What Could Affect BABYGROK’s Token Future Market Analysis And Price Predictions 2025

The cryptocurrency landscape continues to evolve rapidly, with meme tokens like BABYGROK capturing significant attention from investors and traders worldwide. Understanding what could affect BABYGROK’s token future has become crucial for anyone considering investment in this emerging digital asset. BABYGROK, inspired by the popular AI chatbot Grok, represents a unique intersection of artificial intelligence branding and cryptocurrency innovation.

As we navigate through 2025, multiple factors influence the trajectory of meme tokens, from market sentiment and regulatory developments to technological advancements and community engagement. The question of what could affect BABYGROK’s token future encompasses a complex web of interconnected variables that savvy investors must carefully analyze. This comprehensive examination will explore the key elements that could shape BABYGROK’s destiny in the volatile cryptocurrency market.

Market Fundamentals That Shape BABYGROK’s Future

Current Market Position and Trading Volume

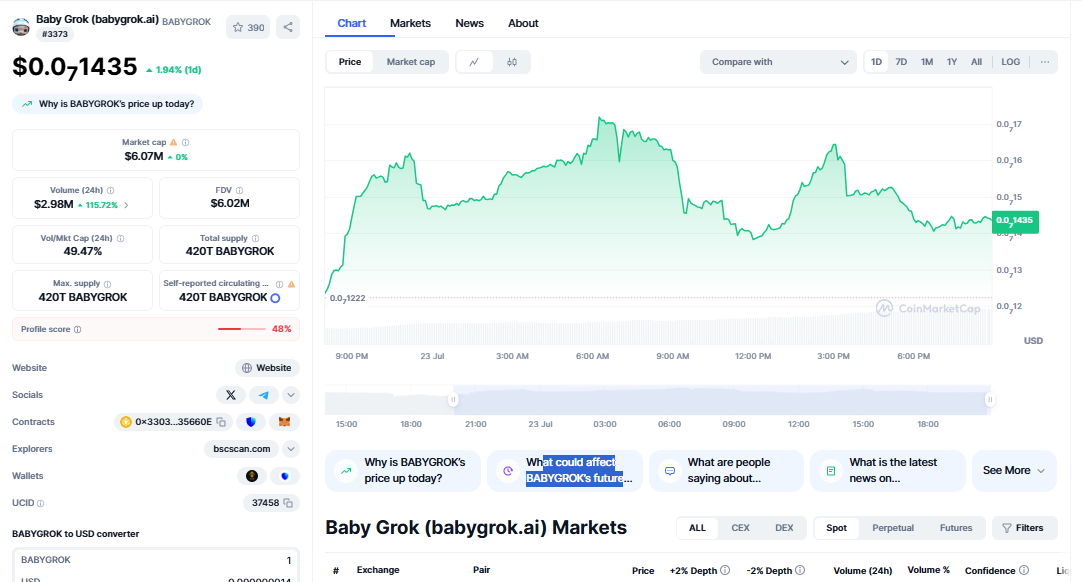

BABYGROK’s position within the broader cryptocurrency ecosystem plays a fundamental role in determining its future prospects. The token’s trading volume, market capitalization, and liquidity levels directly influence investor confidence and price stability. Higher trading volumes typically indicate stronger market interest and reduced price volatility, while low liquidity can lead to dramatic price swings that affect long-term sustainability.

The token’s listing on major cryptocurrency exchanges significantly impacts accessibility and mainstream adoption. When examining what could affect BABYGROK’s token future, exchange partnerships emerge as critical catalysts for growth. Tier-1 exchange listings often trigger substantial price increases and attract institutional investors who require regulated trading platforms.

Market maker activities and whale movements also substantially influence BABYGROK’s price action. Large holders can create significant price movements through strategic buying or selling, making whale tracking an essential component of future predictions. The concentration of token holdings among early investors versus retail traders affects market dynamics and long-term price stability.

Tokenomics and Supply Mechanics

The underlying tokenomics structure fundamentally determines what could affect BABYGROK’s token future. Key factors include total supply, circulating supply, burn mechanisms, and distribution patterns. Deflationary tokens with built-in burn mechanisms often experience upward price pressure as supply decreases over time, assuming demand remains constant or increases.

Vesting schedules for team tokens and early investor allocations create predictable selling pressure that markets must absorb. Understanding these release schedules helps predict potential price impacts and market reactions. Additionally, staking mechanisms and yield farming opportunities can reduce circulating supply while providing utility to token holders.

