Why is ZORA’s Price Up Today? Base App Integration Drives 440% Rally

Cryptocurrency investors are asking “Why is ZORA’s price up today?” as the token experiences an extraordinary 440% surge in just one week, climbing from $0.011 to over $0.078. This remarkable price movement has captured the attention of the entire crypto community, with ZORA becoming one of the top-performing tokens in the market. The primary catalyst behind this explosive rally is Coinbase’s strategic rebrand of its Wallet into the Base App, which has sparked a massive SocialFi boom and sent ZORA’s activity into overdrive. Understanding the factors driving this unprecedented price surge is crucial for investors looking to capitalize on emerging opportunities in the rapidly evolving social finance sector.

ZORA’s Explosive Price Movement

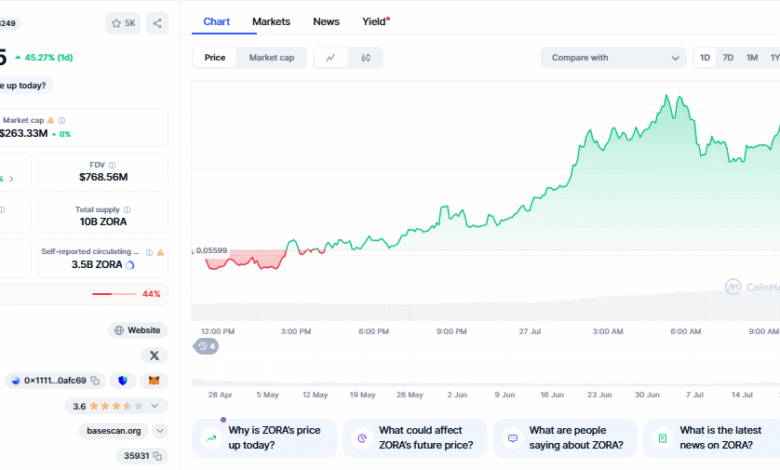

The recent ZORA price surge represents one of the most significant rallies in the token’s history, with multiple catalysts converging to create perfect market conditions. The price of ZORA has rallied 440% in the past week, from $0.011 to $0.0615, as daily creator earnings spiked, demonstrating the token’s sensitivity to platform developments and user adoption metrics.

Current market data indicate that ZORA is trading at various price points across different exchanges, with the live ZORA price today at USD 0.07852 and a 24-hour trading volume of USD 386,788,233.75. This substantial trading volume indicates strong investor interest and liquidity in the token, supporting the sustainability of the current price levels.

The token’s performance metrics reveal impressive gains across multiple timeframes. ZORA’s USD value has increased by +309.85% over the last week, with a circulating supply of 3.50 billion ZORA and a market cap currently at USD 155.16 million. These statistics highlight the magnitude of the recent rally and position ZORA as a significant player in the social finance ecosystem.

Market sentiment indicators indicate an overwhelming bullish sentiment, with the community bullish about Zora (ZORA) as of today. This positive sentiment is backed by fundamental developments that extend beyond speculative trading, providing a solid foundation for the token’s current valuation.

Technical Analysis and Price Patterns

The technical picture for ZORA presents compelling evidence of sustained upward momentum. On the daily chart, ZORA printed a ‘god candle’ yesterday, followed by another green candle today, signaling sustained upward momentum. This candlestick pattern is particularly significant in cryptocurrency markets, often indicating the beginning of a major trend reversal or continuation.

Daily trading activity has reached exceptional levels, with the token experiencing consistent buying pressure across multiple sessions. The volume-to-market capitalization ratio suggests healthy market participation and a reduced risk of sudden price reversals due to low liquidity conditions.

Price action analysis reveals strong support levels forming at key psychological levels, with resistance zones being systematically broken as the rally progresses. The token’s ability to maintain gains above previous resistance levels indicates institutional and retail confidence in the underlying fundamentals.

Moving average indicators indicate that ZORA is trading well above all major trend lines, with the exponential moving averages providing dynamic support for continued upward momentum. This technical setup suggests that the current rally has room for further expansion if fundamental catalysts continue to develop.

