XRP Price Surges 2% as Bullish Breakout Signals Gain Strength

XRP has demonstrated remarkable resilience in today’s trading session, surging 2% in the last 24 hours as traders respond to increasingly bullish technical signals. The digital asset, which serves as the native token of the Ripple network, has been gaining momentum as technical analysts identify key breakout patterns that suggest further upside potential.

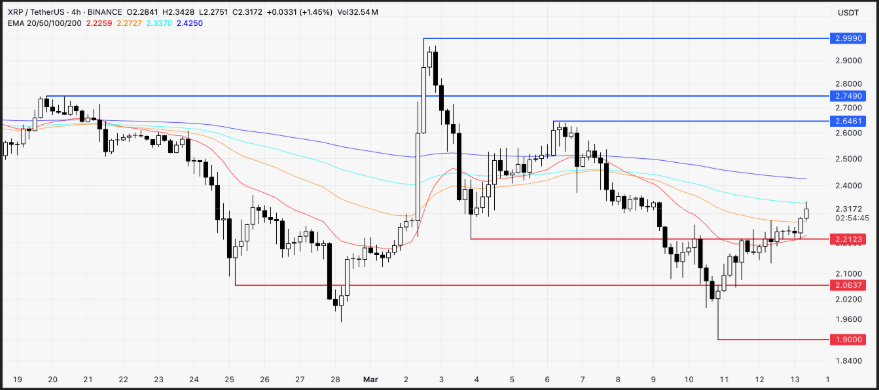

The cryptocurrency market has been closely watching XRP’s price action, particularly as it trades above critical support levels. XRP pushed decisively above $2.20 resistance in the latest session, gaining nearly 2% on the back of surging trading volume and improving macro conditions. This breakout represents a significant technical milestone for the digital asset, as it validates the bullish thesis that many analysts have been developing.

Technical Analysis Reveals Compelling Bullish

The technical landscape for XRP presents a fascinating picture of accumulation and potential breakout scenarios. Professional traders and market analysts have identified several key patterns that support the current upward momentum. XRP has been consolidating above the $2 level for nearly seven months. This extended consolidation phase has created a strong foundation for the current price surge.

The chart patterns emerging from XRP’s recent price action suggest that the digital asset is positioning itself for a significant move higher. Technical analysts have noted the formation of symmetrical triangles and ascending patterns that historically precede major breakouts. These formations, combined with increasing trading volume, create a compelling case for continued upward movement.

Moving averages have begun to align in XRP’s favor, with shorter-term averages crossing above longer-term ones. This technical development often signals the beginning of sustained uptrends and provides additional confirmation for the bullish outlook. The Relative Strength Index (RSI) has also moved out of oversold territory, indicating a shift in momentum that supports the current price surge.

Volume Analysis Confirms Market Interest

Trading volume has played a crucial role in validating XRP’s recent price movements. The surge in trading activity demonstrates genuine market interest rather than speculative buying. XRP has surged 18% in 7 days, reaching $2.75 with strong momentum and increased trading volume, suggesting a bullish market sentiment according to recent market analysis.

The increase in trading volume serves as a confirmation signal for technical analysts who rely on volume to validate price breakouts. When price movements are accompanied by significant volume increases, it suggests that the move has broad market participation and is more likely to be sustained. This volume confirmation adds credibility to the current bullish thesis surrounding XRP.

Resistance Levels and Price Targets

Understanding key resistance levels is crucial for XRP traders and investors looking to capitalize on the current momentum. The token will likely have a bullish breakout as long as it is above the important support level at $2. This level has proven to be a critical foundation for XRP’s price structure, and maintaining above it is essential for continued upward movement.

Analysts have identified several potential price targets based on technical analysis. Technical analysis shows XRP forming a V-shaped recovery pattern targeting $3.40, with a 53% surge in open interest to $5.06 billion signaling bullish sentiment. These targets represent significant upside potential from current levels and provide clear objectives for traders monitoring the situation.

The psychological resistance at $3.00 represents a major milestone that could attract increased market attention. Breaking through this level would likely trigger additional buying interest and could accelerate the upward momentum. Beyond $3.00, the next significant resistance level appears around $3.40, where technical patterns suggest a natural consolidation point.

Market Sentiment and Institutional Interest

The broader cryptocurrency market sentiment has been increasingly favourable toward XRP, with institutional interest showing signs of growth. This positive sentiment is reflected not only in price action but also in the underlying metrics that professional traders monitor. Open interest in XRP derivatives has increased substantially, indicating growing institutional participation in the market.

The shift in market sentiment can be attributed to several factors, including improved regulatory clarity and technical developments within the Ripple ecosystem. As regulatory uncertainties diminish, institutional investors appear more comfortable allocating capital to XRP, contributing to the sustained upward pressure on price.

Elliott Wave Analysis and Projections

Advanced technical analysts utilising Elliott Wave theory have provided additional insights into XRP’s potential trajectory. An Elliott Wave analyst notes XRP is approaching a key technical point, with a potential fifth wave rally that could push the price to $9, following a five-wave advance since July 2023. This analysis suggests that XRP may be in the early stages of a much larger upward movement.

Elliott Wave theory, which attempts to identify recurring patterns in financial markets, provides a framework for understanding potential price movements over extended periods. The identification of wave patterns in XRP’s price action offers traders and investors a longer-term perspective on the asset’s potential trajectory.

Risk Factors and Market Considerations

While the technical outlook for XRP appears increasingly bullish, market participants should remain aware of potential risk factors that could impact price action. Cryptocurrency markets are inherently volatile, and sudden shifts in sentiment or external factors can quickly alter market dynamics. Risks include potential corrections back to $2 due to overbought conditions and ETF approval delays.

The regulatory environment continues to play a significant role in XRP’s price development. Changes in regulatory stance or new developments in ongoing legal proceedings could impact market sentiment and price action. Traders should monitor regulatory news closely as it can provide early indicators of potential market movements.

Trading Strategies and Risk Management

For active traders looking to capitalise on XRP’s current momentum, implementing proper risk management strategies is essential. The current technical setup provides clear entry and exit points, but market conditions can change rapidly. Setting stop-loss orders below key support levels can help protect against unexpected downward movements.

Position sizing becomes particularly important during periods of increased volatility. However, even with bullish technical signals, maintaining appropriate position sizes ensures that traders can weather potential market corrections without significant portfolio damage. The key is to balance the potential for gains with the need to preserve capital.

Future Outlook and Price Predictions

Looking ahead, XRP’s technical foundation appears solid, with multiple indicators suggesting continued upward potential. Experts predict potential rises to $3–$8 in 2025, including Bitget Research’s Chief Analyst Ryan Lee. These projections reflect the growing confidence among market professionals regarding XRP’s long-term prospects.

The convergence of technical indicators, increased trading volume, and improving market sentiment creates a compelling case for XRP’s continued appreciation. However, reaching these ambitious price targets will require sustained momentum and favourable market conditions.

Summary

XRP’s 2% surge in the last 24 hours represents more than just a daily price movement; it reflects the culmination of several technical factors aligning in favour of the digital asset. The combination of strong volume, bullish chart patterns, and improved market sentiment suggests that XRP may be entering a new phase of its price cycle.

As traders and investors navigate this evolving landscape, the key will be to remain disciplined in their approach while capitalising on the opportunities presented by the current technical setup. The bullish signals emerging from XRP’s price action provide a foundation for optimism, but success in cryptocurrency trading requires careful attention to both technical indicators and broader market dynamics.