Top Altcoin Investment Strategies for June 2025 Growth

The cryptocurrency market continues to evolve at a breakneck speed, with innovative altcoins emerging as potential game changers in the digital asset landscape. Top AI Altcoins, As we navigate June 2025, seasoned crypto investors and newcomers alike are seeking high-growth opportunities that could deliver exceptional returns. The altcoin season phenomenon has historically provided investors with life-changing profits, and current market conditions suggest we may be entering another explosive growth phase.

Key factors driving this optimistic outlook include:

- Increased institutional adoption across major corporations and investment funds.

- Enhanced regulatory clarity in the United States and European Union markets.

- Growing mainstream acceptance of blockchain technology and digital assets.

- Development of more sophisticated DeFi protocols and Web3 infrastructure.

Current Cryptocurrency Market Dynamics

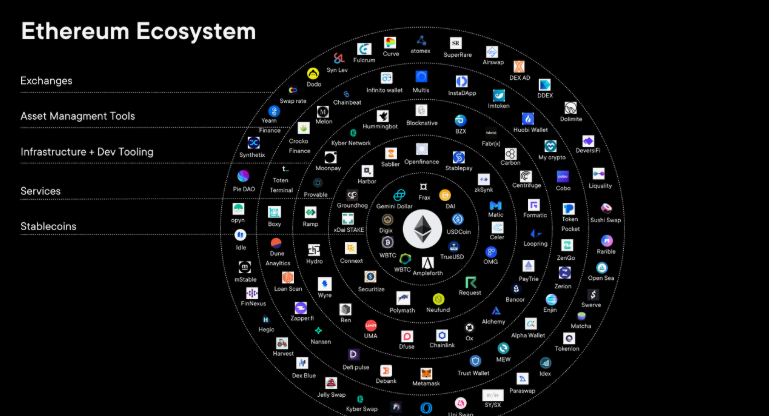

The digital currency ecosystem has matured significantly since Bitcoin’s inception, with alternative cryptocurrencies now representing diverse use cases spanning decentralised finance (DeFi), non-fungible tokens (NFTs), layer-2 scaling solutions, and Web3 infrastructure. Market analysts from leading firms, such as Messari and CoinGecko, have identified several macro trends that could propel select altcoins to significant gains over the coming quarter.

Institutional adoption continues accelerating, with major corporations and investment funds allocating portions of their portfolios to digital assets beyond Bitcoin and Ethereum. This institutional interest creates substantial buying pressure for promising altcoins with strong fundamentals and real-world utility. Additionally, regulatory clarity in key markets, including the United States and European Union, has provided the foundation for sustainable growth in the cryptocurrency sector.

Key Factors Driving Altcoin Performance in 2025

Several fundamental drivers are converging to create optimal conditions for altcoin appreciation:

- Blockchain Interoperability Solutions: The ongoing development addresses one of the industry’s most pressing challenges, enabling seamless asset transfers across different networks. Projects focusing on cross-chain functionality and bridge technologies are particularly well-positioned for significant growth.

- Artificial Intelligence Integration: AI-powered cryptocurrency projects that enhance trading efficiency, improve security protocols, or automate smart contract execution are attracting substantial investor attention. The convergence of AI and blockchain technology creates unique value propositions that traditional financial systems cannot replicate.

- Environmental Sustainability Focus: Proof-of-stake consensus mechanisms and carbon-neutral cryptocurrencies are gaining traction as institutional investors prioritise ESG-compliant investments. This trend particularly benefits altcoins that demonstrate environmental responsibility while maintaining high performance and security standards.

Emerging Sectors Within the Altcoin Ecosystem

The cryptocurrency landscape is rapidly expanding across multiple innovative sectors:

Decentralised Finance (DeFi) Evolution:

- Advanced yield farming optimisers that maximise returns across multiple protocols.

- Automated market makers with sophisticated algorithms for improved liquidity.

- Decentralised insurance platforms protecting against smart contract risks.

- Cross-chain lending protocols enable asset utilisation across different blockchains.

Gaming and Metaverse Cryptocurrencies:

- Play-to-earn gaming models are revolutionising player economic incentives.

- Virtual real estate platforms are creating new paradigms for asset ownership.