Base App Integration: The Primary Catalyst

The most significant factor explaining why ZORA’s price is up today stems from Coinbase’s strategic integration of ZORA technology into the newly rebranded Base App. Coinbase’s rebranding of its Wallet as the Base App has sparked a surge in SocialFi, driving Zora’s (ZORA) activity into overdrive and leading to a massive rally for its token.

This integration represents more than a simple partnership; it’s a fundamental shift in how social content and financial incentives intersect on blockchain platforms. Base App integrated Zora’s content tokenization technology, allowing users to create and trade tokens tied to social media posts using Zora and Farcaster infrastructure. This development opens entirely new revenue streams for content creators and social media participants.

The Base App integration leverages ZORA’s proven infrastructure for content monetization, creating seamless user experiences that bridge traditional social media with decentralized finance opportunities. Users can now tokenize their social media posts directly through the Base App interface, eliminating technical barriers that previously limited adoption of social finance applications.

Market response to the integration has been overwhelmingly positive, with both retail and institutional investors recognizing the potential for scalable revenue generation through social tokenization. The partnership with Coinbase provides ZORA with access to millions of potential users who are already familiar with cryptocurrency trading and wallet management.

Creator Economics and Revenue Surge

The integration’s impact on creator economics provides concrete evidence of fundamental value creation beyond speculative price movements. Daily payouts spiked from around $1,000 to over $30,000 as more than 12,000 unique creators joined the rush. Over 8,000 Zora Smart Wallets were active each day during the boom.

This dramatic increase in creator participation and earnings demonstrates the platform’s ability to generate real economic value for its users. The 30x increase in daily payouts suggests that the social tokenization model has achieved a strong product-market fit, particularly when integrated with user-friendly applications like the Base App.

The surge in active wallet creation shows growing user adoption beyond existing cryptocurrency enthusiasts. New user onboarding through the Base App has simplified the process of participating in social finance, removing traditional barriers that limited growth in decentralized applications.

Revenue sharing mechanisms within the ZORA ecosystem ensure that token holders benefit from increased platform activity through various fee-sharing arrangements and staking rewards. This creates positive feedback loops where increased usage drives token demand, which in turn attracts more creators and users to the platform.

SocialFi Boom and Market Trends

The ZORA price surge occurs within the broader context of a significant expansion of the SocialFi market, where social media platforms are increasingly integrating financial mechanisms and cryptocurrency rewards. This trend represents a fundamental shift in how content creators monetize their work and how audiences engage with digital content.

SocialFi applications have gained tremendous traction in 2025, with users seeking alternatives to traditional social media platforms that offer limited monetization opportunities for individual creators. The combination of social networking, content creation, and decentralized finance creates new economic models that benefit both creators and engaged community members.

Market analysts identify SocialFi as one of the fastest-growing sectors within the cryptocurrency ecosystem, with total value locked in social finance protocols increasing dramatically over the past quarter. This growth trajectory suggests that early movers like ZORA are well-positioned to capture significant market share as the sector matures.

The integration of artificial intelligence, non-fungible tokens, and social tokenization creates compound growth opportunities that extend beyond simple price speculation. These technological convergences enable new forms of digital ownership, content monetization, and community engagement that were previously impossible.

Competitive Landscape Analysis

ZORA’s position within the competitive SocialFi landscape demonstrates several key advantages that justify the current price premium. The platform’s early adoption of Layer 2 scaling solutions enables cost-effective transaction processing, allowing for microtransactions and frequent creator interactions without prohibitive gas fees.

Partnership strategies with major platforms, such as Coinbase, differentiate ZORA from competitors who lack similar distribution channels and user acquisition mechanisms. The Base App integration provides ZORA with immediate access to millions of potential users, creating significant first-mover advantages in the social tokenization space.

Technical infrastructure advantages include native support for multiple token standards, cross-chain interoperability, and user-friendly wallet solutions that simplify the onboarding process for non-technical users. These features address common pain points that have limited adoption of previous social finance applications.