The inflation rate and new token minting policies directly affect long-term value preservation. Projects with uncapped supplies face different challenges compared to those with fixed maximum supplies. BABYGROK’s specific tokenomics model will largely determine its ability to maintain and increase value over extended periods.

Technology and Development Factors

Smart Contract Security and Audits

Technical security represents a cornerstone factor in determining what could affect BABYGROK’s token future. Smart contract vulnerabilities can lead to catastrophic losses and permanent damage to project credibility. Regular security audits by reputable firms provide essential validation and risk mitigation.

The development team’s technical expertise and track record influence investor confidence and project sustainability. Experienced developers with proven histories of successful blockchain projects inspire greater trust than anonymous teams with limited experience. Transparency in development processes and regular code updates demonstrate ongoing commitment to project improvement.

Integration capabilities with decentralized finance (DeFi) protocols expand BABYGROK’s utility beyond simple speculation. Tokens that provide genuine utility through lending protocols, automated market makers, or yield farming platforms often demonstrate greater resilience during market downturns.

Blockchain Infrastructure and Scalability

The underlying blockchain infrastructure hosting BABYGROK significantly impacts transaction costs, speed, and user experience. High gas fees on congested networks can limit adoption and reduce trading activity. Migration to more efficient blockchains or layer-2 solutions may become necessary for sustained growth.

Cross-chain compatibility and bridge protocols enable BABYGROK to access multiple blockchain ecosystems, expanding its potential user base and utility. Multi-chain presence reduces dependency on single blockchain performance and provides alternative pathways for growth.

Network upgrades and hard forks on the hosting blockchain can create uncertainty and technical challenges. Projects must adapt to infrastructure changes while maintaining compatibility and user experience standards.

Regulatory Environment and Compliance

Global Regulatory Landscape

Regulatory developments represent perhaps the most significant external factor affecting what could affect BABYGROK’s token future. Government policies regarding cryptocurrency classification, taxation, and trading restrictions directly impact market accessibility and investor participation.

The evolving regulatory framework in major markets like the United States, European Union, and Asia creates both opportunities and challenges. Clear regulatory guidelines often boost institutional adoption, while restrictive policies can limit growth potential and market access.

Compliance with know-your-customer (KYC) and anti-money laundering (AML) requirements becomes increasingly important as regulations tighten. Projects that proactively implement compliance measures often gain competitive advantages and reduced regulatory risk.

Securities Classification and Legal Status

The legal classification of BABYGROK as either a security or commodity affects trading permissions, exchange listings, and investor eligibility. Securities classifications typically impose stricter regulatory requirements but may provide greater legal clarity and investor protections.

Intellectual property considerations, particularly regarding the Grok brand association, could influence legal challenges and trademark disputes. Clear licensing agreements or brand differentiation strategies help mitigate potential legal complications.

International regulatory coordination efforts may harmonize cryptocurrency policies across borders, creating more predictable operating environments for global projects like BABYGROK.

Community and Social Factors

Community Engagement and Growth

Strong community support forms the foundation of successful meme token projects. Active social media presence, engaged Discord servers, and regular community events foster loyalty and organic growth. Community-driven marketing efforts often prove more effective and cost-efficient than traditional advertising approaches.

The quality and dedication of community moderators and ambassadors significantly influence project reputation and user experience. Well-managed communities attract new members while maintaining positive sentiment during market volatility.

Meme culture and viral marketing potential represent unique advantages for tokens like BABYGROK. Projects that successfully tap into internet culture and trending topics can experience explosive growth periods that traditional cryptocurrencies cannot replicate.

Influencer Partnerships and Celebrity Endorsements

Social media influencer partnerships can dramatically impact what could affect BABYGROK’s token future. Celebrity endorsements and influencer promotions often trigger significant price movements and increased trading volumes. However, regulatory scrutiny of paid promotions requires transparent disclosure practices.

The authenticity and long-term commitment of influencer partnerships affect their ultimate success. Genuine enthusiasm from respected crypto personalities provides more sustainable growth than purely transactional promotional arrangements.

Building relationships with crypto education content creators helps establish credibility and attract informed investors who contribute to long-term project stability.

Market Sentiment and External Factors

Broader Cryptocurrency Market Trends

Bitcoin and Ethereum price movements significantly influence altcoin markets, including meme tokens like BABYGROK. Bull and bear market cycles create rising and falling tides that affect virtually all cryptocurrency projects. Understanding these macro trends helps predict potential future scenarios for BABYGROK.

Institutional adoption of cryptocurrencies creates legitimacy and attracts mainstream investment capital. Corporate treasury allocations to Bitcoin and Ethereum often spill over into alternative cryptocurrencies as institutions diversify their digital asset portfolios.

