Why is XRP’s Price Down Today? Market Analysis and Expert Predictions (2025)

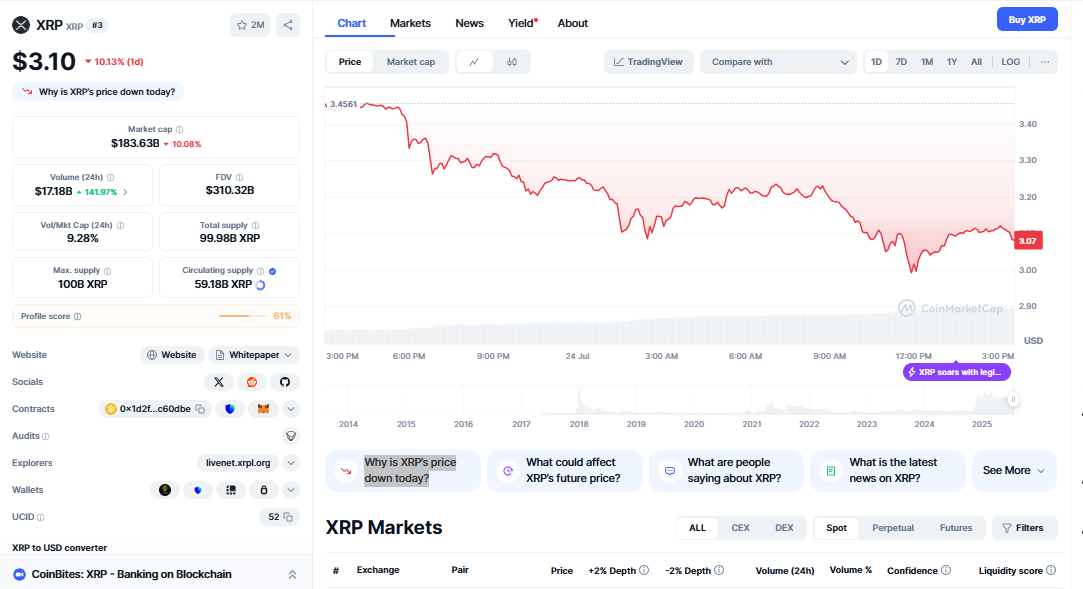

Understanding why XRP’s price is down today requires a comprehensive look at multiple market factors affecting this third-largest cryptocurrency by market capitalisation. XRP is down 12.05% in the last 24 hours, trading at approximately USD 3.12 with significant trading volume. This price decline reflects broader market sentiment, technical factors, and specific events impacting Ripple’s ecosystem.

The question “Why is XRP’s price down today?” resonates with millions of investors and traders who have witnessed XRP’s volatility throughout 2025. From reaching new highs earlier this year to experiencing recent corrections, XRP’s price movements often mirror complex interactions between regulatory developments, market psychology, and institutional adoption patterns. Today’s decline represents more than just a temporary setback—it reflects deeper market dynamics that every XRP holder should understand.

Whether you’re a seasoned crypto trader or new to digital assets, comprehending the factors behind XRP’s price movements is crucial for making informed investment decisions in today’s rapidly evolving cryptocurrency landscape.

Why XRP’s Price is Down Today: Key Market Factors

Several interconnected factors contribute to today’s XRP price decline, creating a perfect storm of selling pressure that has pushed the cryptocurrency lower across major exchanges.

Market-Wide Cryptocurrency Correction

The broader cryptocurrency market is experiencing a significant correction, with major digital assets losing value simultaneously. Many cryptocurrencies seemed to follow similar downward trends, indicating that XRP’s decline isn’t isolated but part of a larger market movement affecting Bitcoin, Ethereum, and other top cryptocurrencies.

This market-wide correction often occurs when institutional investors reduce their risk exposure, retail traders take profits, or when macroeconomic factors create uncertainty in financial markets. XRP, despite its strong fundamentals, remains susceptible to these broader market forces that drive sentiment across the entire cryptocurrency ecosystem.

Technical Analysis Indicators Signal Bearish Momentum

From a technical perspective, XRP’s price action shows several bearish indicators that help explain today’s decline. XRP open interest (OI) has decreased by 10% to $3.6 billion over the last seven days, signaling reduced trader confidence and liquidity in the market.