Community governance mechanisms and creator-focused economic models align platform incentives with user success, creating sustainable growth dynamics that benefit all ecosystem participants. This alignment contrasts with traditional social media platforms where value extraction often conflicts with creator interests.

Creator Coins Launch Impact

The launch of Creator Coins on the ZORA platform represents another significant catalyst driving the current surge in prices. Zora (ZORA) surged over 75% to a 3-month high of $0.022 on July 20. This rally followed the launch of its new content monetization tool, Creator Coins, on the Base platform.

Creator Coins enable individual content creators to launch their tokens tied to their personal brand and content creation activities. This innovation allows for creators to capture value directly from their audience engagement and build sustainable revenue streams that are independent of traditional advertising models.

The economic model underlying Creator Coins creates multiple revenue streams for the ZORA ecosystem. Coin creators earn from fees on trading volume, where the higher the trading volume, the more creators earn. There are different rewards available on Zora, allowing creators, collectors, developers and the platform to earn from trading activity.

Market response to Creator Coins has exceeded initial expectations, with thousands of creators launching their tokens within days of the feature’s availability. This rapid adoption demonstrates strong demand for alternative monetization models and validates ZORA’s approach to social finance integration.

Revenue Model Innovation

The Creator Coins revenue model introduces innovative mechanisms for value distribution that benefit multiple stakeholders within the ecosystem. Creators receive direct compensation based on their token’s trading activity, while collectors and investors can participate in creator success through token appreciation and dividend distributions.

Platform fees generated from Creator Coin transactions contribute to ZORA’s overall revenue, creating sustainable business models that don’t rely solely on external funding or speculative token trading. This approach ensures the long-term viability of the platform and its continued development of new features and capabilities.

Secondary market trading of Creator Coins generates additional liquidity and price discovery mechanisms that help establish fair valuations for creator brands and content. These markets operate continuously, providing creators with real-time feedback on their market value and audience engagement levels.

Cross-platform integration possibilities allow Creator Coins to function across multiple social media and content platforms, increasing their utility and potential market reach. This interoperability creates network effects that benefit both creators and token holders through increased adoption and usage.

Read More: Why is ZORA’s Price Up Today? Base App Integration Drives 440% Rally

Market Sentiment and Community Response

Community sentiment surrounding ZORA’s recent price performance reflects genuine excitement about the platform’s technological capabilities and growth potential. Social media discussions show users praising the seamless integration experience and the financial opportunities created by social tokenisation features.

Developer community engagement has increased significantly, with new applications and integrations being built on the ZORA infrastructure. This developer interest indicates confidence in the platform’s long-term viability and suggests continued innovation and feature development in the months to come.

Institutional interest in ZORA has grown in tandem with retail enthusiasm, with several cryptocurrency funds and investment firms publicly discussing their positions in the token. This institutional validation provides additional credibility and potential for sustained price support during market volatility.

Media coverage of ZORA’s price surge has mainly been favorable, with cryptocurrency publications highlighting the fundamental drivers behind the rally rather than dismissing it as purely speculative. This coverage helps build broader awareness and potential future adoption among cryptocurrency investors.

Investor Behavior Analysis

Trading pattern analysis reveals that ZORA’s price surge is supported by both retail and institutional buying, with large transactions indicating the participation of sophisticated investors. Accumulation trends suggest that investor demand for the token remains high, which can further support the rally.

Holding period analysis shows that many ZORA purchasers are maintaining their positions rather than taking quick profits, suggesting confidence in the token’s continued appreciation potential. This holding behavior reduces selling pressure and supports price stability during periods of consolidation.

Options and derivatives activity around ZORA has increased dramatically, with both bullish and hedging strategies being implemented by professional traders. This activity indicates that the token has gained legitimacy within sophisticated trading communities and provides additional liquidity mechanisms.

The geographic distribution of ZORA trading shows global participation, with significant activity in both Asian and Western markets. This international interest reduces dependence on any single regional market and provides support during different trading sessions across different time zones.