Central bank digital currency (CBDC) developments may impact the entire cryptocurrency landscape by providing government-backed digital alternatives to private cryptocurrencies.

Economic Conditions and Global Events

Macroeconomic factors such as inflation rates, interest rates, and currency devaluations influence cryptocurrency demand as alternative stores of value. Economic uncertainty often drives investors toward digital assets as hedges against traditional financial system risks.

Geopolitical events and international conflicts can create safe-haven demand for cryptocurrencies in affected regions. Capital controls and banking restrictions may increase cryptocurrency adoption as people seek financial alternatives.

Global pandemic effects on digital transformation and remote work acceleration have permanently altered financial behaviors and increased cryptocurrency acceptance worldwide.

Competition and Market Positioning

Meme Coin Competition Landscape

The saturated meme coin market presents significant competitive challenges for BABYGROK. Hundreds of similar projects compete for investor attention and capital, making differentiation essential for survival. Unique value propositions and genuine utility help projects stand out in crowded markets.

First-mover advantages in specific niches can provide sustainable competitive moats. Projects that successfully establish themselves as leaders in particular categories often maintain market dominance even as new competitors emerge.

Partnership strategies and collaboration opportunities with other projects can create synergistic growth rather than zero-sum competition. Strategic alliances may provide mutual benefits and expanded market reach.

Innovation and Differentiation Strategies

Continuous innovation in tokenomics, utility, and community features helps maintain competitive advantages. Projects that regularly introduce new functionalities and use cases demonstrate ongoing value creation and development commitment.

Gaming integrations, NFT marketplace connections, and metaverse applications represent potential differentiation opportunities for BABYGROK. These integrations provide practical utility beyond speculative trading.

Educational content creation and financial literacy initiatives can position BABYGROK as a community-focused project that provides genuine value to its holders beyond potential price appreciation.

Technical Analysis and Price Prediction Factors

Chart Patterns and Trading Indicators

Technical analysis provides insights into potential price movements and market sentiment shifts. Support and resistance levels, moving averages, and momentum indicators help traders and investors make informed decisions about BABYGROK positions.

Volume analysis reveals the strength behind price movements and helps identify genuine breakouts versus false signals. Increasing volume during price advances suggests sustainable momentum, while declining volume may indicate weakening trends.

Relative strength index (RSI) and other oscillators help identify overbought and oversold conditions that often precede price reversals. These indicators provide timing insights for entry and exit decisions.

Market Cycles and Seasonal Patterns

Cryptocurrency markets often exhibit cyclical patterns related to Bitcoin halving events, seasonal trading patterns, and quarterly institutional rebalancing. Understanding these cycles helps predict potential future price movements and market sentiment shifts.

Holiday seasons and tax-related selling pressures create predictable market dynamics that affect most cryptocurrencies. Year-end portfolio rebalancing and tax-loss harvesting can create temporary price pressures.

Conference seasons and major cryptocurrency events often coincide with increased market activity and price volatility as news and announcements drive trading interest.

Risk Assessment and Mitigation Strategies

Project-Specific Risks

Development team risks include key person dependencies, technical expertise limitations, and potential team departures. Anonymous teams present additional risks related to accountability and long-term commitment verification.

Smart contract risks encompass code vulnerabilities, upgrade mechanisms, and potential exploits. Regular audits and bug bounty programs help identify and address technical risks before they impact users.

Market manipulation risks in smaller cap tokens include pump-and-dump schemes, coordinated buying or selling, and false information campaigns designed to influence prices.

Market and Regulatory Risks

Regulatory changes can dramatically impact token accessibility, trading venues, and investor eligibility. Staying informed about regulatory developments and maintaining compliance helps mitigate these risks.

Exchange delisting risks affect liquidity and price discovery mechanisms. Maintaining listings on multiple exchanges and meeting evolving compliance requirements reduces delisting risks.

Market volatility risks are inherent in cryptocurrency investments, particularly for smaller projects with limited liquidity. Diversification and position sizing help manage these risks.

Investment Strategies and Recommendations

Dollar-Cost Averaging and Position Management

Systematic investment approaches like dollar-cost averaging help reduce timing risks and smooth out price volatility impacts. Regular small purchases over extended periods often produce better results than attempting to time market entries perfectly.

Position sizing relative to overall portfolio risk tolerance ensures that BABYGROK investments don’t create excessive concentration risk. Most financial advisors recommend limiting cryptocurrency exposure to small percentages of total investment portfolios.