The decrease in open interest represents fewer active positions in XRP futures markets, typically indicating that traders are closing positions rather than opening new ones. This reduction in market participation often precedes or accompanies significant price movements, as we’re witnessing today.

Additionally, long positions valued at $7.98 million were liquidated, creating additional selling pressure as leveraged positions were forcibly closed when prices moved against traders’ expectations.

Recent Market Performance and Trend Analysis

XRP’s Position in Current Market Rankings

Despite today’s decline, XRP maintains its position as a major cryptocurrency player. The current CoinMarketCap ranking is #3, with a live market cap of $184,800,206,690, demonstrating that while prices may fluctuate, XRP’s fundamental market position remains strong.

This ranking reflects XRP’s established presence in the cryptocurrency ecosystem and its continued relevance to institutional investors, payment providers, and retail traders worldwide. The substantial market capitalisation provides some buffer against extreme volatility while maintaining sufficient liquidity for large transactions.

Trading Volume and Market Activity

Current trading activity shows mixed signals about market sentiment. A 24-hour trading volume of $11,244,490,462 indicates robust market participation despite the price decline, suggesting that today’s movement reflects active price discovery rather than lack of interest.

High trading volumes during price declines often indicate that significant market participants are repositioning their holdings, whether through profit-taking, stop-loss orders, or strategic rebalancing of their cryptocurrency portfolios.

Historical Context: XRP’s Price Patterns and Seasonal Trends

Understanding XRP’s Historical Performance

XRP’s price movements follow certain historical patterns that provide context for today’s decline. XRP historically has had a positive July in terms of monthly returns. The median monthly return for the coming month for XRP sits at 6.91%, which makes today’s decline somewhat contrary to seasonal expectations.

This historical context suggests that while today’s price action may seem concerning, XRP has often recovered during July periods, potentially setting up opportunities for traders who understand these seasonal patterns.

Long-term vs. Short-term Market Dynamics

The cryptocurrency market often experiences short-term volatility that contradicts longer-term trends. The realised price for short-term XRP holders (1w 3m) has surged well above the aggregated average, indicating that recent buyers entered at higher price levels, potentially creating pressure for profit-taking or loss mitigation.

This dynamic between short-term and long-term holders creates complex market pressures where recent buyers may be more sensitive to price movements, while long-term holders often provide stability during market corrections.

Regulatory Environment and Its Impact on XRP Pricing

Current Regulatory Landscape

The regulatory environment continues to play a crucial role in XRP’s price movements. Regulatory uncertainty, limited market acceptance, and technical weaknesses remain concerns for some analysts, though the overall regulatory picture has improved significantly compared to previous years.

Regulatory developments can create both opportunities and challenges for XRP, with positive news often driving price increases while uncertainty or negative developments contribute to selling pressure.

Institutional Adoption and Partnership Developments

Recent institutional partnerships and adoption efforts provide a counterbalance to today’s price decline. These developments suggest that while short-term price movements may be negative, the underlying fundamentals supporting XRP’s long-term value proposition continue to strengthen.

Financial institutions increasingly recognise XRP’s utility for cross-border payments and settlements, creating a foundation for future growth that extends beyond daily price fluctuations.

Technical Analysis: Key Support and Resistance Levels

Critical Price Levels to Watch

Technical analysts have identified several key price levels that will determine XRP’s near-term direction. If XRP holds the $2.25 support zone, the next major resistance levels are at $2.69 and $3.04, providing a roadmap for potential recovery scenarios.

These technical levels serve as important psychological and mathematical points where buying or selling pressure tends to increase, making them crucial for traders attempting to time their market entries and exits.

Chart Pattern Analysis

Current chart patterns show XRP testing important support levels established during previous trading sessions. The ability to hold these levels will likely determine whether today’s decline represents a temporary correction or the beginning of a more significant downward movement.

Professional traders often watch these technical patterns closely, as they can provide early signals about potential trend changes and help identify optimal entry and exit points for trading positions.

Expert Predictions and Market Outlook

Short-term Price Projections

Market analysts provide varied perspectives on XRP’s short-term outlook. “Short-term price targets range from $2.00–$2.17 on the downside to $2.65–$3.00 on the upside,” according to professional analysts, suggesting significant potential volatility in either direction.