- NFT gaming ecosystems with interoperable digital assets.

- Significant gaming studio partnerships are bringing blockchain to mainstream audiences.

Layer-2 and Scaling Solutions:

- Ethereum layer-2 networks reduce transaction costs while maintaining security.

- Alternative layer-1 blockchains offering superior user experiences.

- Zero-knowledge rollup technologies enable private, scalable transactions.

- Cross-chain bridge protocols facilitate seamless asset transfers.

Right-Growth Altcoin Investments

Investing in altcoins with 10x potential requires sophisticated risk management approaches to protect capital while maximising upside potential.

Portfolio Diversification Strategies:

- Allocate across multiple sectors (DeFi, gaming, layer-2, AI integration).

- Balance market capitalisations from large-cap to micro-cap opportunities.

- Limit speculative altcoin exposure to 5-10% of the total investment portfolio.

- Geographic diversification across different regulatory jurisdictions.

Technical Analysis Fundamentals:

- Identify key support and resistance levels for optimal entry and exit points.

- Monitor trading volume patterns to confirm the validity of price movements.

- Utilise momentum indicators like RSI and MACD for timing decisions.

- Combine fundamental project analysis with technical chart patterns.

Position Management Techniques:

- Implement dollar-cost averaging during periods of market volatility.

- Set predetermined profit-taking levels at 2x, 5x, and 10x targets.

- Use stop-loss orders to limit downside risk on speculative positions.

- Regularly rebalance portfolio allocations based on performance.

Market Timing and Seasonal Patterns

Historical cryptocurrency market data reveals distinct seasonal patterns that savvy investors utilise to achieve maximum returns. The summer months traditionally experience increased participation from retail investors, potentially driving altcoin prices higher as mainstream media coverage intensifies. The phenomenon known as “altcoin season” typically occurs when Bitcoin dominance declines and capital flows into alternative cryptocurrencies.

Regulatory announcements and macroeconomic events create additional timing considerations for altcoin investments. Federal Reserve monetary policy decisions, inflation data releases, and geopolitical developments can trigger significant movements in the cryptocurrency market. Staying informed about these external factors helps investors position their altcoin portfolios advantageously.

Conference seasons and major blockchain events often catalyse altcoin price movements as project teams announce partnerships, technological upgrades, or ecosystem expansions. Events like Consensus, Devcon, and major exchange listings frequently coincide with substantial price appreciation for featured projects.

Due Diligence Framework for Altcoin Selection

Successful altcoin investing requires comprehensive research methodologies that evaluate multiple project dimensions. Team credentials and previous experience in blockchain development or relevant industries provide crucial insights into execution capabilities. Projects led by experienced entrepreneurs with successful track records demonstrate higher probabilities of achieving ambitious roadmap objectives.

Tokenomics analysis reveals how cryptocurrency supply mechanisms affect long-term price dynamics. Projects with deflationary token models, staking rewards, or utility-driven demand often outperform those with unlimited supply or unclear value accrual mechanisms. Meme Tokens Gain: Understanding vesting schedules for team tokens and investor allocations helps predict potential selling pressure.

Partnership ecosystems and real-world adoption metrics distinguish genuinely valuable projects from speculative assets. Altcoins with established corporate partnerships, active developer communities, and growing user bases possess sustainable competitive advantages that support long-term appreciation.

Technology Trends Shaping Altcoin Innovation

Zero-knowledge proof technology represents one of the most significant innovations in blockchain, enabling privacy-preserving transactions while maintaining network transparency. ZK-rollup implementations and privacy-focused cryptocurrencies leveraging these technologies are attracting substantial investment as privacy concerns intensify across digital platforms.

Quantum-resistant cryptography development addresses potential future threats to blockchain security. Projects implementing post-quantum cryptographic standards position themselves advantageously as quantum computing capabilities advance. This technological preparation demonstrates forward-thinking development approaches that institutional investors particularly value.

Internet of Things (IoT) integration creates new use cases for cryptocurrency networks that facilitate machine-to-machine transactions. As IoT device networks expand globally, cryptocurrencies enabling autonomous payments and data monetisation could experience exponential growth driven by technological adoption rather than speculative trading.