Technical Infrastructure and Platform Development

ZORA’s underlying technical infrastructure plays a crucial role in supporting the current price surge and future growth potential. In Spring 2025, ZORA transitions to a Base Layer 2 “social network” and issues its native ZORA token to incentivize community participation further.

The transition to Base Layer 2 infrastructure offers significant scalability improvements, enabling high-throughput social interactions without the cost and speed limitations of Ethereum mainnet transactions. This technical upgrade directly addresses user experience issues that have limited adoption of previous social finance applications.

Innovative contract architecture improvements enable more sophisticated tokenization models and automated revenue distribution mechanisms. These technical capabilities support the Creator Coins functionality and provide foundation for future feature development and platform expansion.

Security audits and ongoing development partnerships ensure that the platform maintains high standards for user fund protection and the reliability of smart contracts. These security measures are particularly crucial for social finance applications that process frequent microtransactions and monetize user-generated content.

Interoperability and Cross-Chain Features

ZORA’s commitment to cross-chain interoperability positions the platform to benefit from growth across multiple blockchain ecosystems. Integration with Ethereum, Base, and other Layer 2 solutions provides users with flexibility in choosing their preferred blockchain environment while maintaining access to ZORA’s social finance features.

Bridge protocols and cross-chain communication mechanisms enable seamless asset transfers and platform interactions regardless of users’ preferred blockchain networks. This interoperability reduces friction and expands the potential user base beyond single-chain communities.

API integration capabilities enable third-party developers to build applications that leverage ZORA’s infrastructure, providing unique user experiences and specialized functionality. This ecosystem approach creates network effects that benefit all platform participants and drives continued innovation.

Future roadmap items include integration with additional blockchain networks and support for emerging technologies, such as zero-knowledge proofs and decentralized identity systems. These developments will further enhance platform capabilities and user privacy protections.

Investment Considerations and Risk Assessment

While ZORA’s price surge presents significant opportunities, potential investors should carefully consider various risk factors and market dynamics before making investment decisions. Cryptocurrency markets remain highly volatile, and social finance tokens can experience rapid price swings based on platform adoption metrics and broader market sentiment.

Regulatory considerations surrounding social tokenization and creator economics are continually evolving, with potential implications for how platforms like ZORA operate in various jurisdictions. Investors should monitor regulatory developments and their potential impact on social finance applications.

Competition within the SocialFi sector continues to intensify, with new platforms and established technology companies entering the market. ZORA’s ability to maintain its competitive advantages and continue innovating will be crucial for long-term success and token value appreciation.

Technical risks associated with smart contract functionality, blockchain security, and platform scalability could impact user experience and token value. While ZORA has implemented comprehensive security measures, the rapidly evolving nature of blockchain technology creates ongoing risks that investors should be aware of.

Valuation Metrics and Growth Projections

Current valuation metrics for ZORA suggest that the token may still be undervalued relative to its potential market opportunity and revenue-generating capabilities. Comparisons with traditional social media platforms and emerging SocialFi competitors indicate significant room for growth as the sector matures.

Revenue multiples based on creator earnings and platform transaction volumes indicate that ZORA is trading at reasonable valuations compared to similar technology companies and cryptocurrency projects. These metrics support the case for continued price appreciation as platform adoption increases.

Network effects and user growth trajectories offer positive indicators for future value creation, as each new creator and user contributes to platform utility and token demand. Mathematical modeling of these network effects suggests exponential growth potential under favorable market conditions.

Market penetration analysis indicates that ZORA has captured only a small fraction of the potential social tokenization market, leaving substantial room for expansion as awareness and adoption increase among content creators and social media users.

Future Outlook and Strategic Developments

ZORA’s development roadmap includes several strategic initiatives that could drive continued price appreciation and platform growth. Integration with additional social media platforms and content creation tools will expand the addressable market and increase token utility.

Partnership announcements with major technology companies and content platforms could provide additional catalysts for price movement and user adoption. The success of the Coinbase Base App integration demonstrates ZORA’s ability to execute strategic partnerships that create mutual value.

Product development priorities focus on improving user experience, expanding creator monetization options, and developing new financial primitives for social interactions. These developments address current platform limitations and position ZORA for continued growth in the competitive social finance (SocialFi) market.