Stop-loss strategies and profit-taking plans help manage emotional decision-making during volatile periods. Pre-determined exit strategies reduce the impact of fear and greed on investment outcomes.

Long-term vs. Short-term Perspectives

Long-term holding strategies focus on fundamental project development and adoption trends rather than short-term price movements. This approach suits investors who believe in BABYGROK’s long-term potential and can tolerate extended volatility periods.

Short-term trading strategies attempt to profit from price volatility and market inefficiencies. These approaches require significant time commitment, technical analysis skills, and risk management discipline.

Hybrid approaches combine long-term core positions with shorter-term trading allocations, allowing investors to benefit from both fundamental growth and market timing opportunities.

Read More: What Could Affect BABYGROK’s Token Future

Future Outlook and Predictions

Short-term Prospects (3-6 months)

Near-term price movements will likely depend heavily on broader cryptocurrency market conditions and Bitcoin price trends. Positive market sentiment could drive significant gains, while bearish conditions may pressure BABYGROK prices regardless of project-specific developments.

Exchange listing announcements and partnership developments could create short-term price catalysts. Community growth milestones and viral marketing successes may also generate trading interest and price volatility.

Regulatory clarity developments in major markets could provide either positive or negative price impacts depending on the specific regulatory outcomes and their implications for meme token trading.

Medium-term Outlook (6-18 months)

Medium-term success will largely depend on BABYGROK’s ability to develop genuine utility beyond speculative trading. Projects that successfully transition from pure meme status to functional utility often demonstrate greater price stability and sustained growth.

Competition from new meme tokens may challenge BABYGROK’s market position unless the project establishes clear differentiation and loyal community support. Innovation in tokenomics, partnerships, and use cases becomes increasingly important.

Broader cryptocurrency adoption trends and institutional interest in alternative cryptocurrencies could benefit BABYGROK if the project maintains credibility and regulatory compliance.

Long-term Vision (2-5 years)

Long-term success requires sustainable business models, continuing technological innovation, and maintained community engagement. Projects that survive multiple market cycles often emerge stronger with more dedicated user bases.

Integration with emerging technologies like artificial intelligence, augmented reality, and Internet of Things applications could provide new utility and adoption drivers for BABYGROK.

Global regulatory framework maturation may create clearer operating environments that benefit compliant projects while eliminating fraudulent competitors.

Conclusion

Understanding what could affect BABYGROK’s token future requires comprehensive analysis of multiple interconnected factors ranging from technological developments to regulatory changes and market dynamics. The cryptocurrency landscape continues evolving rapidly, creating both opportunities and challenges for innovative projects like BABYGROK.

Successful navigation of BABYGROK’s future depends on staying informed about market trends, regulatory developments, and project-specific progress. Investors should conduct thorough research, implement appropriate risk management strategies, and maintain realistic expectations about potential outcomes in the volatile cryptocurrency market.

As we move forward in 2025, the factors that could affect BABYGROK’s token future will continue evolving with changing market conditions and technological advancements. Whether you’re considering investment or simply monitoring developments, understanding these complex dynamics provides essential foundation for informed decision-making in the exciting but unpredictable world of cryptocurrency investing.

FAQs

Q1. What are the main factors that could affect BABYGROK’s token future?

The primary factors include market sentiment, regulatory developments, technological innovations, community growth, competition from other meme tokens, and broader cryptocurrency market trends. Additionally, tokenomics structure, exchange listings, and partnership announcements significantly impact future prospects.

Q2. How does BABYGROK compare to other meme tokens in terms of growth potential?

BABYGROK’s connection to AI branding provides unique positioning compared to traditional meme tokens. However, success depends on execution, community building, and ability to develop genuine utility beyond speculative trading. The saturated meme coin market makes differentiation crucial for long-term success.

Q3. What regulatory risks should BABYGROK investors consider?

Key regulatory risks include potential securities classification, exchange delisting requirements, taxation changes, and geographic trading restrictions. Investors should monitor regulatory developments in their jurisdictions and consider compliance implications for their investment strategies.

Q4. Is BABYGROK suitable for long-term investment strategies?

Long-term suitability depends on individual risk tolerance and investment objectives. Meme tokens typically exhibit high volatility and uncertain fundamentals compared to established cryptocurrencies. Conservative investors should limit exposure to small portfolio percentages and focus on projects with clear utility development plans.

Q5. How can investors stay informed about developments affecting BABYGROK’s future?

Investors should follow official project channels, monitor cryptocurrency news sources, track regulatory developments, and engage with community discussions. Technical analysis, on-chain metrics, and market sentiment indicators provide additional insights for informed decision-making.