These projections reflect the uncertainty inherent in cryptocurrency markets, where multiple factors can quickly shift sentiment and drive prices in unexpected directions.

Long-term Market Potential

Despite today’s decline, long-term projections for XRP remain optimistic among many analysts. “Long-term forecasts suggest $4.20–$10+ by 2030 if Ripple capitalizes on payment adoption”, indicating that current price weakness may represent opportunity rather than fundamental deterioration.

These longer-term projections depend on continued adoption of Ripple’s technology, favorable regulatory developments, and broader acceptance of cryptocurrency payments in traditional financial systems.

Market Psychology and Investor Sentiment

Understanding Fear and Greed Cycles

Cryptocurrency markets are heavily influenced by investor psychology, with fear and greed cycles driving significant price movements. Today’s XRP decline may reflect a shift toward fear-driven selling, where investors prioritize capital preservation over potential gains.

These psychological factors often create opportunities for contrarian investors who can maintain objectivity during periods of market stress, though timing such strategies requires careful analysis and risk management.

Social Media and News Impact

Modern cryptocurrency markets are highly responsive to social media sentiment and news developments. Negative news coverage or social media discussions about XRP can amplify selling pressure, while positive developments can quickly reverse negative trends.

Understanding this dynamic helps explain why cryptocurrency prices can move so dramatically on seemingly minor news or events, as algorithmic trading systems and retail investors react rapidly to information flows.

Comparison with Other Major Cryptocurrencies

Bitcoin and Ethereum Performance

Comparing XRP’s performance with other major cryptocurrencies provides important context for today’s decline. Ethereum and Dogecoin have also seen price drops of 27% or more since January 18. Bitcoin fell 25% but gained some momentum more recently, showing that XRP’s struggles are part of a broader market correction.

This comparative analysis suggests that XRP’s decline reflects market-wide factors rather than XRP-specific problems, which may be encouraging for long-term holders who believe in the cryptocurrency’s fundamental value proposition.

Market Correlation Analysis

The correlation between XRP and other cryptocurrencies has important implications for portfolio diversification and risk management. When correlations are high, as they appear to be during today’s decline, diversification within cryptocurrency holdings provides limited protection against market downturns.

Trading Strategies During XRP Price Declines

Dollar-Cost Averaging Approach

For long-term investors, periods of price decline can present opportunities to implement dollar-cost averaging strategies, gradually accumulating XRP positions as prices fall. This approach can reduce the impact of timing decisions while building positions over time.

However, investors should carefully consider their risk tolerance and only invest amounts they can afford to lose, as cryptocurrency investments remain highly speculative despite their growing mainstream acceptance.

Risk Management Considerations

Professional traders emphasize the importance of risk management during volatile periods like today’s XRP decline. Setting stop-loss orders, position sizing appropriately, and maintaining adequate diversification can help protect capital during market downturns.

These risk management principles become especially important during periods of high volatility, when emotions can drive poor decision-making and lead to significant losses.

Impact of Institutional Investment on XRP Pricing

Institutional Adoption Trends

Institutional investment in XRP continues to evolve, with major financial institutions exploring Ripple’s technology for cross-border payments and settlements. These institutional relationships provide fundamental support for XRP’s value proposition, even during periods of price weakness.

The growth of institutional adoption suggests that XRP’s long-term trajectory may be less dependent on retail trading sentiment and more influenced by business adoption and practical utility in financial services.

ETF and Investment Product Development

The development of XRP-focused investment products, including potential exchange-traded funds (ETFs), could significantly impact future price dynamics. If Ripple secures its banking license and ETFs gain traction, XRP could break above $3.50, targeting new all-time highs.

These institutional investment vehicles could provide new sources of demand for XRP while making it more accessible to traditional investors who prefer regulated investment products over direct cryptocurrency ownership.

Technology Developments and Network Updates

Ripple Network Improvements

Ongoing improvements to the Ripple network and XRP Ledger continue to enhance the cryptocurrency’s utility and efficiency. These technological developments provide fundamental support for XRP’s value proposition, independent of short-term price movements.

Network upgrades, partnerships with payment providers, and improvements to transaction processing capabilities all contribute to XRP’s long-term value proposition, even when prices are declining due to market factors.

