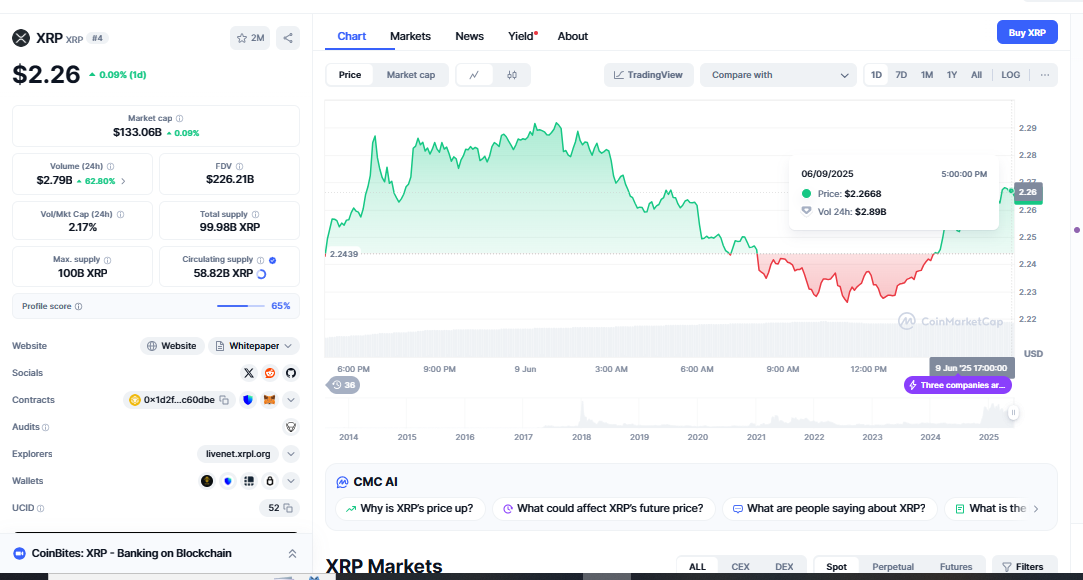

XRP Breaks Key Resistance Above $2.25 with Strong Bullish Move

XRP is gaining pace above its trendline at $2.15 after bouncing back from a significant support level. A second fakeout, positioned below this level, caught aggressive sellers off guard. XRP Price Prediction, Price action is producing a higher bottom immediately below a descending resistance line. XRP breakout above $2.25, which is lowering volatility and setting up a breakout.

When prices approach essential levels, the range narrows and pressure increases until the direction shifts. XRP is approaching the bottom of its descending resistance, so a breakout above $2.25 would significantly alter the market’s dynamics. That breakout would indicate resistance between $2.40 and $2.45. XRP has not been able to break through this critical zone in the past few weeks, so a breakout would be even more important. The twin fakeout pattern increases bullish pressure under a resistance shelf that has previously stopped price increases.

On-Chain Confirmation: Positive 90-Day Volume Delta

The tech structure is only part of the picture. The recent favorable 90-day spot taker cumulative volume delta is significant for XRP. As a result of this change, purchase orders now frequently outnumber sales orders. This kind of movement indicates that accumulation is accelerating, even when the news is unfavorable or the markets are down. When traders examine on-chain movements, they see a positive cumulative volume delta as a sign that the market is likely to continue rising for an extended period.

A positive 90-day CVD is crucial in markets like XRP, where retail and algorithmic activity drive the momentum. A positive divergence for a few weeks indicates that buyers are comfortably withstanding selling pressure and preparing for possible price rises.

Structural Trend: From Higher Low to Breakout Bias

XRP is gaining pace above its trendline at $2.15 after bouncing back from a significant support level. A second fakeout, positioned below this level, caught aggressive sellers off guard. Price action is producing a higher bottom immediately below a descending resistance line, which is lowering volatility and setting up a breakout.

When prices approach essential levels, the range narrows and pressure increases until the direction shifts. XRP is approaching the bottom of its descending resistance, so a breakout above $2.25 would significantly alter the market’s dynamics. That breakout would indicate resistance between $2.40 and $2.45. XRP has not been able to break through this critical zone in the past few weeks so that a breakout would be even more important. The twin fakeout pattern increases bullish pressure under a resistance shelf that has previously stopped price increases.

From Higher Low to Breakout Bias

Reclaimed support and a good volume delta are both good signs for bullish optimism. XRP needs to stay above $2.15 and $2.25 for a lower-high, higher-low structural flip to be valid. Due to this change in structure, descending resistance becomes a dynamic breakthrough zone. So, a ceiling can turn into a foundation.

People in the market discuss holding “structure above support” and returning to declining trendlines to transition from weakness to strength. The higher low pattern allows XRP purchasers to move up to the next supply level. Selling between $2.40 and $2.45 would be in line with past breakouts that didn’t work; thus, stop-loss triggers might be used to get back in. If this momentum keeps up, XRP could start to go higher again.

Volume Drives Momentum: Confirm

XRP’s breakout potential depends on volume confirmation, despite the promising structural setup and on-chain support. A breakout with low trade volume may not be effective, which could result in a brief move. Traders may feel more confident entering if XRP breaks $2.25 on substantial volume.

Breakouts with significant buying activity often lead to short covering and quick leg-ups. If the volume during the breakout is more than usual, XRP might rise to $2.40 or more. Resistance may soon come back for low-volume breaks.

Past help us understand today’s setup

Breakouts after fakeouts and prolonged periods of consolidation have caused XRP to experience significant movement. In both 2021 and 2022, there were substantial rallies when support was regained and volume-driven trend changes occurred. The technical setup is more believable because of the parallel patterns. XRP breaks from confined lower zones and has a history of leading to significant gains. “Fakeouts often lead to real follow-through when confirmation arrives,” as chart readers often say.

Path Forward: Strategy and Risk Control

The next clear goal for XRP after it breaks $2.25 is $2.45, where there is significant liquidity. Traders should evaluate volume and momentum before opening new trades. If the price doesn’t follow the new pivot at $2.15, risk levels and stop-loss orders below it can help limit losses.

However, if XRP doesn’t break above $2.25 or below $2.15, it could revert to its range, and the bullish scenario would be over. Check the structure, volume, and on-chain signals to see if this rally is real.

Summary

All the main signs point in the same direction. XRP has strong support, a higher low, a restored trend structure, and significant on-chain accumulation from day traders and institutional buyers. If the price remains above $2.25, it will likely move toward $2.40–$2.45. Traders and investors who are involved and take action may be able to catch the subsequent rise.

But market factors can still affect crypto markets. Keep an eye on macro catalysts and news that could change people’s emotions or the amount of money available. XRP Surges Past $2.25, If XRP crosses through $2.25 with confidence, the next breakthrough could be on its way.