENA between $8.00 and $15.00 by 2030, assuming successful execution of long-term development goals. Optimistic scenarios, driven by exceptional market conditions and breakthrough technological developments, could see prices reaching $20.00 or higher.

These projections consider potential challenges including regulatory changes, technological disruptions, and competitive pressures. The wide price range reflects inherent uncertainty in long-term cryptocurrency forecasting.

Factors Influencing THENA’s Future Price Performance

Technological Development and Innovation

THENA’s commitment to continuous innovation significantly impacts its long-term value proposition. The development team’s focus on scalability improvements, user experience enhancements, and advanced DeFi primitives creates sustainable competitive advantages. Regular protocol upgrades and feature additions maintain user engagement and attract new participants.

The platform’s research and development initiatives target emerging market opportunities, including institutional DeFi solutions and cross-chain interoperability. These developments could unlock new revenue streams and expand the addressable market significantly.

Market Adoption and User Growth

User base expansion directly correlates with THENA’s long-term success. The platform’s user-friendly interface and comprehensive educational resources facilitate onboarding for both retail and institutional users. Growing adoption metrics, including active users, transaction volume, and total value locked, support positive price momentum.

Partnership development with other DeFi protocols and traditional financial institutions creates network effects that amplify user growth. Strategic collaborations expand THENA’s reach while providing additional utility for THE token holders.

Regulatory Environment Impact

Regulatory clarity in major jurisdictions influences THENA’s growth trajectory significantly. Positive regulatory developments could accelerate institutional adoption, while restrictive regulations might limit market access. The platform’s compliance-focused approach positions it favorably for regulatory approval.

Ongoing dialogue between regulators and DeFi projects suggests potential for balanced frameworks that encourage innovation while protecting consumers. THENA’s transparent operations and community governance model align with regulatory expectations for decentralized finance.

Investment Strategies for THENA Coin Through 2030

Dollar-Cost Averaging Approach

Implementing a dollar-cost averaging strategy helps mitigate volatility risks while building long-term positions. This approach involves regular THE token purchases regardless of price fluctuations, potentially reducing average cost basis over time. The strategy works particularly well for assets with strong fundamental value propositions.

Yield Farming and Staking Opportunities

THENA’s native staking mechanisms provide additional income streams beyond capital appreciation. Token holders can participate in various yield farming programs, earning rewards while supporting protocol security. These opportunities enhance total return potential while maintaining long-term exposure.

Portfolio Diversification Considerations

While THENA shows strong long-term potential, maintaining diversified cryptocurrency exposure remains essential. Allocating 5-10% of the crypto portfolio to THENA provides meaningful exposure while limiting concentration risk. Regular rebalancing ensures optimal risk-adjusted returns.

Risk Factors and Mitigation Strategies

Market Volatility Challenges

Cryptocurrency markets experience significant volatility, which could impact THENA’s price trajectory. Investors should prepare for potential drawdowns of 50-70% during market cycles. Maintaining appropriate position sizing and risk management protocols helps navigate volatile periods.

Technological and Competitive Risks

The DeFi sector faces constant technological evolution and competitive pressures. New protocols with superior features could challenge THENA’s market position. However, the platform’s established user base and continuous development provide competitive moats.

Regulatory and Compliance Considerations

Changing regulatory landscapes could affect THENA’s operations and token value. Monitoring regulatory developments and maintaining compliance with evolving requirements helps mitigate these risks. The platform’s proactive approach to regulatory engagement reduces potential negative impacts.

Expert Opinions and Market Sentiment

Industry experts generally maintain positive outlooks for established DeFi protocols like THENA. Analysts highlight the platform’s strong fundamentals, innovative features, and committed development team as key strengths. However, experts also emphasize the importance of thorough due diligence and risk management.

Market sentiment indicators suggest growing institutional interest in DeFi protocols with proven track records. THENA’s transparent governance and consistent performance attract sophisticated investors seeking long-term exposure to decentralized finance.

Comparison with Other DeFi Tokens

Competitive Landscape Analysis

THENA competes with other DEX platforms and liquidity protocols across multiple chains. Key competitors include Uniswap, SushiSwap, and Curve Finance. THENA’s unique ve(3,3) tokenomics and BNB Smart Chain focus differentiate it within the competitive landscape.

Performance comparison shows THENA’s resilience during market downturns and strong recovery potential. The platform’s focus on sustainable yield generation provides advantages over purely speculative tokens.

Market Position and Differentiation

THENA’s strategic positioning as a comprehensive DeFi platform with governance tokens creates multiple value accrual mechanisms. The platform’s community-driven approach and transparent operations build trust among users and investors.

Technical Indicators Supporting Long-Term Growth

On-Chain Metrics Analysis

On-chain data reveals increasing user activity and transaction volume, supporting positive price momentum. Metrics including total value locked, daily active users, and transaction frequency, show consistent growth patterns. These indicators suggest underlying demand for THENA’s services.

Token Supply Dynamics

THENA’s tokenomics include mechanisms for supply control and value accrual. The emission schedule gradually reduces new token creation while fee burning creates deflationary pressure. These dynamics support long-term price appreciation as demand increases.

Conclusion

The comprehensive analysis of THENA coin price prediction 2026-2030 reveals significant growth potential driven by DeFi sector expansion, technological innovation, and increasing institutional adoption. While projections range from $2.50 to potentially $20.00 by 2030, investors should consider various risk factors and market conditions.

THENA’s strong fundamentals, innovative features, and strategic positioning create favorable conditions for long-term value appreciation. The platform’s commitment to continuous development and community governance provides sustainable competitive advantages in the evolving DeFi landscape.

For investors considering THENA coin exposure, conducting thorough research and implementing appropriate risk management strategies remains essential. The cryptocurrency market’s inherent volatility requires careful position sizing and diversification to optimize risk-adjusted returns.

FAQs

Q1. What factors will drive THENA coin price growth through 2030?

THENA’s price growth through 2030 will be driven by DeFi sector expansion, technological innovations, increased institutional adoption, and the platform’s unique ve(3,3) tokenomics. The growing demand for decentralized liquidity solutions and yield optimization tools supports long-term value appreciation.

Q2. Is the THENA coin a good long-term investment for 2026-2030?

THENA shows strong long-term potential based on its innovative technology, established market position, and continuous development roadmap. However, cryptocurrency investments carry significant risks, and investors should conduct thorough research and maintain appropriate diversification.

Q3. How does THENA compare to other DeFi tokens for long-term holding?

THENA differentiates itself through unique tokenomics, BNB Smart Chain focus, and comprehensive DeFi platform features. Compared to competitors, THENA offers sustainable yield generation mechanisms and strong governance frameworks that appeal to long-term investors.

Q4. What are the main risks for THENA coin price prediction 2026-2030?

Key risks include market volatility, regulatory changes, technological disruption, and competitive pressures. The cryptocurrency market’s inherent uncertainty makes long-term predictions challenging, requiring careful risk management and regular portfolio reassessment.

Q5. How should I approach investing in THENA for the 2026-2030 period?

Consider dollar-cost averaging, maintain diversified exposure, and utilize THENA’s staking opportunities for additional yield. Never invest more than you can afford to lose, and regularly review your investment thesis as market conditions evolve.