Central Bank Digital Currency (CBDC) Integration

Ripple’s involvement in central bank digital currency (CBDC) projects worldwide represents a significant opportunity for XRP adoption. As governments explore digital currency implementation, Ripple’s technology and XRP’s utility could benefit from increased institutional adoption.

These CBDC partnerships could provide substantial long-term value for XRP holders, though the timeline for such developments may extend beyond current market cycles.

Read More: Why is XRP’s Price Down Today?

Global Economic Factors Affecting XRP

Macroeconomic Environment

Global economic conditions significantly impact cryptocurrency markets, including XRP. Inflation concerns, interest rate changes, and geopolitical tensions all influence investor appetite for risk assets like cryptocurrencies.

Today’s XRP decline may partly reflect broader economic uncertainties that drive investors toward traditional safe-haven assets and away from more speculative investments like cryptocurrencies.

Currency Market Dynamics

As a cryptocurrency designed for cross-border payments, XRP is particularly sensitive to changes in traditional currency markets and international payment flows. Disruptions in global trade or changes in currency exchange patterns can impact demand for XRP’s payment utility.

Understanding these macroeconomic connections helps explain why XRP’s price movements sometimes correlate with traditional financial markets rather than purely cryptocurrency-specific factors.

Future Outlook and Recovery Scenarios

Potential Catalysts for Recovery

Several factors could drive XRP’s recovery from today’s decline. Positive regulatory developments, new institutional partnerships, technological improvements, or broader cryptocurrency market recovery could all contribute to renewed investor interest in XRP.

The optimistic case envisions XRP approaching $4 by end of 2025 and ~$6 by 2026, suggesting that current price levels may represent attractive entry points for investors with longer time horizons.

Scenario Planning for Investors

Investors should consider multiple scenarios when evaluating XRP’s potential recovery. Best-case scenarios involve rapid institutional adoption and regulatory clarity, while worst-case scenarios might include continued regulatory challenges or broader cryptocurrency market decline.

Developing investment strategies that account for multiple potential outcomes can help investors navigate the uncertainty inherent in cryptocurrency markets while positioning for potential long-term gains.

Conclusion

Understanding why XRP’s price is down today requires analyzing multiple interconnected factors from market psychology to technical indicators, regulatory developments to institutional adoption trends. While today’s decline may concern short-term traders, the combination of strong fundamentals, ongoing institutional partnerships, and historical recovery patterns suggests that current price levels may present opportunities for patient investors.

The cryptocurrency market’s inherent volatility means that periods like today’s XRP decline are normal parts of the investment cycle. Successful cryptocurrency investing requires maintaining perspective during both euphoric rallies and concerning corrections, focusing on long-term value creation rather than daily price movements.

For investors wondering why XRP’s price is down today, the answer lies in understanding that cryptocurrency markets remain young, volatile, and influenced by rapidly changing factors. Those who can navigate this volatility while maintaining disciplined investment approaches may be best positioned to benefit from XRP’s long-term potential.

FAQs

Q1. What are the main reasons XRP’s price is down today?

XRP’s price decline today results from multiple factors, including broader cryptocurrency market correction, decreased open interest in futures markets, technical selling pressure, and reduced trader confidence. XRP is down 12.05% in the last 24 hours, with open interest decreasing by 10% over the past week.

Q2. Is this XRP price drop part of a larger market trend?

Yes, today’s XRP decline is part of a broader cryptocurrency market correction. Many cryptocurrencies seem to follow similar downward trends, indicating that XRP’s performance reflects market-wide sentiment rather than XRP-specific issues.

Q3. Should investors buy XRP during this price decline?

Investment decisions should be based on individual risk tolerance and investment strategy. XRP historically has had a positive July with median monthly returns of 6.91%, but past performance doesn’t guarantee future results. Consider dollar-cost averaging and proper risk management.

Q4. What are expert predictions for XRP’s recovery?

Analyst predictions vary widely. Short-term targets range from $2.00–$2.17 on the downside to $2.65–$3.00 on the upside, while long-term forecasts suggest potential for significant growth if adoption increases and regulatory clarity improves.

Q5. How does XRP’s decline compare to other major cryptocurrencies?

XRP’s decline is consistent with broader market corrections affecting major cryptocurrencies. Ethereum and Dogecoin have seen drops of 27% or more since January, while Bitcoin fell 25%, showing XRP’s performance aligns with market trends.