International expansion efforts aim to bring ZORA’s social tokenization capabilities to new geographic markets with different regulatory environments and user preferences. Success in global markets could significantly increase the platform’s total addressable market and token demand.

Ecosystem Development and Community Building

Community governance initiatives will give ZORA token holders increasing influence over platform development and strategic decisions. Although the ZORA token currently carries no governance rights, it serves as a cultural and economic currency within the ecosystem, with plans for enhanced governance features in future updates.

Educational programs and creator support initiatives help onboard new users and maximize creator success on the platform. These programs create positive user experiences that encourage long-term platform engagement and token holding behavior.

The growth of the developer ecosystem, facilitated by grants, hackathons, and technical resources, encourages third-party innovation and platform integration. A thriving developer ecosystem creates additional value for token holders by increasing platform utility and driving feature development.

Research and development investments in emerging technologies, such as artificial intelligence, virtual reality, and decentralized identity systems, position ZORA at the forefront of social finance innovation. These investments could create new revenue streams and competitive advantages in future market cycles.

Conclusion

The question “Why is ZORA’s price up today?” has a clear answer rooted in fundamental developments that extend far beyond speculative trading. The combination of Coinbase’s Base App integration, the successful launch of Creator Coins, and the broader expansion of the SocialFi market has created ideal conditions for ZORA’s extraordinary 440% rally. With daily creator earnings surging from $1,000 to over $30,000 and more than 12,000 creators joining the platform, ZORA demonstrates the power of social tokenization when combined with user-friendly infrastructure and strategic partnerships.

The platform’s transition to Base Layer 2 infrastructure, growing developer ecosystem, and innovative revenue-sharing models position ZORA for continued growth as social finance becomes mainstream. While cryptocurrency investments carry inherent risks, ZORA’s strong fundamentals and proven ability to generate real economic value for creators suggest the current rally reflects genuine value creation rather than pure speculation.

FAQs

Q1. Why is ZORA’s price up today specifically?

ZORA’s price is up today primarily due to Coinbase’s Base App integration, which has created a massive SocialFi boom. The rebrand of Coinbase Wallet to Base App integrated ZORA’s content tokenization technology, allowing users to create and trade tokens tied to social media posts. This has driven daily creator earnings from $1,000 to over $30,000, with more than 12,000 creators joining the platform and over 8,000 Zora Smart Wallets active daily.

Q2. What is driving ZORA’s 440% price surge this week?

The 440% price surge is driven by multiple factors: the Base App integration with Coinbase, the successful launch of Creator Coins functionality, and the broader SocialFi market boom. The integration allows users to tokenize social media posts directly through Base App, creating new revenue streams for creators and driving massive user adoption. Trading volume has reached $386 million in 24 hours, indicating strong institutional and retail interest.

Q3. Is ZORA’s price increase sustainable long-term?

ZORA’s price increase appears to have sustainable fundamentals, including real revenue generation through creator monetization, growing user adoption, and strategic partnerships with major platforms like Coinbase. The platform has transitioned to Base Layer 2 infrastructure, improving scalability and user experience. However, investors should consider that cryptocurrency markets remain volatile and social finance tokens can experience rapid price swings.

Q4. How does the Creator Coins launch affect ZORA’s value?

The Creator Coins launch has significantly boosted ZORA’s value by creating new utility for the token and driving platform adoption. Creators can launch personal tokens tied to their content, with trading volume generating fees that benefit both creators and the ZORA ecosystem. The feature has attracted thousands of creators within days of launch, demonstrating strong product-market fit and creating multiple revenue streams for the platform.

Q5. What are the main risks for ZORA investors right now?

Main risks include cryptocurrency market volatility, regulatory uncertainty around social tokenization, increasing competition in the SocialFi sector, and technical risks associated with smart contract functionality. While ZORA has strong fundamentals and strategic partnerships, the rapidly evolving nature of social finance creates ongoing risks. Investors should also consider that the token currently carries no governance rights, though this may change in future updates.